A number of the flows into small-cap funds at present appear to be pushed by the hope that their stellar run will proceed. However going overboard on any fund class after it has had an awesome run is a cardinal retail mistake that always results in grief. Making good returns on the small-cap class requires some strategising. Right here’s how one can win with small-cap funds.

Portfolio Podcast | Diving into smallcap funds: Studying dangers, rewards, and profitable methods

Know what’s regular

In comparison with some other fund class, small-cap funds face huge swings in returns. their efficiency for a specific 5 or 10-year interval and anticipating an encore can result in disappointments.

Anybody trying on the trailing one1-year, five5-year and 10-year returns on small-cap funds at present is sure to be blown away, as a result of they common 28 per cent, 18 per cent and 22 per cent respectively. (All return references are to CAGR or compounded annual progress price). In distinction, BSE Sensex has delivered 20 per cent for one 12 months and 13 per cent for five5- and 10-years. However these returns should not a standard prevalence for small-cap funds.

Level-to-point return comparisons are all the time distorted by the beginning and finish dates for the information. At present, 10-year returns on small-cap funds look phenomenal as a result of July 2013 was a low level for Indian markets, with the BSE Sensex languishing at 19,000 ranges and the BSE Smallcap 250 index at 900. From that time, the Sensex has tripled and the BSE Smallcap 250 has shot up fivefold. However there have been many 10ten-year durations when small-cap funds have earned lacklustre returns. As an example, within the ten years to July 2020, small-cap funds had made a mere 8 per cent CAGR.

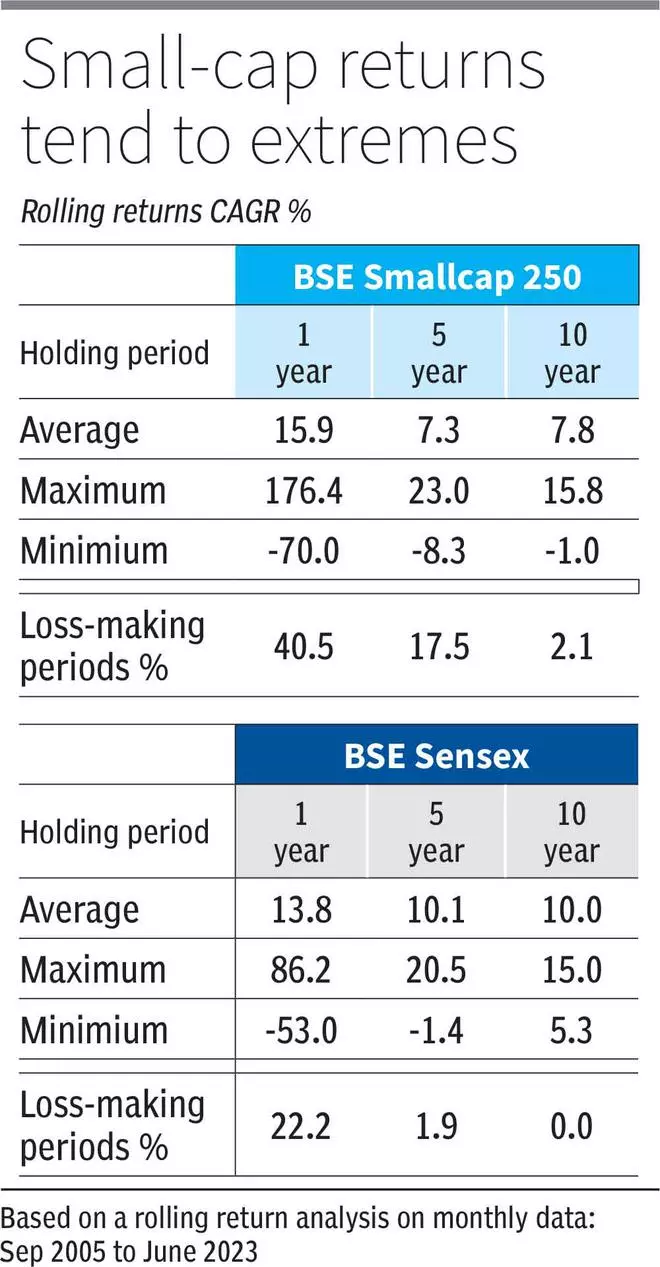

Working a rolling return evaluation (which seems at a number of point-to-point returns over a very long time) is helpful to gauge the returns that a median investor is prone to have made on small-cap funds. A rolling return evaluation on month-to-month information for the BSE Smallcap250 index for the final 18 years (September 2005 to June 2023), exhibits that the typical returns managed by this index over 5-year durations was at a modest 7.2 per cent and for 10-year durations at 7.8 per cent.

Poor averages for the Smallcap 250 index stem from the yawning hole between its greatest and worst durations. Whereas this index has managed a staggering 23 per cent return in its greatest five5-year interval, it misplaced 8 per cent yearly in its worst five5-year spell. In its greatest 10-year interval, it managed a 15 per cent CAGR (higher than the Sensex’ 12 per cent), however in its worst decade it suffered a 1 per cent annual loss.

Thus, buyers excited by the previous five-year or 10-year returns on small-cap funds at present, have to know that they’re the most effective durations on document for this class. Going by the regulation of averages, after delivering outsized returns within the final 10 years, returns on small-cap funds may very properly revert to regular, or (god forbid) below-normal over the subsequent 10 years. The ‘regular’ 10-year return on energetic small-cap funds has been 15-16 per cent. This could mood your long-term return expectation from this class.

As small-cap funds are inclined to swing between extraordinarily good and terribly dangerous returns, the dimensions of your small-cap investments and SIPs shouldn’t be out of proportion to your total fairness portfolio. Resolve on a selected allocation to small-cap funds inside your fairness portfolio based mostly in your threat urge for food (say, 10-25 per cent) and dimension your lump sums or SIPs accordingly. Resist the temptation to load up on this class throughout good occasions.

Have a 10-year horizon

On a trailing return foundation, small-cap funds have delivered nice returns over the past one, three and 5 years. However the shorter your holding interval in a small-cap fund, the upper is your probability of creating losses from it or incomes measly returns. The above rolling return evaluation exhibits that for buyers who held the small-cap index for one-year durations, it delivered a loss 41 per cent of the time. For individuals who stretched their holding interval to 5 years, losses cropped up 17.5 per cent of the time. For individuals who held on for 10 years, losses have been a minuscule risk, occurring solely 2 per cent of the time.

This affords two takeaways for buyers. One, don’t make investments any cash in small-cap funds that you just want to pull out inside 10 years. Over one-, three- or five-year time frames, the possibility of exiting with sub-par returns is excessive. Two, on condition that markets seldom give advance warning of a correction or a bear section, it’s best for first-time buyers to take solely the SIP path to this class. That is additionally why most small-cap funds bar lump sums and gate SIPs in bull markets.

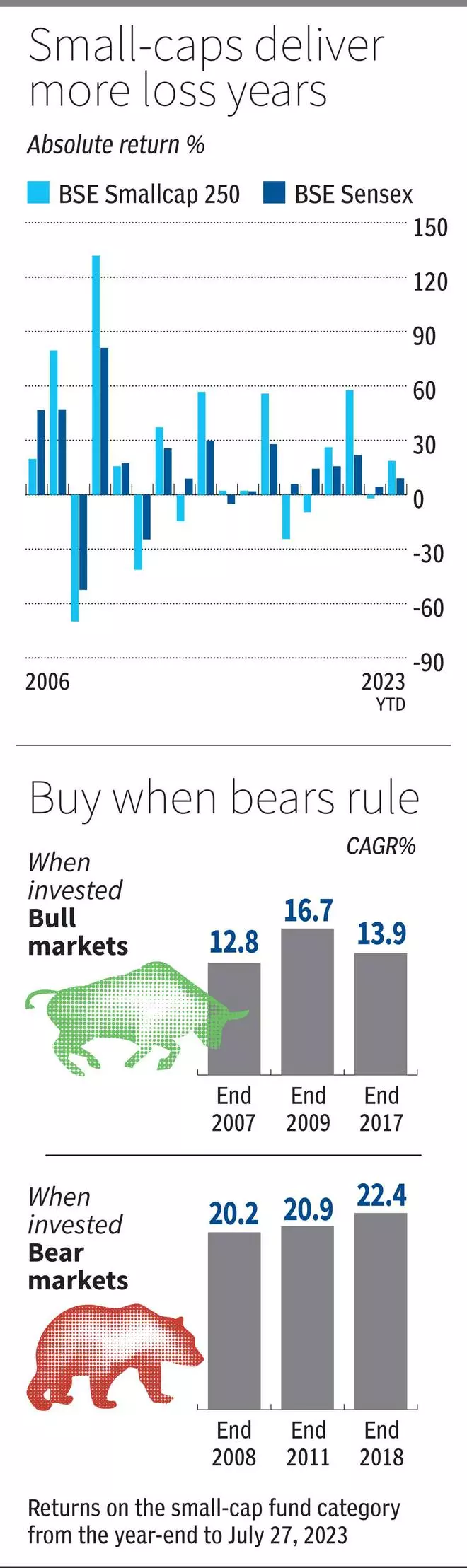

Make investments after a fall

Small-cap funds topic their buyers to a stomach-churning journey. The BSE Smallcap 250 index has had roughly double the variety of loss-making years because the Sensex since 2006. At any time when the Sensex has sunk right into a bear market, the Smallcap index has tumbled a lot tougher. In 2008, the Smallcap index misplaced 69 per cent in comparison with the Sensex’ 52 per cent fall. In 2011, it fell over 41 per cent in opposition to 24 per cent on the Sensex. In 2018, small-caps misplaced 24 per cent whereas the Sensex gained.

When a fund you personal loses 40 or 70 per cent of its worth in a 12 months, it may be very robust to hold on to it, and proceed your SIPs. But, holding on is important to benefit from the excessive long-term returns that comply with bruising bear markets.

Because of this roaring bull markets are dangerous occasions to make your first investments in small-cap funds. When the inevitable correction arrives, the tendency to panic and change out, or cease SIPs, will be excessive. A great way to keep away from the behavioural mistake of bailing out too quickly is to start out your small-cap fund investments after an enormous market fall. This might help you keep the course together with your investments and vastly enhance the long-term returns you get to make.

Our evaluation (desk 3) exhibits that had you invested in small-cap funds after huge bull years reminiscent of 2007, 2009 or 2017, your common returns until date would have ranged at 12.8-16.7 per cent. However had you invested after huge market falls in 2008, 2011 or 2018, you’d have simply managed a 20 per cent return.

Gauging market tops or bottoms is feasible solely with the good thing about hindsight. However to get pleasure from higher returns out of your small-cap funds it is sufficient to make investments after a major market (Sensex) fall (say, 20 or 30 per cent). First-time buyers with no small-cap allocation can begin out with small SIPs in bull market and add to them on important declines. Seasoned buyers with an present small-cap allocation can keep off including to it in bull markets and bide their time on additions (SIPs or lump sums) till the market falls.

Lively over passive

Within the large-cap and mid-cap classes, energetic fund managers have been discovering it tough to beat their benchmarks in recent times. This has led to buyers shifting to passive funds monitoring indices such because the Nifty50, Nifty100, Nifty Midcap 150 and Sensex30. Whereas some buyers personal passive-only portfolios, others combine and match energetic with passive funds.

The small-cap class has additionally seen the launch of many index funds within the final couple of years. The menu now consists of index funds monitoring the Nifty Smallcap 50, Nifty Smallcap 250 and the Nifty Microcap 250 indices. So, do you have to take the passive path to small-cap funds too?

The energetic fund path to small-cap investing appears to attain over the passive route for 3 causes. One, on a median, energetic small-cap funds have nonetheless managed to beat their benchmark (BSE Smallcap 250 index) over three-, five- and 10-year time frames. Whereas the index managed returns of 39.1 per cent, 15.1 per cent and 18.1 per cent over these time durations, energetic small-cap funds averaged 39.2 per cent, 18.1 per cent and 22.4 per cent respectively. The margins by which the highest funds beat the indices is 4-5 share factors.

Two, in contrast to the large-cap or mid-cap areas the place energetic managers have a restricted universe of shares to select from (100 large-caps and 150 mid-caps by the SEBI definition), the small-cap class opens up a big taking part in subject for energetic inventory choice (all shares past the highest 250). After SEBI’s categorisation norms in 2018, the market cap cut-off for the small-cap phase has moved up from ₹5,000 crore to ₹17,000 crore.

Three, cautious inventory choice is vital to win at small-cap investing in the long term and that is higher achieved with energetic funds. Small-cap investing in India, in contrast to large-cap or mid-cap investing, is susceptible to excessive governance in addition to enterprise dangers. A couple of third of the small-cap shares that have been listed 10 years in the past aren’t even traded at present. Most small corporations fail to scale as much as a significant dimension. Given the various qualitative components that go into figuring out small-cap survivors, this can be a house for elementary investing. As index suppliers choose their small-cap index constituents based mostly primarily on market cap and liquidity and never governance, valuations or fundamentals, energetic managers can construct a better-quality portfolio of small-cap shares than the index suppliers.

Selecting energetic small-cap funds

Hitherto, we’ve mentioned how buyers ought to time their bets on small-cap funds and really helpful the energetic route. However given the vast gaps in returns between the chief and laggard funds inside small-caps, how can buyers select the correct energetic funds? We recommend the next filters.

- Within the small-cap house, bull markets make each investor (and fund supervisor) appear to be a genius. To make sure that your small-cap fund’s returns are the results of some ability, and never plain fluke, search for funds which have existed over total market cycle (a bull and bear section). They need to have fared higher than the index in each. On condition that the final huge falls within the small-cap house transpired in 2011 and 2018, search for funds which were round since 2010. Go for a fund with a protracted monitor document even when it has a big asset dimension.

- Deciding on small-cap shares in India is a really completely different ballgame from selecting mega or mid-caps. Small-caps require a bottom-up method with an ear to the bottom on governance and administration strikes. Search for small-cap funds with a specialist supervisor — who isn’t juggling a battery of large- and mid-cap funds in the identical fund home.

- In India, the small-cap house is a worth investing minefield. Small-caps that commerce low-cost are sometimes these slowed down by governance or enterprise dangers. Gravitate in direction of small-cap funds managed within the progress or high quality kinds, quite than value-style ones. Don’t draw back from funds with a excessive portfolio PE as this can be a sign of higher enterprise high quality.

- To handle inflows and dangers, small-cap fund managers have leeway to take a position upto 35 per cent of their corpus in money equivalents, large-cap or mid-cap shares. Test how a small-cap fund is utilizing this leeway. Money calls in frothy markets might enable a fund to handle draw back higher than friends. Allocating extra to mid-caps quite than large-caps may give a return kicker. Based mostly on the above components, Nippon India Smallcap and SBI Smallcap funds will be thought of.

#Win #Smallcap #Funds