JP Morgan had then introduced that it might add from June 28, the Indian authorities bonds to its international rising markets index for presidency bonds, opening up a $1.3-trillion Indian sovereign debt market to a broader vary of worldwide buyers.

The inclusion of Indian authorities bonds will likely be staggered over a 10-month interval from June 28 to March 31, 2025, it was then introduced.

Additionally, on the finish of March 2025, Indian authorities bonds will maintain 10 per cent weightage within the GBI-EM World Diversified Index after 1 per cent is added each month, JP Morgan had mentioned.

RBI-classified bonds

Solely these bonds categorized by Reserve Financial institution of India underneath the Absolutely Accessible Route (FAR) had been eligible for index inclusion. Inside this subset of IGBs, there are at the moment 27 FAR-designated bonds which met the index inclusion standards as of June 28, 2024.

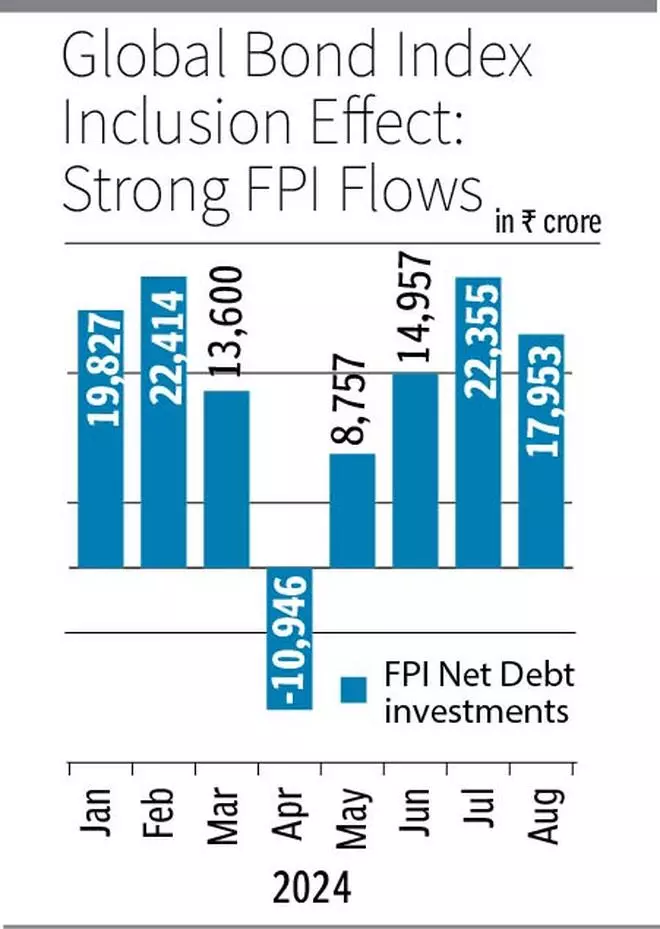

Now, of the $18 billion that FPIs have invested in Indian authorities debt put up index inclusion announcement, as a lot as $12.9 billion has come between October 2023 and June 2024. The online debt FPI flows since June 28 — day of index inclusion— until finish August stood at $5.1 billion.

“Additionally, now with the expectation of potential sovereign ranking improve given the nation’s sturdy fiscal balances, dedication to improved fiscal consolidation and secure political regime resulting in progress stability, we must always see FPI debt flows persevering with to stay optimistic,” Anitha Rangan, Economist at Equirus, mentioned.

“That is the best (inflows) after a gradual outflow now we have been witnessing since 2018. Internet/web after greater than 5 years, debt FPI inflows have resumed on a gradual optimistic be aware,” she added.

Rangan additionally highlighted that the doubtless upcoming US Fed price cuts will set off additional FPI debt flows into India together with the prospect of rankings improve.

In the meantime, debt market consultants highlighted that international buyers are inclined to make the most of the optimistic motion in yields (of g-secs) earlier than the precise occasion.

Publish the index inclusion announcement, India’s 10-year G-sec yield has gained 25 foundation factors rallying from 7.25 per cent to 7 per cent by June 2024. It has additional moved to six.85 per cent in September 2024, reflecting a acquire of 40 foundation factors.

Mahendra Jajoo, Chief Funding Officer-Mounted Earnings, Mirae Asset Funding Managers (India), mentioned that India’s international bond index inclusion story to this point has unfolded in step with expectations. The story may be very a lot intact. Due to non permanent components, it has now turn into a aspect story, however will bounce again sometime, he added.

General story has been in a means “excessive jacked” by new scorching points resembling international central banks price cuts, home banks preventing for deposits and so on. This (India bond inclusion) has turn into a aspect problem for now, he famous.

“The long-term story on bond inclusion may be very a lot intact, however there can be non permanent roadblocks when there are structural developments. Insurance policies must be reviewed and tweaked as experiences are gained”, Jajoo mentioned.

“This (India bond inclusion) has turn into a aspect story and never the frontline story anymore. What might have been a really massive factor has turn into subdued due to attendant components. Had bigger index gamers rapidly come to incorporate it and there was no tweaking in FAR guidelines, then the bond inclusion story would have been much more pronounced.”

Deal with US Fed

On an optimistic be aware, Jajoo mentioned that after the approaching US Fed price minimize occurs this month, FPI flows would proceed to enhance on the again of sturdy India story.

Shantanu Bhargava, Managing Director, Head of Listed Investments, Waterfield Advisors, mentioned, “Indian Bond Index inclusion has prompted international portfolio buyers to take a look at our markets and make investments. However the bond index’s inclusion, we imagine FPIs would’ve and can proceed to put money into eligible Indian bonds, given our re-rating as an economic system. This inclusion has merely accelerated the pattern”.

He mentioned the US Fed discount will doubtless profit rising markets as a complete by way of flows away from US , because the yield on US Treasury securities will fall. “India is well-positioned amongst EMs to attract extra such flows. At this second, there are a number of choices within the rising market area which are as well-positioned as India,” Bhargava added.

#FPIs #pump #billion #Indian #authorities #debt #Morgan #Bond #index #inclusion #announcement