- Additionally Learn: Fairness market outlook 2024: No case for pessimism, however ample case for warning

On the higher finish of the curve, 10-year G-Sec maturing in 2033 trades at 7.22 per cent. Now we have the G-Sec maturing in 2037 buying and selling at 7.35 per cent. Within the 12 months that noticed the collapse of Silicon Valley Financial institution and some others, Israel-Hamas struggle, huge treasury yield spikes and subsequent regular falls within the US, 10-year Indian G-Secs traded in a band of seven.1-7.4 per cent and have been fairly steady. With inflation shifting southwards globally, uncooked materials prices correcting and crude oil costs cooling off, along with the bond market occasions on yield strikes subsiding, it seems doubtless that we’re at or round peak rates of interest. In actual fact, market pricing signifies expectations for the US Fed to chop charges 3-4 instances within the second half of 2024. The RBI could not instantly comply with swimsuit as charge hikes have been of smaller quantum and GDP progress as but appears on the right track. Nonetheless, there are expectations of a charge lower later in 2024, although the quantity might be low. From right here on, increased coupons obtainable could be a plus and charge cuts leading to bond worth will increase would end in first rate capital features for fixed-income traders. One key set off is JP Morgan’s choice so as to add Indian Authorities Bonds (IGBs) to its Authorities Bond Index-Rising Markets (GBI-EM). These IGBs can have a ten per cent weightage within the bond index, which manages about $240 billion. The addition will start in June 2024 on the charge of 1 share level a month and proceed for 10 months until the ten per cent weightage within the index is reached by March 2025. The addition of IGBs is anticipated to carry no less than $24 billion in the direction of index funding and $30-40 billion into the bond market over the following 12 months or so. If different index suppliers corresponding to Bloomberg, S&P and FTSE resolve to incorporate Indian bonds, there could also be additional inflows as effectively. There’s prone to be a fall in yields of G-Secs and an increase in bond costs over the course of the 12 months.

Investing at peak rates of interest

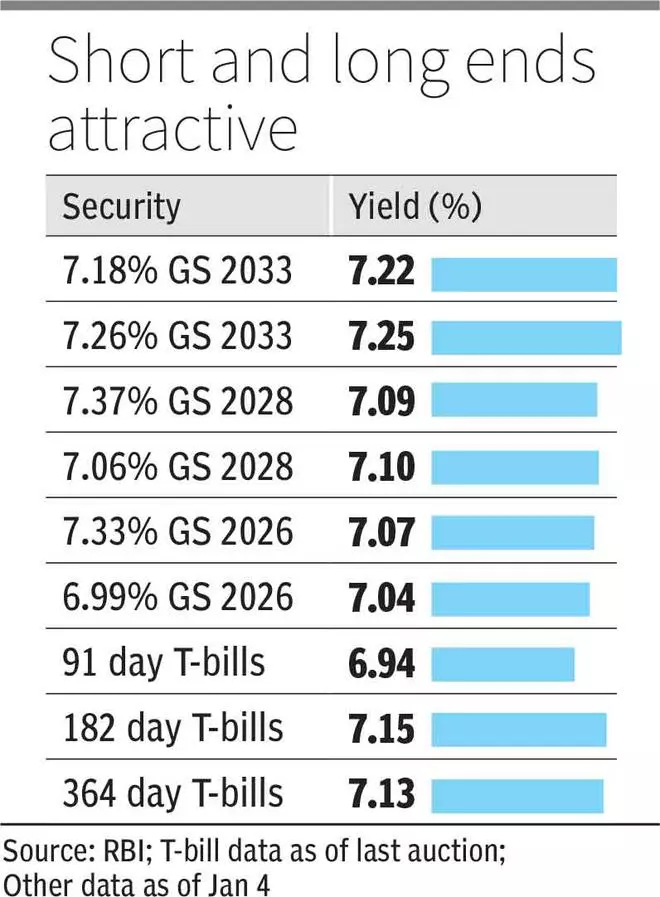

Yields on the two ends of the curve seem fairly engaging for the time being. Quick-term and long-term securities can be found north of seven.1 per cent yields. Liquid, cash market and ultra-short length mutual funds sport portfolios with yield-to-maturity of seven.55-7.98 per cent. These are funds that spend money on secure authorities securities, T-bills and short-term bonds that mature inside a couple of months to lower than a 12 months, and carry nearly no credit score danger. Traders seeking to profit from the present yields can think about the next funds from the classes: Liquid: Aditya Birla Solar Life Liquid and SBI Liquid funds. Cash Market: Aditya Birla Solar Life Cash Supervisor, Nippon Life Cash Market, SBI Financial savings and HDFC Cash Market funds. Extremely-Quick Length: ICICI Prudential Extremely Quick Time period, Nippon Extremely Quick Length and Mirae Asset Extremely Quick Length funds. For the medium time period, traders can think about high quality NCDs within the 3-5-year tenor once they come up, however should ideally prohibit such publicity to 5-10 per cent of their debt portfolios. Muthoot Finance NCDs, opening subsequent week with yields of 9 per cent for 36 and 60 months, are one such possibility. 360 One Prime, additionally opening subsequent week, gives greater than 9 per cent for 24-60-month tenors. For the longer tenure, gilt funds with maturity durations of 6-10 years appear engaging as are choose goal maturity funds. ICICI Prudential Gilt and Kotak Gilt funds are good decisions with 7.64 per cent and seven.66 per cent YTMs, respectively. Bharat Bond ETFs maturing in 2030 and 2033, each with yield to maturity of seven.6 per cent, are engaging. UTI CRISIL SDL Maturity April 2033 Index (7.86 per cent YTM) and Kotak Nifty SDL July 2033 Index (7.76 per cent YTM) are choices to contemplate.

Traders should ideally select their choices in order that they coincide with a particular objective.

#Debt #Outlook #peak #charges #time #play #bond #yields #brief #lengthy #tenors