The US is the most important pharmaceutical market on the planet. By advantage of its dimension, its splendid IP safety legal guidelines, and deep-pocketed insurers, a lot of the cutting-edge innovation in pharma tends to be concentrated right here. For traders and normal readers alike, one needs to be abreast of the most recent pharmaceutical innovation happening abroad. Will a weight reduction tablet be a actuality? When will HIV be cured? What’s the way forward for most cancers therapies?

Indian traders can entry progress in manufacturing, banking, commodity, providers and even IT in Indian markets; however for cutting-edge tech and pharmaceutical publicity, the US is the place to look to.

Right here, we spotlight the most important unmet wants in medication presently being addressed by US Huge Pharma, corresponding to Merck, Gilead, Eli Lilly, and likewise by large gamers primarily based in Europe — Novo Nordisk and Roche.

We additionally lay down the fundamental framework for investing in or assessing US pharma and the shares which are in focus presently.

Oncology

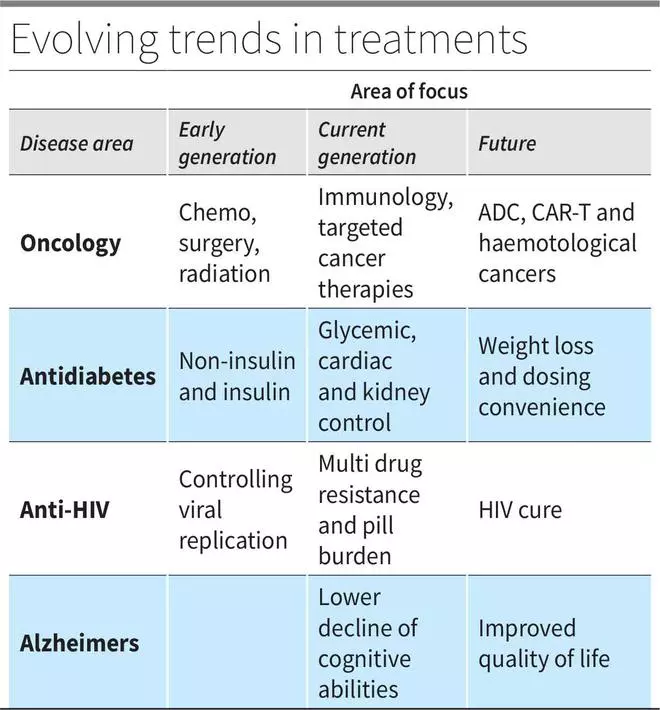

From plain chemotherapy, to surgical procedure, to radiation and now immunotherapy, most cancers therapy has come a good distance. Immunotherapy, because the title suggests, is a pharmaceutical method of utilizing the physique’s immune system to eradicate most cancers cells.

Pembrolizumab (Keytruda) authorized in 2014 is the primary main Monoclonal anti physique or mAB from Merck. The product has raked in approvals for a number of cancers and has generated $20 billion in gross sales in 2022. This works by serving to T-cells discover and assault most cancers cells. The PD-1 protein on T-cells is deactivated by PD-L1 protein discovered on the floor of a cancerous cell. Keytruda and Opdivo (from Bristol-Myers Squibb) that concentrate on PD-1 and Tecentriq (a PD-L1 inhibitor by Roche) can cease T-cells from switching off — by blocking the PD-1/PD-L1 interplay between a most cancers cell and a T-cell. This enables for regular immune motion on most cancers cells.

Nevertheless, mABs haven’t had a excessive success charge. Therapy-resistant affected person cohorts to mABs stood significantly excessive at 70-80 per cent.

Combining the chemo route of toxicity and mABs’ focused actions on most cancers cells are Antibody Drug Conjugates or ADCs. These depend on an mAB to focus on most cancers cells after which launch the cytotoxin into the most cancers cells. The hyperlink to affix the mAB and the toxin makes ADCs a three-part drug.

The three elements concerned on this course of, together with the truth that a number of mABs can be found, have opened the ADC market. In comparison with mABs, ADC market is dominated by smaller gamers. Gilead acquired Immunomedics for $20 billion for its main ADC – Trodelvy; Roche’s main drug trastuzumab (Herceptin) for breast most cancers is now paired with a cytotoxin and branded as Kadcyla, which is anticipated to generate peak gross sales of $3-4 billion over the following two years. Merck paid $4 billion in upfront funds to Daiichi Sankyo to collaborate on ADC. The US FDA has authorized 10 ADCs for most cancers therapy, and greater than 80 ADCs are beneath medical trials.

One other route of focusing on most cancers cells is CAR-T therapies. From the blood drawn from the affected person, T-cells are remoted and picked up. Chimeric antigen receptors (CAR), which may have an effect on most cancers cells, are then induced in these T-cells. That is carried out by infecting them with a nullified virus that’s engineered to generate CARs. Such cells are cultured to multiply after which reinfused into the affected person’s blood stream. For example, leukemia and lymphoma cancers have CD-19 markers, that are focused by the CAR-T cells after which they do their job of destroying the most cancers cells. This section has additionally witnessed important M&A with Celgene buying Juno Therapeutics for $9 billion and Gilead buying Kite Pharma for $12 billion.

These novel approaches may additionally handle the shortcomings in hematological cancers (blood) which haven’t confronted as a lot success as in stable cancers.

Diabetes

Antidiabetic therapy kicked off with the invention of the primary animal-made insulin round a century in the past. From there, innovation introduced forth insulin synthesised from people, artificial insulins, longer and shorter appearing insulins.

Other than capsules and the ever-reliable metformin, three main classes function in anti-diabetes. There are Dipeptidyl Peptidase IV inhibitors (DPP-IVs Januvia/Janumet), Sodium-glucose Cotransporter-2 Inhibitors (SGLT2s Jardiance, Farxiga) and Glucagon-like peptide-1 receptor agonists (GLP-1RAs Trulicity, Victoza, Ozempic).

GLP-1RA is inching over the opposite classes with improved glycemic management in medical trials. With constructive influence on non-glycemic features as nicely together with weight reduction, cardiac occasions and kidney capabilities, GLPs will witness extra product innovation and R&D dedication within the quick time period.

GLP-1 is a standard peptide launched by the gut in response to a meal. This binds to GLP-1 receptors within the pancreas and prompts insulin manufacturing, which is impaired in Kind-2 diabetes sufferers. GLP-1 receptor agonists are exterior brokers that bind to the GLP-1 receptors and elevate insulin secretion by the pancreas. However, GLP-1 receptors are additionally present in kidney, lung, coronary heart, pores and skin, immune cells, and a number of other different tissues. This enables GLP-1RA to realize a multi-modal end result, which improves cardiac and renal outcomes, and aids weight reduction slower gastric emptying by binding to intestinal receptors. This function separates GLP-1RA from different modes.

Therapy regimens at the moment are not simply restricted to glycemic management. Novo Nordisk’s Semaglutide, a number one GLP-1RA routine, has proven in research that it may well scale back an hostile cardiovascular occasion by 20 per cent in chubby sufferers. In Kind-2 diabetes sufferers, Sema’s examine to point out improved outcomes in continual kidney illness was profitable even on interim evaluation.

Semaglutide, branded as Wegovy, confirmed a 17-18 per cent weight reduction sustained over 68 weeks’ trial for overweight sufferers handled with Wegovy. This has created a flutter as Pfizer, Eli Lilly and others have joined the race within the class.

Comfort is one other necessary dimension on which anti-diabetes therapies place a big weight. As soon as-a week insulin, Ozempic, has been authorized and once-a-week long-acting basal analogue is within the works. With frequent insulin injections being a major criticism in diabetes therapy routine, Novo Nordisk has additionally launched a tablet model of its GLP-1RA, Rybelsus.

HIV

From being a near-fatal prognosis, HIV is now a continual situation with near-normal life expectancy. The primary antiretroviral remedy (ART) began with azidothymidine within the late 90s, which belongs to the nucleoside reverse transcriptase inhibitor (NRTI) class of medicines. The present routine is a mixture of NRTIs, nonnucleoside NRTIs (NNRTI), protease and integrase inhibitors and casts a heavy tablet burden, other than negative effects. ART remedy is targeted on limiting viral replication at a number of ranges of cell growth. NNRTI and NRTI act on the mobile stage, protease inhibitors work on the maturation section, integrase inhibitors on the integration section of the viral lifecycle.

Truvada is the primary authorized PrEP (pre-exposure prophylaxis) therapy for these vulnerable to viral publicity. These work at very early stage of viral publicity and have discovered excessive success when taken recurrently within the tablet kind.

Nevertheless, therapy resistance to ARTs from prior publicity is an rising concern in HIV sufferers. Gilead’s Lenacapavir, authorized final 12 months, is a single-pill therapy routine for sufferers with multi-drug resistance to ART routine. This formulation additionally addresses the tablet burden with a single tablet.

That stated, by limiting viral replication, ARTs, by design, can’t treatment or result in remission of HIV. There’s hope, although. By pinpointing a cohort of sufferers whose viral load was beneath management with restricted therapy, researchers have recognized broadly neutralising antibodies or bNAbs as a possible treatment for HIV. Antibodies cope with viruses however fail to take action in HIV an infection. By engineering bNAbs in a fashion much like mABs for most cancers or vaccines (the place antibody response to neutered virus generates immune safety), HIV treatment could also be on the horizon.

Gilead’s a number of Part-2 programmes with ART mixture are in progress. Research as not too long ago as February 2023 introduced proof of idea — 90 per cent members confirmed virological suppression at 26 weeks. By the way, Gilead’s Sovaldi and Harvoni have been the primary cures for Hepatitis C. The World Well being Group (WHO) goals to eradicate the virus by 2030.

Alzheimer’s

The degenerative illness of the mind has proved to be a troublesome problem for pharmaceutical firms. Leqembi (lecanemab), developed by Eisai in collaboration with Biogen, was the primary and solely authorized drug for Alzheimer’s in July 2023. This comes after a number of failed makes an attempt, and one controversial false begin within the latest years.

Alzheimer’s illness is characterised by amyloid beta deposits on mind cells resulting in shrinking and lack of cognitive talents. Regardless of a transparent marker of amyloid plaques and a goal space to work on, pharma firms failed to deal with plaque removing or a statistical enchancment in cognitive functioning after plaque removing, until the latest approval. Pfizer, Eli lilly, Merck and lots of others confronted failure within the area. The amyloid concept itself was in query.

Biogen’s adacanumab had a peculiar begin. The corporate itself stopped growth in 2019, nevertheless it surprisingly pursued a high-dose examine into 2021. Later, FDA authorized adacanumab with an accelerated approval for high-dose model, which confronted sharp criticism. Three advisers resigned over the approval of the drug that might have value $56,000 every year to manage. Nevertheless, with a “conventional” approval for Eisai-partnered lecanemab for Alzheimer’s (in comparison with accelerated approval for adacanumab), Biogen has the primary authorized therapy, placing adacanumab on the backburner.

Cognitive operate enchancment is a vital marker for Alzheimer’s therapy and lecanemab delivers decrease degeneration in comparison with placebo on this depend. The therapy decreased medical decline by 27 per cent at 18 months on medical dementia scoring and on each day dwelling scale delivered a 37 per cent enchancment in comparison with placebo. As is clear, the event is passable however much more progress is left to be made on Alzheimer’s therapy curve.

Takeaways for Traders

Analysing pharma shares within the US rests on three elements: medicine about to run out, medicine in ramping up stage and the pipeline. With sharp fall publish genericisation, medicine about to run out might be a serious overhang for any firm, with no portfolio in ramping up levels. Pipeline merchandise can’t actually offset absence of merchandise in ramp-up stage, as pipeline belongings are given decrease chances of success. Usually, Part-I/II/III belongings get 10/20/50 per cent chance of success.

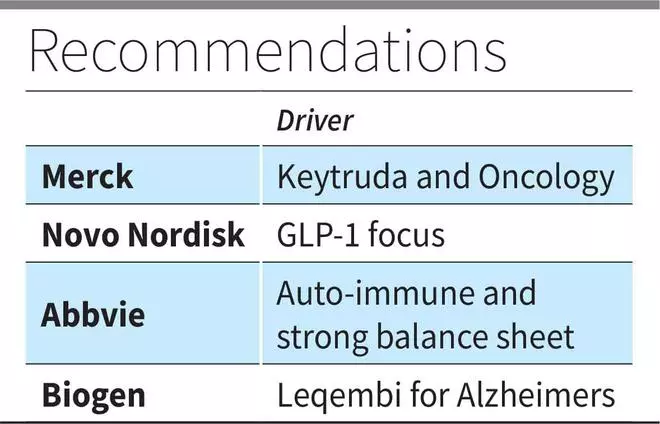

So an excellent pharma inventory ought to have low influence from expiries and pretty distributed pipeline. Alongside such traces, we earlier beneficial Novo Nordisk (+140 per cent since July-21) and Abbvie (+27 per cent since Oct-21). We reiterate the advice on two shares which at the moment are buying and selling at 31 instances and 12 instances FY24 earnings.

Novo Nordisk, with gross sales ramp-up in weight reduction, tablet format and weekly injections of GLP-1RA, is nicely poised to develop even now. The pipeline will handle NASH (untreated liver illness), hematology and different non-diabetic areas as nicely.

Abbvie, regardless of Humira’s patent loss by finish 2023 ($22 income billion in 2022) will proceed to be powered by Rinvoq and Skyrizi in autoimmune, other than deep pipeline belongings. The Allergan acquisition, funded out of the money flows from Humira as a alternative for Humira, can cushion the patent loss to an extent.

Analyst focus for Merck (12 instances FY24 EPS) will begin shifting to Keytruda’s probably patent loss in 2028. Regardless of the overhang, traders can accumulate the inventory on dips. The deep pipeline powered by Keytruda mixtures in immunology, ADC and different cancers, and the stability sheet power ought to help Merck’s inventory. Whereas biosimilar launches will influence Keytruda’s gross sales in 2028, the speed of decline could also be decrease owing to robust doctor desire for Keytruda.

One other necessary side to contemplate is the pipeline valuation. Right here’s an instance of how it’s carried out. For example, Biogen (and Eisai’s) Leqembi for Alzheimer’s (AD) is anticipated to generate peak gross sales of $7 billion by 2030. It has introduced an inventory value of $26,500 for annual course and we assumed 50 per cent rebate to insurers on common right here. Contemplating the 6 million sufferers in AD within the US, assuming 50 per cent are gentle to average (relevant group in keeping with FDA label) and 15 per cent on therapy by 12 months 7, the drug alone can rake in $12 billion (halved to account for Eisai’s share) by 2030 in cumulative gross sales for an organization whose market cap is $33 billion buying and selling at 14 instances FY24 EPS.

#Merck #Novo #Nordisk #Gilead #Biogen #funding #alternatives #international #Huge #Pharma