With the federal government asserting targets of reaching near 500 GW of put in capability from RE sources by 2030, energy era corporations wish to set up RE-based capacities. To attach the era capacities to the central grid, vital investments can be required in constructing the associated transmission evacuation system. Within the mild of this, energy advisory physique Central Electrical energy Authority (CEA) has recognized an incremental funding of near ₹2.4 lakh crore within the inter-state transmission system (ISTS).

Right here’s how the upcoming estimated capex can have a constructive affect on the listed corporations within the energy transmission worth chain.

Spillover impact on transmission builders

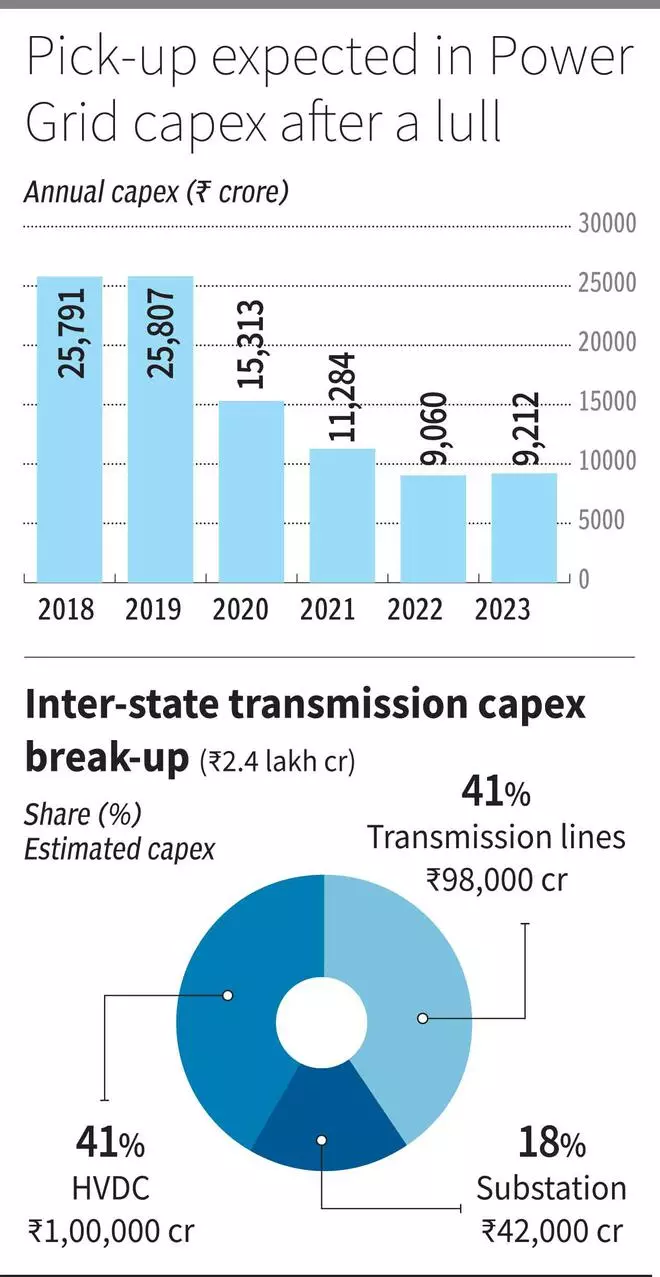

The capital expenditure of Energy Grid Company (PGCIL) has been thought of because the barometer of the nation’s transmission capex. The annual capex made by PGCIL steadily elevated to ₹25,800 crore in FY2018 from the extent of ₹12,100 crore in FY11. It was pushed by the addition in thermal-based era capacities. Nevertheless, the annual capex has steadily fallen over the past 5 years, to ₹9,212 crore in FY23, on account of the truth that majority of the deliberate inter-regional transmission capability referring to thermal has been accomplished.

Throughout this time, numerous engineering, procurement and development (EPC) corporations, reminiscent of KEC Worldwide and Kalpataru Tasks Worldwide — which had been seen as proxy performs on PGCIL’s capex — began diversifying each segment-wise and geography-wise, as alternatives within the area lowered.

Issues are anticipated to alter with the upcoming ₹2 lakh crore of capex estimated to be carried out until 2030 (adjusting for capex carried out throughout Q4FY23). To start with, whereas the PGCIL administration hasn’t given out a particular quantity, it has indicated that the annual capex can attain considerably greater than ₹11,000 crore by FY25 or FY26. Peak energy demand has been hitting all-time excessive ranges of 216-223 GW throughout April-June 2023. Therefore, as per an April 2023 Nuvama report (Transmission & Railways: Decadal Thrust), it will likely be mandatory so as to add era capability to the tune of atleast 400 GW by 2028-30 and subsequent investments in transmission capability to keep away from energy deficit state of affairs by then.

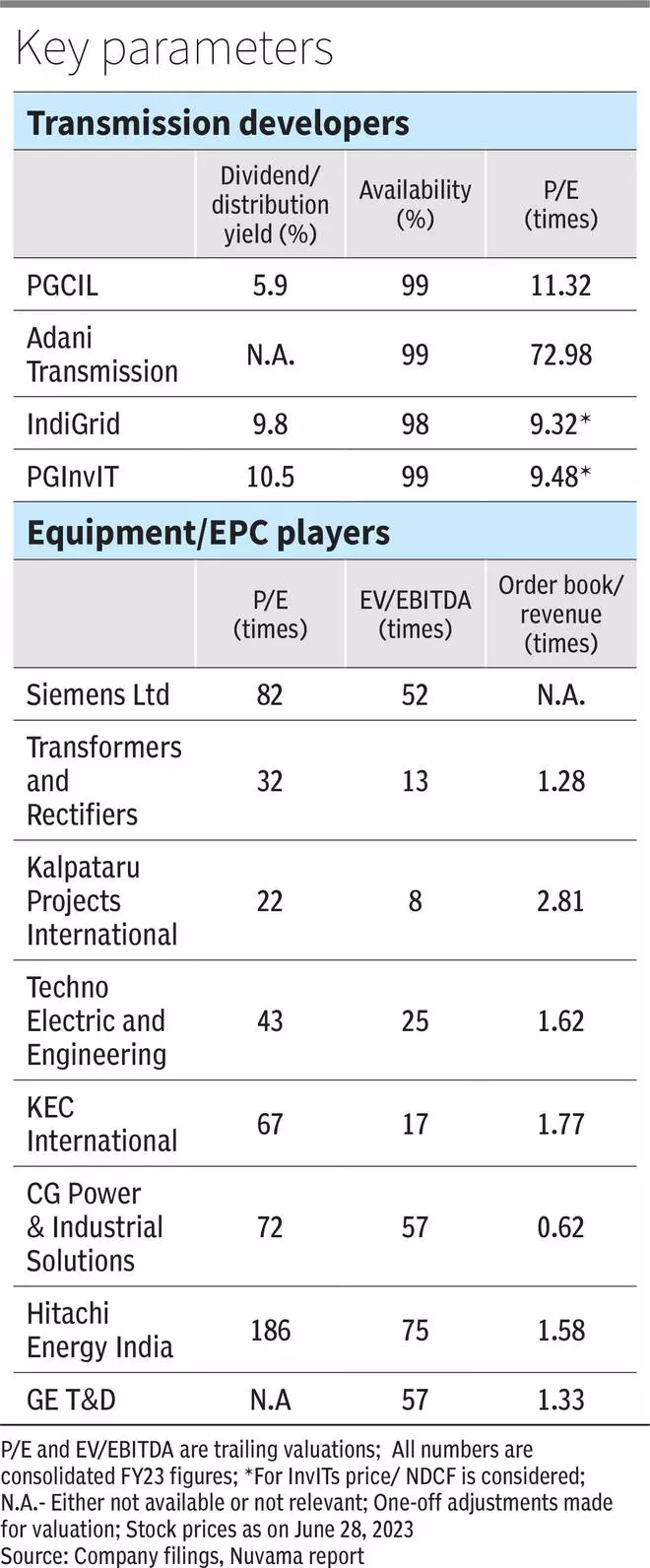

Transmission corporations primarily earn availability-based income pursuant to long-term (35-year) transmission serviceagreements (TSAs). Until 2011, the inter-state transmission tasks had been awarded on the idea of regulated tariff mechanism (RTM) and a majority of the awards went to to PGCIL. On such tasks, tariff earned is cost-plus based mostly — which ensures restoration of all prices and a return of round 15.5 per cent topic to making sure prices and technical availability (usually 95-98 per cent) inside the normative parameters.

Nevertheless, put up that, tariff-based aggressive bidding (TBCB) for all inter-state transmission strains was made obligatory (aside from sure vital tasks, which shall proceed to be alloted to PGCIL below RTM foundation), which has led to rising competitors within the sector. Below TBCB scheme, tariffs for tasks should not set on a cost-plus foundation however, quite, bidders are required to cite for tariffs over a interval of 35 years. Whereas greater than 90 per cent of TBCB bids until now have collectively been received by PGCIL (40 per cent), Sterlite Energy (29 per cent) and Adani Transmission (23 per cent), different gamers like Tata Energy, ReNew Energy and GR Infra have additionally participated within the bids.

PGCIL and Adani Transmission are gamers who’ve energy transmission as their core enterprise and so they can profit from the upbeat capex plans. Different corporations reminiscent of Kalpataru Energy and Techno Electrical take part in bids for BOOT tasks whereby they handle the transmission belongings for a sure time frame and hive them off later. Additional, sure gamers undertake monetisation of seasoned transmission belongings as it may well assist them finance new transmission infrastructure, by bringing in much-needed capital. Energy Grid InvIT and IndiGrid are the 2 listed InviTs sponsored by PGCIL and Sterlite Energy, respectively.

Advantages for EPC and gear gamers

Together with the facility transmission builders, such uptick in investments can profit the transmission strains and towers engineering, procurement and development (EPC) corporations and energy gear producers. Usually, a transmission system consists of transmission line bundle (together with conductors, towers and insulators) and substation bundle (together with energy transformers, switchgears, circuit-breakers, reactors and different elements).

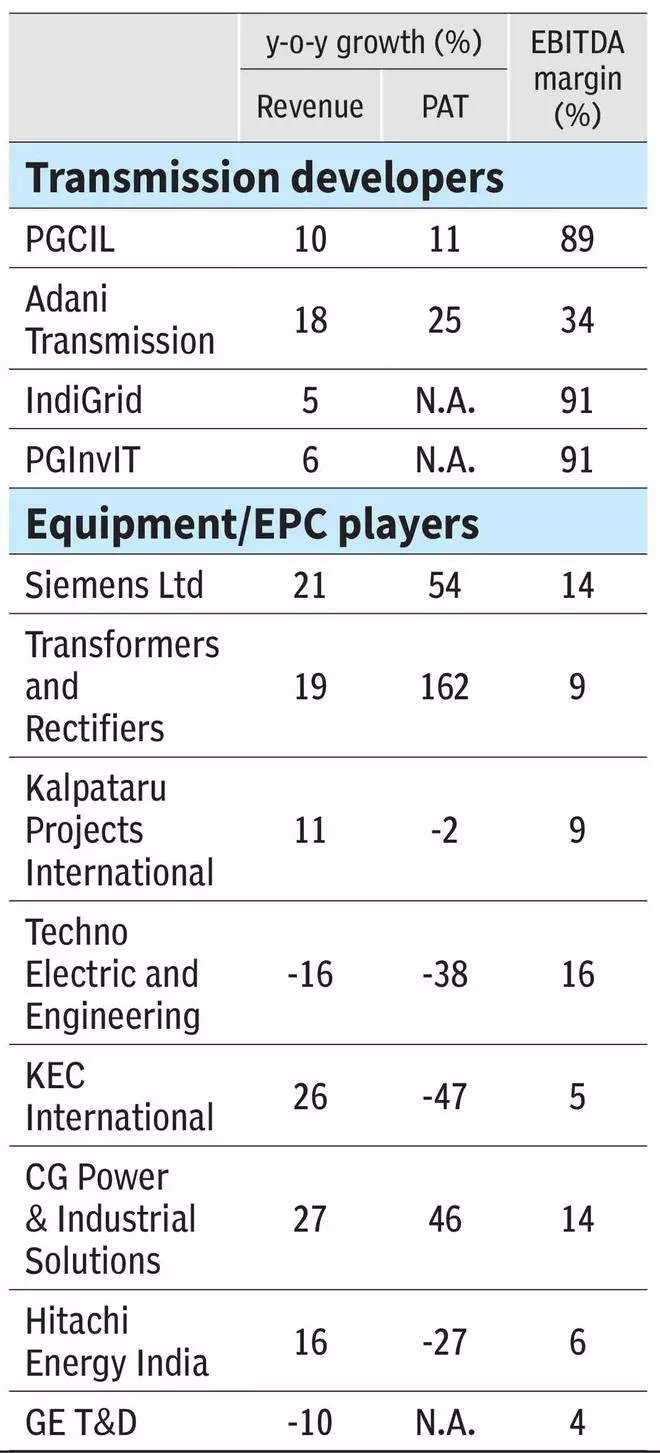

The CEA transmission plan estimates an addition of round 51,000 ckm (within the alternate present) of transmission strains within the ISTS area, implying an absolute development of round 30 per cent over the subsequent seven years (JP Morgan report). With this, of the CEA estimated capex of round ₹2.4 lakh crore, round ₹98,000 crore (41 per cent) shall be spent on the transmission strains capability addition, as per the Nuvama report. Among the key EPC-based gamers within the area are KEC Worldwide, Kalpataru Tasks Worldwide, L&T (small portion of income) and Tata Tasks (unlisted). KEC Worldwide, which nonetheless garners a good portion of its income (42 per cent) from the home T&D section, stays a major beneficiary of capex within the section.

About ₹42,000 crore (17 per cent) of investments are anticipated to be made in alternate current-based substations. As per a February 2023 JP Morgan report (Progress optionality with secure return), the prevailing sub-stations can take up an extra 33.7GW. Thus, new substation capex is required for evacuating 294GW of RE energy, which is equal to 433,575 MVA. The present capability is 459,826 MVA, implying doubling of substation capability within the subsequent seven years.

Transformer is probably the most vital a part of the substation which helps in stepping up or stepping down the voltage ranges. For the transmission area, usually, energy transformers with greater than 66 kv (kilo volt) are required and are used for stepping up voltage ranges. Transformers and Rectifiers India, Bharat Bijlee and Voltamp Transformers are pure-play transformer gamers within the listed area whereas Siemens Ltd, Hitachi Vitality India, GE T&D, ABB India, CG Energy and Techno Electrical & Engineering Co usually present complete substation packages. Nevertheless, provided that investments are majorly coming within the 400-800 kv vary, gamers reminiscent of ABB India, Voltamp Transformers and Bharat Bijlee could not take pleasure in alternatives within the ISTS area as they’ve capacities based mostly in decrease voltages.

Whereas the above-mentioned investments are taking place within the common alternate present (AC) area, India additionally plans so as to add 4 giant high-voltage direct present (HVDC) transmission corridors having a possible funding of about ₹1-lakh crore (42 per cent of CEA estimated ₹2.4-lakh crore). For transmission tasks involving distances longer than, say, 350 km, HVDC will be an optimum answer on account of its price effectivity in comparison with the common HVAC-based transmission. As an example, as per CEA, about 1,100 km of HVDC strains is deliberate to be laid between Barmer and Jabalpur. Hitachi Vitality, GE T&D and Siemens are broadly current within the gear half (substation bundle) of those tasks, which accounts for 50-60 per cent of estimated HVDC capex (₹1-lakh crore) i.e. ₹50,000-60,000 crore as per the administration of those corporations.

How financials and valuation stack up

Regardless of TBCB coming in, risk-return profile of energy transmission tasks nonetheless stays beneficial for the builders because the returns are solely 100-150 foundation factors (bps) lower than the RTM-based tasks (JP Morgan report). PGCIL earns about 95 per cent of its revenues from the RTM tasks, offering stability to the corporate’s EBITDA margins at about 87 per cent degree. Put up a decadal excessive double-digit development, income CAGR moderated to round 5.4 per cent throughout FY2019-22 on account of fewer alternatives.

Nevertheless, double-digit development is perhaps seen, going ahead, with rising capex. Its listed peer, Adani Transmission, earns 30-40 per cent of its revenues from transmission enterprise and has comparatively decrease EBITDA margin as a result of presence of distribution enterprise. Put up commissioning of an HVDC venture, Adani Transmission shall be incomes about 50 per cent of its transmission income from TBCB and relaxation from RTM. Whereas PGCIL’s D/E is round 1.5 instances, Adani’s is greater at 2.7 instances.

Each energy transmission EPC corporations KEC Worldwide and Kalpataru Tasks Worldwide are having fun with all-time excessive order e book at ₹30,553 crore and ₹ 25,241 crore, led by robust YoY development so as inflows to the tune of 29 per cent and 39 per cent respectively, in FY23. Home transmission orders account for round 40 per cent of KEC’s order e book, making it a play on home transmission capex. For Kalpataru, it’s simply 6 per cent on account of great diversification. Nevertheless, as per Kalpataru’s administration, the corporate could go for home orders, supplied a beneficial threat return profile is current. KEC’s EBITDA margin has taken a beating in latest instances, reaching about 5 per cent in opposition to Kalpataru’s 9 per cent on account of execution of its legacy SAE Towers’ (Brazil) mounted value orders points. Nevertheless, margins are anticipated to get well within the coming 12 months.

On this context, word that for sure EPC gamers and gear producers, margins have been inclined to volatility in enter prices. Whereas copper and aluminium can largely be hedged by means of derivatives, corporations discover it troublesome to hedge motion in metal costs in case of mounted value contracts.

On account of capex cycle revival, energy gear shares have seen a re-rating within the final one 12 months. The ability transmission gear (substation and tranformers) area stays extremely aggressive with the presence of assorted giant Indian-based corporations and Indian subsidiaries of MNCs. On account of robust know-how assist from MNC father or mother, Siemens Ltd and Hitachi Vitality India commerce at a major premium than Indian counterparts reminiscent of Transformers and Recitifiers and Techno Electrical and Engineering.

GE T&D has not been in a very good place on account of losses on account of surge in enter costs, given mounted value nature of contracts and delay in TBCB ordering. Absence of any main HVDC order, leading to decadal-low order e book, can be another excuse. Hitachi Vitality has additionally confronted such points but it surely has began diversifying into different segments like railways and has witnessed vital soar (85 per cent) in its order inflows in FY23. The upcoming HVDC orders can provide vital enhance to the revenues and margins of Hitachi and GE T&D.

One other participant, CG Energy, has seen a turnaround ever because it got here below Murugappa group as the corporate has turned debt-free and has been producing EBITDA margins to the tune of 12-14 per cent. Siemens Ltd will be thought of because the one greatest positioned within the energy gear area amongst these gamers on account of its presence throughout numerous voltage lessons. It’s a debt-free firm and generates EBITDA margin to the tune of 11-13 per cent.

Additional, if traders need to take publicity to the transmission area in a much less dangerous method, Infrastructure Funding Trusts or InvITs could be a good various. Each IndiGrid and PGInvIT have regular cashflows owing to secure nature of enterprise. At distribution steering of about ₹13.8 and ₹12 per unit for FY24, each IndiGrid and PGInvIT respectively can present traders a sexy pre-tax yield of round 10 per cent.

#Energy #Transmission #Funding #Alternatives #Progress #Potential #India