“Not solely does God undoubtedly play cube, however he generally confuses us by throwing them the place they’ll’t be seen’

That was legendary physicist, the late Stephen Hawking, on why predicting the longer term is not possible. Sure, there might be exceptions to this rule like ‘Paul the Octopus’, however repeatedly it has been confirmed people fail miserably after they try to predict the longer term. When you aren’t satisfied, simply have a look at what was predicted by economists and market contributors for the 12 months 2023, — and the way totally different it really turned out to be.

Firstly of the 12 months, the US Fed anticipated the GDP of the world’s largest economic system to develop at simply 0.5 per cent. Consensus of economists/analysts was leaning in direction of a recession. As we stand right this moment, the US is anticipated to shut the 12 months with a GDP development of two.6 per cent!! That’s as far-off from recession because the Earth is from the Solar. In India too, the expansion has shocked to the upside. Throughout the board, whether or not India or the US or many different nations, predictions of fee cuts didn’t materialise. These are only a few examples amongst many.

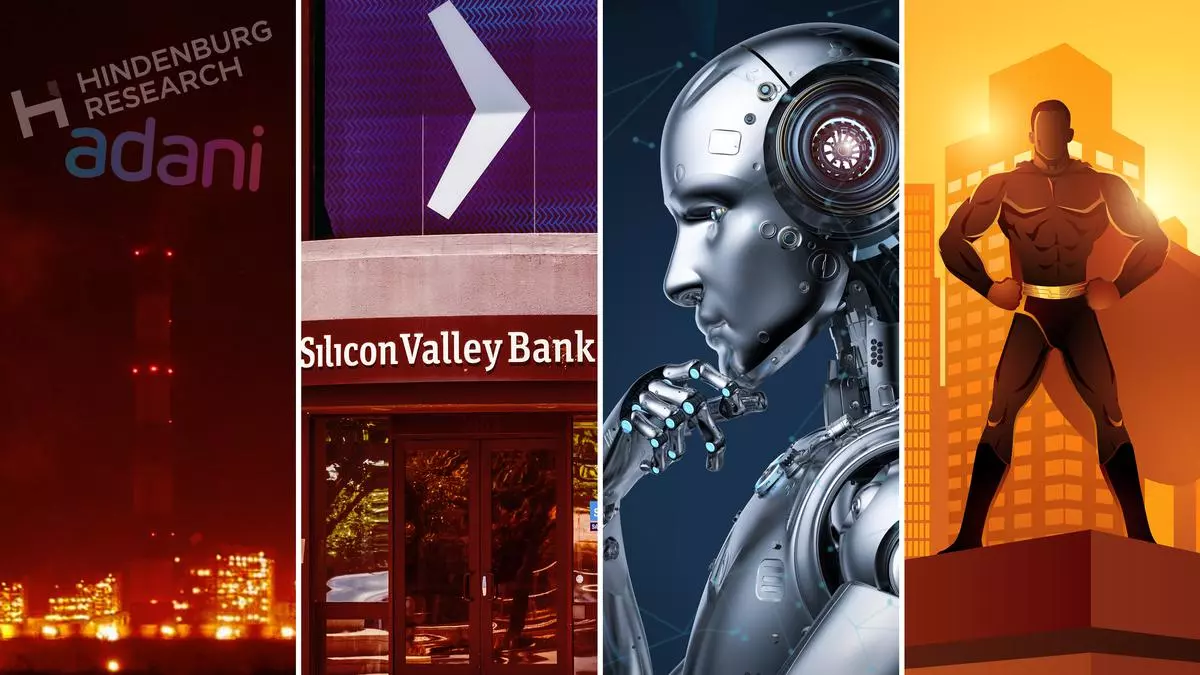

Markets needed to cope with these in addition to many different ‘out of the blue’ occasions that performed out throughout the 12 months. However just like the unstoppable power that may uproot even ‘immovable objects’, markets the world over, together with in India, defied expectations of even the bulls. Because the 12 months nears an in depth, right here’s wanting again at some defining market occasions of 2023 and what we are able to be taught from them.

1) The ‘Huge Quick’

Quick promoting is just not broadly prevalent in India. However within the developed markets, particularly the US, for many years, brief sellers have positioned long-term bets shorting corporations, broader markets — as engrossingly chronicled within the worldwide finest promoting e-book, The Huge Quick, and broadly profitable film of identical identify — and even the housing market.

In India, such methods usually are not simple to execute and the one widespread strategy to do it’s by way of the F&O market, which is restricted to only 185 shares and main indices. Right here too, it’s restricted by time horizon and brief sellers must preserve rolling over positions. In such a market, the report by brief vendor Hindenburg on Adani got here like a bolt out of the blue. Whereas this wasn’t the primary occasion, with studies by Veritas towards a number of Indian corporations within the earlier decade, this was the primary time there was a market shaking influence.

The Hindenburg report was sufficient to bitter sentiment throughout the board in India, with Nifty 50 being the one one amongst giant economic system indices turning crimson within the first two months of the 12 months, clocking a fall of round 5 per cent.

In fact, wanting again, this turned out to be only a blip in Nifty’s YTD rally of 17 per cent. However then, nothing unfold like worry, and considerations on Adani group’s leverage and potential domino influence on markets and economic system, which seems far-fetched now, spooked many. Adani Group shares, after all, bore the brunt — falling within the vary of 30 to 80 per cent by finish of February.

2) Banking disaster

Markets started 2023 with an hangover from the quickest mountain climbing cycle by the US Fed. The Fed Funds fee had moved from zero to 4.5 per cent (highest degree since 2007) in 2022. Whereas such degree of hikes had been carried out within the Eighties, these had been from a a lot increased base when the Fed Funds fee was already in excessive single or low double-digit percentages. Given the beginning base right here was zero, the hikes of 2022 rely as probably the most extreme hikes by way of depth. Whereas most market contributors had been optimistic, some macro watchers had been anticipating one thing to interrupt as a result of influence of the speed hikes.

In order that one thing broke was not a shock when Silicon Valley Financial institution folded up in early March. That its domino impact, inside days, sunk one of many largest and iconic world banks — Credit score Suisse — was additionally not a shock. In any case, when Bear Stearns had collapsed precisely 15 years again within the March of 2008, its ripple results went on to sink Lehman, which in flip sunk AIG, paralysing the worldwide monetary system. However right here once more, it was fairly exceptional how swift motion by Central Bankers (though they are often faulted for not pre-empting it) calmed market’s nerves fairly rapidly.

Unprecedented actions by the Swiss Nationwide Financial institution throwing a lifeline, equipped nearly adequate liquidity to Credit score Suisse to outlive until the weekend. As uncertainty prevailed, this delivered to fore the reminiscences of the weekend of September 13-14 of 2008, when regulators tried to rearrange for takeover of Lehman by Merrill Lynch, however what really occurred was Merrill Lynch offered itself to Financial institution of America (to keep away from its personal chapter) over the weekend, whereas Lehman filed for chapter on the morning of September 15.

However having learnt from previous errors, the regulators pulled their would possibly collectively this time round over the weekend to make sure Credit score Suisse acquired absorbed by UBS. In response to the Swiss regulator, this helped keep away from a ‘monetary disaster’ worldwide.

The banking disaster reminded us that generally bankers by no means be taught the teachings. Whether or not it was SVB or US Fed, each had been caught napping, and the incident was an enormous embarrassment to the US Fed for not being alert to monetary vulnerabilities and the regional banking disaster.

The height of the banking disaster in direction of end-March, and market turmoil it precipitated, marked the underside for the India inventory markets in 2023 with the Sensex and Nifty 50 registering their lows of 57,085 and 16,828. They’ve returned 24 and 26 per cent respectively since.

The worldwide monetary system luckily managed to stave off a monetary disaster in 2023. However are the underlying structural issues solved? We will know solely in 2024.

3) Nvidia and the AI Gold Rush

ChatGPT was launched in 2022. However 2023 was really the 12 months when AI theme acquired world consideration. The inflexion level was in Could 2023 when the semiconductor GPU firm, NVIDIA delivered its Q1 (April ending) outcomes and Q2 outlook in what’s termed because the ‘biggest beat of all instances’. Its market cap elevated by $200 billion or the equal of a whole Reliance Industries in a single day after this outcome. Its Q1 outcomes by which income beat expectations by 10 per cent, was overshadowed by the 52 per cent beat in its Q2 income steering. Such a beat versus expectations is unprecedented.

A veteran tech analyst at Morgan Stanley, Joseph Moore, famous that he had by no means seen 1 / 4 like this within the 25 years that he has lined shares. One Wall Road analyst termed it the ‘steering for ages’, whereas one other famous that the Nvidia outcomes are a reminder that ‘we’re in an AI gold rush.’ Even probably the most bullish analyst and investor was taken unexpectedly. This was the sign (crystal) that the AI theme had arrived.

This inflection level changed the close to decade lengthy widespread FAANGM theme with new stylish Magnificent Seven (NVIDIA, Microsoft, Alphabet, Amazon, Meta Platforms, Apple and Tesla) – corporations which are at pole place within the AI increase. Though not all of them, together with corporations like Apple, have laid out a transparent AI highway map, markets appear to be satisfied.

Right here is an fascinating titbit — till a number of weeks again when the broader US markets began taking part available in the market rally, all the upside in S&P500 of round 20 per cent for the 12 months was pushed by the Magnificent Seven; ie the S&P 493 was flat for the 12 months! Such has been the influence of the AI wave! The Mag7 shares are up within the vary of 55 to 242 per cent for the 12 months, with a mean return of 115 per cent!

India too was a beneficiary of the AI wave because the optimistic sentiment buoyed markets globally, particularly the tech shares. The Nifty IT which had been in brutal bear marketplace for over a 12 months after peaking in January 2022, acquired some additional legs from the AI wave, though the influence to enterprise mannequin of IT companies corporations is unclear. Some new corporations additionally had profitable IPOs by including the AI jargon to their line of companies.

4) Return of the Bond Vigilantes

‘If one thing can’t go on for ever, it’s going to cease’ – this is named the Stein’s Legislation in economics and Bond Traders learnt it the laborious approach in 2023. Globally within the earlier decade, bond traders in developed economies had earlier loved an excellent run as zero rate of interest insurance policies and quantitative easing suppressed bond yields and elevated the worth of the bonds. Actually, within the US, the chance free 30-year authorities bond index had outperformed the S&P 500 within the interval between 1988 and 2020. It’s fairly one thing when a danger free asset outperforms a broadly widespread fairness index for so long as three many years. Because the multi decade bond bull market gave strategy to stress from excessive inflation and Fed fee hikes, bond traders endured a lot ache and volatility in 2023.

Excessive yields had triggered SVB collapse. Nonetheless, submit the banking disaster, it appeared the yields had peaked as recession fears resulted in traders flocking to protected haven of US bonds.

In hindsight that turned out to be head pretend. The US 10-year bond yield had peaked at 4 per cent simply earlier than the banking disaster in March and collapsed to close 3 per cent in April. However from there it rallied all the way in which to five per cent by October. Throughout US, Europe and Japan, bond yields spiked to decade-level highs if no more (16-year excessive within the US). This was sufficient to roil world fairness markets as nicely, together with in India, which got here beneath stress in October/early November.

Whereas bond yields have cooled off since in anticipation of rate of interest cuts subsequent 12 months, 2023 can be often known as the 12 months when Bond Vigilantes (bond traders who preserve a vigil on inflation and monetary deficit developments) awoke from their comatose state after dovish Central Banks had neutralised them within the earlier decade.

Plan for prospects, not certainties, in 2024

Amidst the various twists and turns in 2023, most main world indices churned wholesome returns (see desk). However right here too there have been surprises. The Nifty 50 and the Nasdaq standout. Nifty 50 delivered one of the best earnings development by a large margin. However Nifty 50 wasn’t one of the best performing index. Nifty 50’s PE a number of shrank marginally this 12 months, reflecting a extra essentially sound efficiency.

The Nasdaq Composite, which is tech-heavy and development oriented, outperformed each main index by a large margin. Excessive rates of interest and fairness valuations are inversely correlated because it will increase the discounting fee of future money flows. Moreover, elevated borrowing prices can influence revenue margins. Sometimes development shares are inclined to get disproportionately impacted by increased rates of interest as they’re valued primarily based on earnings nicely into the longer term, impacting their current worth in a excessive rate of interest surroundings. Nonetheless, the Nasdaq Composite defied this, seeing a PE a number of enlargement within the hope of higher earnings development in 2024. Thus, 2023 was a 12 months the place hope and optimism trumped present fundamentals. Throughout unstable 2023, issues shifted from consensus view of US recession at begin of 12 months to a fiery debate now on whether or not recession is delayed or derailed. Therefore quite a bit in 2024 will depend upon how inflation and rates of interest development. If the hopes of 2023 are belied, this might create challenges for markets in 2024. However 2023 has taught us to not make foolhardy predictions. So finest to plan for prospects relatively than certainties.

#AdaniHindenburg #Silicon #Valley #Financial institution #Gold #Rush #return #Bond #Vigilantes #defining #developments