The preliminary public providing of cryogenics gear manufacturing firm Inox India is open for subscription throughout December 14-18. At present totally owned by the promoter group, submit challenge the promoter shareholding shall drop to round 76 per cent.

On the higher finish of the value band, the overall provide is round ₹1,459 crore and its market cap can be ₹5,990 crore. Whereas the inventory is priced at a trailing P/E of round 38 instances, its closest world peer, Chart Industries (listed in US), trades at a P/E of round 22 instances. Chart Industries has additionally seen excessive income development within the final three years however has generated decrease margins than Inox India.

General, although Inox India operates in a distinct segment section and the corporate is performing effectively now, its enterprise is weak to the broader capex cycle (cyclical). Contemplating this, the valuation seems to be costly. Therefore, buyers can wait and look ahead to higher alternatives to enter the inventory.

Enterprise

The corporate manufactures and provides cryogenic gear, providing options throughout design, engineering, manufacturing and set up of kit and techniques. Usually, cryogenic gear is used to retailer, transport and deal with cooled gases in liquid type. They discover utility in industrial sectors resembling industrial gases, liquefied pure gasoline (LNG) , inexperienced hydrogen, vitality, metal, medical and healthcare, chemical substances and fertilisers, aviation and aerospace, prescribed drugs, and development. Therefore, the demand for cryogenic gear is pushed by the capex deployed in these sectors.

The corporate primarily operates in three segments — industrial gasoline (70 per cent of income), LNG (25 per cent), and cryo scientific (5 per cent).

Its industrial gasoline division designs, manufactures, provides and installs vacuum-insulated cryogenic storage tanks and techniques for the storage, distribution and transportation of commercial gases, whereby it providesturnkey in addition to EPC options. Air Liquide International E&C Options, Hyundai Engineering and Building, Naveen Flourine, and All Secure International are a few of its prospects within the section.

Its LNG division manufactures, provides and installs commonplace and engineered gear for LNG storage, distribution and transportation in addition to small-scale LNG infrastructure options appropriate for industrial, marine and automotive utility. Its prospects right here embrace Caribbean LNG Inc, IRM Vitality Restricted, Saint Gobain India Non-public Restricted, and Shell Vitality India Non-public Restricted.

The cryo scientific section provides specialised engineered gear for scientific functions targeted on satellite tv for pc and launch services, cryogenic propulsion techniques and analysis, and fusion and superconductivity. Right here the corporate’s main buyer is ISRO.

The corporate’s principal uncooked supplies embrace aluminium merchandise (sheets, bars, plate, and piping), stainless-steel merchandise (sheets, plates, heads, valves, devices and piping), palladium oxide, carbon metal merchandise (together with sheets, plates, sections and heads), valves and gauges, and fabricated metallic parts. The corporate sometimes sources the uncooked materials on spot foundation, which exposes it to volatility in uncooked materials costs. Additional, practically 45 per cent of the corporate’s gross sales are from exports.

Financials

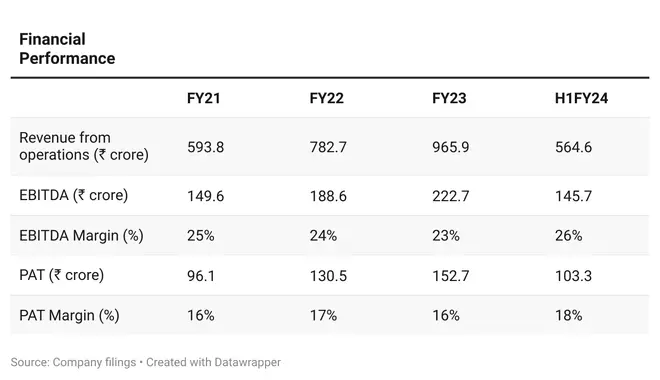

The corporate has seen a CAGR of round 27 per cent in its working income throughout FY21-23 to round ₹966 crore. This was primarily supported by 35 per cent CAGR development throughout the interval within the industrial gases section, pushed by sustained funding to enhance India’s medical oxygen infrastructure and revival of commercial demand for gases. Its EBITDA development has been consistent with the income development, posting EBITDA of round ₹226 crore; therefore the corporate has been in a position to preserve its EBITDA margin of 23-25 per cent and go on the volatility in metal costs to its prospects. Additional, income and EBITDA grew by practically 16 per cent and 20 per cent, respectively, to round ₹565 crore and ₹487 crore throughout H1FY24.

As the corporate operates on an asset-light mannequin, it doesn’t have important debt on its steadiness sheet, leading to D/E of round 0.08 instances as on September 30, 2023.

.jpg)

Outlook

The corporate has an order e-book of round ₹1,036 crore, which it expects to be executed within the subsequent 6-12 months. Of the overall order e-book, industrial gasoline includes 53 per cent, adopted by LNG and cryo scientific at round 25 per cent and 22 per cent, respectively. The corporate at present has three manufacturing services and is establishing a fourth facility too. It has incurred capex of round ₹80 crore throughout H1FY24 and the administration has guided for related capex throughout H2FY24.

As per CRISIL, demand for cryogenic gear is anticipated to be pushed by the elevated demand for cleaner fuels resembling LNG and hydrogen as a result of world concentrate on lowering carbon emissions from typical vitality sources. Additional, one wants to notice {that a} majority of the industries the corporate serves are cyclical in nature and therefore weak to world financial downturn. In FY23 the corporate derived 45 per cent of its income from exports and whether or not this can be impacted by the worldwide financial slowdown must be monitored.

#Inox #India #IPO #subscribe