With this, the federal government is hopeful of assembly and even exceeding the tax assortment goal for the 12 months.

Ease of compliance

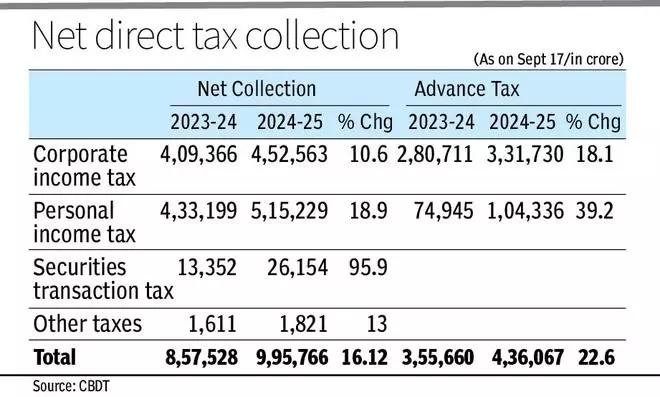

Although the Division didn’t give any motive for the expansion within the assortment, it’s believed that ease of compliance and decrease charges underneath the brand new tax regime together with an increase in incomes pushed the online direct tax (gross assortment minus refund) mop-up by over 16 per cent to ₹9.96-lakh crore. The federal government estimates to gather over ₹22-lakh crore by way of direct taxes in FY25, and has managed to get practically ₹10-lakh crore in a bit over five-and-half months.

Company IT surge

Underneath the interval into consideration, advance tax assortment submit the second instalment rose to over ₹4.36- lakh crore from ₹3.55-lakh crore, a progress of twenty-two.6 per cent. Whereas the Company IT surged by 39 per cent, Private IT rose over 18 per cent.

The IT Division additionally highlighted that the online assortment was up regardless of the bounce in refunds. Over ₹2.05-lakh crore was given as refund throughout April 1 and September 17 up 56 per cent from ₹1.31-lakh crore within the corresponding interval of the final fiscal 12 months.

- Additionally learn: Direct tax mop-up rises 20% to ₹5.74 lakh crore on larger advance company tax

#Advance #tax #assortment #FY25 #tops #Finances #Estimate