We gave an Accumulate score on the inventory within the version dated July 17, 2022, owing to cheap valuation, robust dividend yield, assured earnings mannequin and the inventory being a secure guess given the volatility out there then. Since then, the inventory has returned almost 62 per cent (together with dividends). This has been as a consequence of its re-rating as its P/E went up from round 9 instances to almost 14 instances.

Investor optimism within the inventory is pushed by expectations of elevated capex, which is able to assist the corporate’s progress within the medium time period. Larger capex incurred in constructing transmission belongings will end in commercialisation of initiatives as soon as the execution is accomplished, which may enhance the corporate’s revenues and money flows, going ahead.

At present, the inventory delivers a dividend yield of round 5 per cent and the corporate advantages from the robust progress visibility on account of its deliberate capex over the subsequent 7-8 years. Finally, traders can proceed to ‘Accumulate’ the inventory on account of constructive trade dynamics, secure enterprise mannequin, robust stability sheet and wholesome dividend yield.

Enterprise

PGCIL handles about 50 per cent of India’s whole energy transmission community and has a close to monopoly in dealing with the nation’s inter-state energy transmission community. Energy transmission is the majority motion {of electrical} power — from energy producing plant to an electrical substation. The corporate generates about 96 per cent of its income from the transmission enterprise, whereas different sources of income have been telecom (2 per cent) and consultancy (2 per cent).

A majority of the corporate’s transmission income (95 per cent) comes from the regulated tariffs set by the Central Electrical energy Regulatory Fee (CERC), which ensures full pass-through of prices plus 15.5 per cent of pre-tax ROE (Return on Fairness) on its accomplished initiatives awarded below the regulated tariff mechanism. The elements of the annual transmission expenses embrace return on fairness, curiosity on time period mortgage, curiosity on working capital mortgage, operations and upkeep bills and depreciation.

PGCIL wants to make sure technical community availability above the normative degree of 98 per cent to recuperate the annual transmission expenses. Finally, availability-based tariff means the corporate’s tariff cost doesn’t depend upon the quantity of energy transmitted.

Together with this, PGCIL earns income below TBCB (tariff-based aggressive bidding), the place it competes with personal gamers akin to Adani Power Options and Sterlite Transmission. Right here, initiatives are awarded to these offering most cost-effective bids, and tariffs are aggressive. Nonetheless, regardless of the competitors, the corporate has been capable of keep its foothold in TBCB with 40-50 per cent market share in bids.

Financials and valuation

PGCIL has been capable of obtain 99.85 per cent availability throughout H1FY24 as towards the normative degree of 98 per cent.

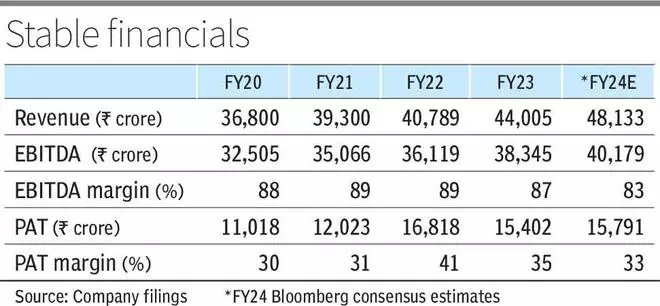

It had a flattish progress of round 1.5 per cent in income throughout H1FY24 from operations of round ₹22,315 crore. Additional, EBITDA throughout the interval elevated by 5 per cent to round ₹19,591 crore with EBITDA margin increasing from round 85 per cent to 88 per cent, aided by decrease transmission prices. Over time, the corporate has been capable of keep its EBITDA margins within the 83-88 per cent vary owing to its regulatory return mannequin.

Regardless of being in a capital-intensive enterprise, PGCIL has been capable of scale back its leverage over the past 5 years, leading to discount in its D/E from round 2.4 instances throughout FY18 to round 1.4 instances as of H1FY24. Additional, the corporate’s skill to entry debt at cheaper ranges in comparison with its personal friends leads to a aggressive edge, particularly whereas bidding for TBCB initiatives. PGCIL offers its traders a gorgeous dividend yield of round 5 per cent.

The inventory is buying and selling at a P/B of two.7 instances.

Progress triggers in place

Throughout FY2011-18, the corporate’s progress was pushed by sharp improve in capex, which reached round ₹25,800 crore in FY18. Nonetheless, it fell to almost ₹9,212 crore in FY23 as a consequence of elevated competitors within the area and nearly all of the deliberate inter-regional transmission capability referring to thermal was accomplished. With ₹2.4-lakh crore RE associated inter-State transmission alternatives over the subsequent 7-8 years, the transmission area seems to have seen revival.

As per the administration, there’s an anticipated capex visibility for the corporate of round ₹1,88,000 crore in whole in transmission area by 2032. This contains inter-state initiatives price ₹1,16,500 crore, intra-state initiatives price ₹37,000 crore, cross-border interconnection initiatives price ₹10,000 crore and worldwide initiatives price ₹7,500 crore. Thereby administration expects the capex to succeed in greater than ₹12,500 crore in FY25 which can regularly improve to annual capex of ₹20,000-25,000 crore by FY27 or FY28.

The corporate incurred capex of round ₹4,246 crore throughout H1FY24, whereas the administration has revised its FY24 capex goal from round ₹8,800 crore to round ₹10,000 crore cut up equally between RTM and TBCB initiatives.

Transmission aside, the corporate additionally estimates ₹17,000-crore outlay in different companies akin to photo voltaic era, sensible metering and information middle over the subsequent 7-8 years. As on September 30, 2023, PGCIL has ₹55,000 crore of works in hand, together with ₹16,500 crore of TBCB initiatives.

#Energy #Grid #Corp #Traders #Accumulate #Inventory