Regardless of the rise, the retail inflation, primarily based on Client Worth Index (CPI), is second lowest within the final 59 months. Additionally, that is the second successive month of sub-4 per cent retail inflation charge. However the expectation is that the speed might go up additional in September. Holding this in thoughts, the October evaluation assembly of the Financial Coverage Committee (MPC) is unlikely to make any change in coverage rate of interest.

Key drivers

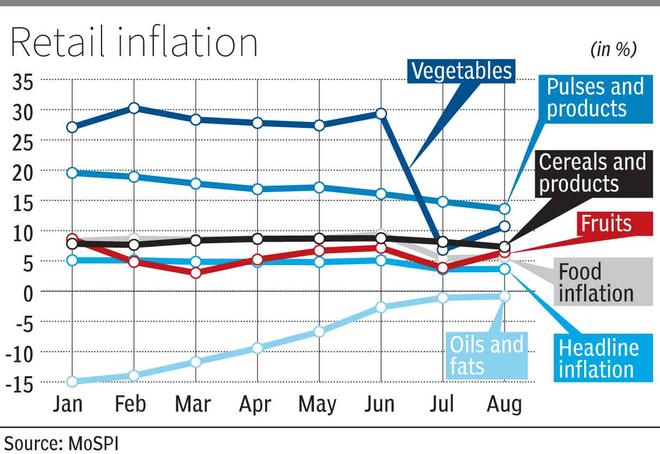

Vegetable inflation recorded a soar to over 10 per cent in August as towards 6.8 per cent in July. Equally, fruit inflation rose to over 6 per cent as towards round 3.5 per cent in the course of the interval into consideration. Costs of pulses and cereals have been nonetheless excessive, impacting headline inflation.

Although the core inflation (headline inflation minus gas and meals inflation) remained regular at 3.4 per cent, economists imagine it could go up. Swati Arora, Economist with HDFC Financial institution, mentioned core inflation (excluding meals and gas from headline inflation) has bottomed out and is anticipated to rise going ahead, maybe shifting above 4 per cent over the approaching months reflecting increased gold costs, enchancment in pricing energy and restoration in demand. “A low base can be more likely to weigh on core inflation studying. For the total yr, we proceed to anticipate CPI to common at 4.6 per cent,” she mentioned.

Going additional, an increase in general charge is anticipated.

Aditi Nayar, Chief Economist with ICRA, estimated the headline CPI inflation to rise to 4.8 per cent in September led by a pointy uptick within the meals and drinks inflation print amid the fading of the elevated base (meals and drinks inflation: 6.3 per cent in September 2023 vs. 9.2 per cent in August 2023).

Coverage stance

“However the anticipated hardening in September, the typical CPI inflation will undershoot the MPC’s Q2 FY25 estimate of 4.6 per cent. With the Q1 FY2025 GDP development print (6.7 per cent), having undershot the MPC’s forecast for the quarter (7.1 per cent), a change in stance within the October 2024 coverage assembly can’t be fully dominated out,” she mentioned.

Upasna Bhardwaj, Chief Economist, at Kotak Mahindra Financial institution, mentioned: “The slight uptick in we proceed to anticipate full yr estimate at 4.5 per cent and therefore RBI to stay focussed on inflation over the following few months. In the meantime, given benign international situations and protracted straightforward liquidity situations, we see excessive chance of a change within the coverage stance to impartial within the upcoming coverage.”

#Retail #inflation #rises #marginally #Aug #change #MPC #stance