- Learn: States get practically 3/4th of GST on medical insurance, says Sitharaman

The Council is scheduled to satisfy on Monday and deliberate lowering and even absolutely exempting GST on life and medical insurance premium. As on date, the GST price on premia for medical insurance, time period insurance policy and unit-linked insurance policy, appeal to 18 per cent GST. On endowment plans, the GST is utilized in a different way. Whereas it’s 4.5 per cent for premium paid throughout the first yr, it’s 2.25 per cent from the second yr. For all times insurance coverage within the type of single premium annuity insurance policies, the GST price is 1.8 per cent. Charges are the identical for all age teams and could be reviewed primarily based on the advice of the GST Council.

4 choices

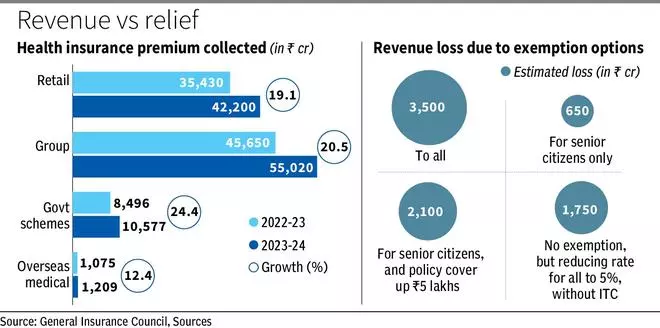

Sources say the fitment committee is more likely to current 4 choices for GST on medical insurance premium: full exemption, exemption just for senior residents, exemption for senior citizen together with coverage having protection as much as ₹5 lakh and lowering price to five per cent with out Enter Tax Credit score (ITC), and that these may lead to income lack of ₹3,500 crore, ₹650 crore, ₹2,100 crore and ₹1,750 crore, respectively. Nonetheless, “the committee is unlikely to suggest any explicit choice and should request the Council to take a ultimate name,” a supply stated.

- Learn: ‘Well being, reinsurance premia fetched ₹24,500 cr in GST over 3 years until FY24’

Earlier, this month, in a response to a query, the Lok Sabha was knowledgeable that well being, reinsurance premia fetched ₹24,500 crore in GST over 3 years until FY23-24. Later, the problem of GST on well being turned a giant political difficulty throughout final session of Parliament. Responding to this, Finance Minister Nirmala Sitharaman identified that even earlier than the rollout of GST, States used to levy tax on insurance coverage premiums.

“Out of the 18 per cent GST on medical insurance coverage, practically half goes on to the States. Of the remaining half, 41 per cent strikes into the devolution pool, which additionally goes to States. This implies greater than ₹74 out of each ₹ 100 collected goes to the States,” she stated, dismissing allegations that cash collected via GST is “pocketed” by the Centre.

Additional, Sitharaman stated Parliament isn’t the appropriate discussion board to determine about GST, however the GST Council. Additionally, the problem of GST on insurance coverage has been mentioned practically 3 times within the GST Council, but this debate nonetheless retains surfacing.

In February this yr, the Parliamentary Standing Committee on Finance really useful decreasing of GST on medical insurance, notably for senior residents. It underlined that there’s a have to rationalise the GST price on insurance coverage merchandise, particularly well being and time period insurance coverage, which is eighteen per cent now. The excessive GST price ends in a excessive premium burden which acts as a deterrent for buying insurance coverage insurance policies, the committee stated.

To make insurance coverage extra reasonably priced, the committee stated: “GST charges relevant to medical insurance merchandise, notably retail insurance policies for senior residents and micro-insurance insurance policies (as much as limits prescribed below PMJAY or Pradhan Mantri Jan Aarogya Yojana, now ₹5 lakh) and time period polices, could also be lowered.”

#GST #price #rejig #well being #insurance coverage #premia #end result #income #loss