Enterprise

RailTel, a Miniratna Central public sector endeavor, is an data and communications know-how (ICT) infrastructure supplier and one of many largest impartial (carrier-agnostic) telecom infrastructure suppliers in India. It initially began off as an in-house telecom providers supplier for Indian Railways. RailTel was later mandated with the duty of constructing and sustaining a high-speed cellular communication hall alongside railway tracks to fulfill the communication wants of Indian Railways. As a part of its contract with the Railways, RailTel additionally has the ‘proper of manner’ alongside the tracks for laying optic fibre cables. When absolutely applied, its high-speed optic fibre cable (OFC) spine community will cowl the whole railway community throughout the nation. As of now, its community is unfold throughout all main cities and cities, enabling the corporate to serve 70 per cent of the nation’s inhabitants. Companies supplied utilizing its community cowl leased line, VPN, and enterprise/retail broadband. Nonetheless, it must be famous that whereas the protection is large, the dimensions as but is low. For instance, the OFC of RailTel spans round 60,000 km as in comparison with Jio’s 15 lakh km. The corporate additionally gives information centre and associated providers to Railways and different enterprises (primarily PSUs). This, and some different passive telecom/community infrastructure providers, make up the telecom section of the corporate which accounted for close to 60 per cent of the corporate’s income in FY23. RailTel derived steadiness income from its tasks section which encompasses ICT {hardware}/ software program and system integration tasks for enterprises and likewise options and signalling providers for the Railways.

Latest efficiency

In 1H FY24, RailTel reported working income of ₹1,067 crore and internet revenue of ₹106 crore — up by 33 per cent and 30 per cent over 1HFY23. In latest quarters, the corporate has been getting a lift to enterprise from its tasks section, which noticed income develop by 96 per cent in 1H to ₹466 crore as in comparison with telecom section which reported sluggish development of simply 6 per cent. The outlook for the tasks too seems robust with order e-book at round ₹5,000 crore (though a few of it is rather long run), and development is anticipated to outpace the telecom enterprise strongly within the second half as nicely. Nonetheless, one factor to be famous right here is that the tasks enterprise has decrease EBIT margins at round 7.5 per cent (1H FY24) than the telecom enterprise (21 per cent). So, in a case the place tasks enterprise is driving development for the corporate, the earnings development can be decrease than topline development. The nice efficiency aside, as talked about above, the information flows round ‘Kavach’ methods have additionally added to constructive sentiment within the inventory as RaiTel is prone to be concerned in its implementation. Nonetheless, the constructive sentiment on this facet is overdone as the chance and affect is unquantifiable as of now and there are additionally uncertainties on how these will play out given the lengthy timelines and intricacies concerned.

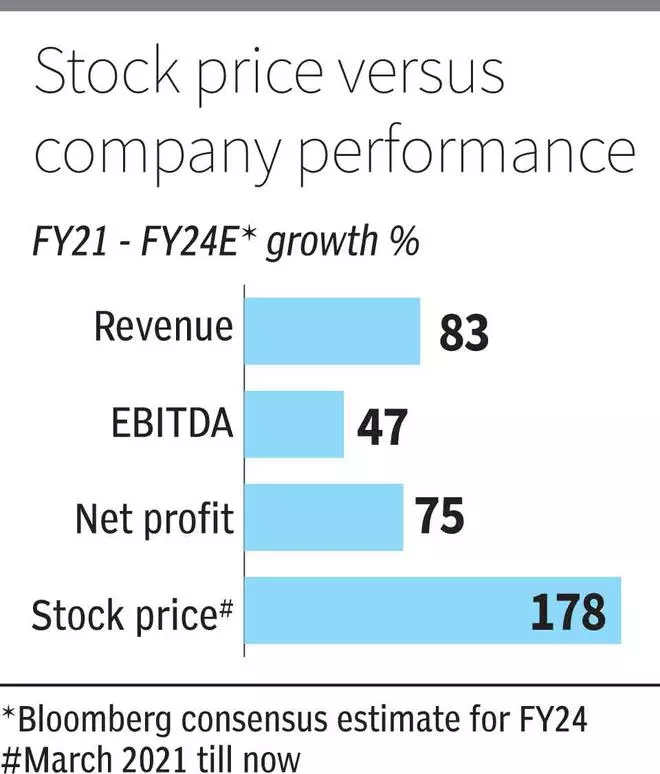

With the latest surge in shares, the danger reward is unfavourable

#Valuation #Kavach #Means #Vande #Bharat #Specific #Breather