Gold had a powerful exhibiting in 2023. Each by way of greenback and rupee, the valuable steel appreciated.

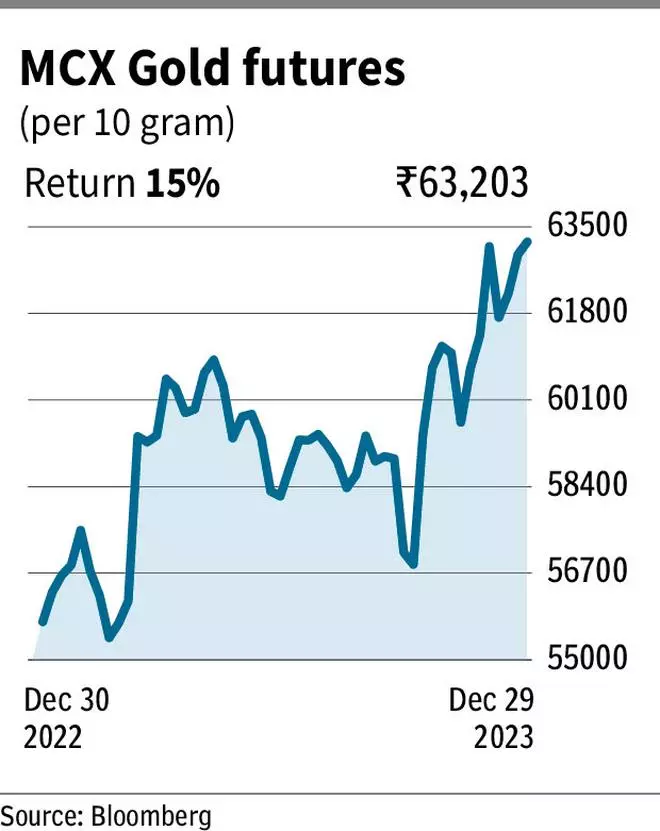

When it comes to greenback, gold gained 13 per cent because it ended the yr at $2,063 per ounce. Within the home market, gold futures on the Multi Commodity Alternate (MCX) wrapped up the yr at ₹63,203 per 10 grams, appreciating 15 per cent.

Notably, by way of rupee, gold futures produced a double-digit acquire in 4 of the final 5 years, establishing its potential pretty much as good diversification wager in a single’s portfolio

In our outlook for 2023, we forecast gold to the touch $2,100 and ₹61,000 in international and native markets, respectively. The respective highs for the yr had been $2,136 and ₹63,881, which had been made in December.

Right here, we take a look at the elements that moved gold in 2023 and what’s in retailer in 2024.

Crises-powered rally

The widespread knowledge is that gold does properly throughout crises and this idea remained true in 2023. The danger-on sentiment prevailed available in the market final yr, which may be seen from the rally within the fairness markets. However regardless of this, gold costs went up, primarily sparked off by two occasions, which led to buyers in search of security in gold.

In March 2023, the Silicon Valley Financial institution disaster and in October, the Israel-Hamas struggle known as on gold bulls. However between Might and September, the costs moderated, nearly erasing the beneficial properties that resulted from the March rally. General, the most recent stretch of the upside since October resulted in gold posting a acquire for the yr.

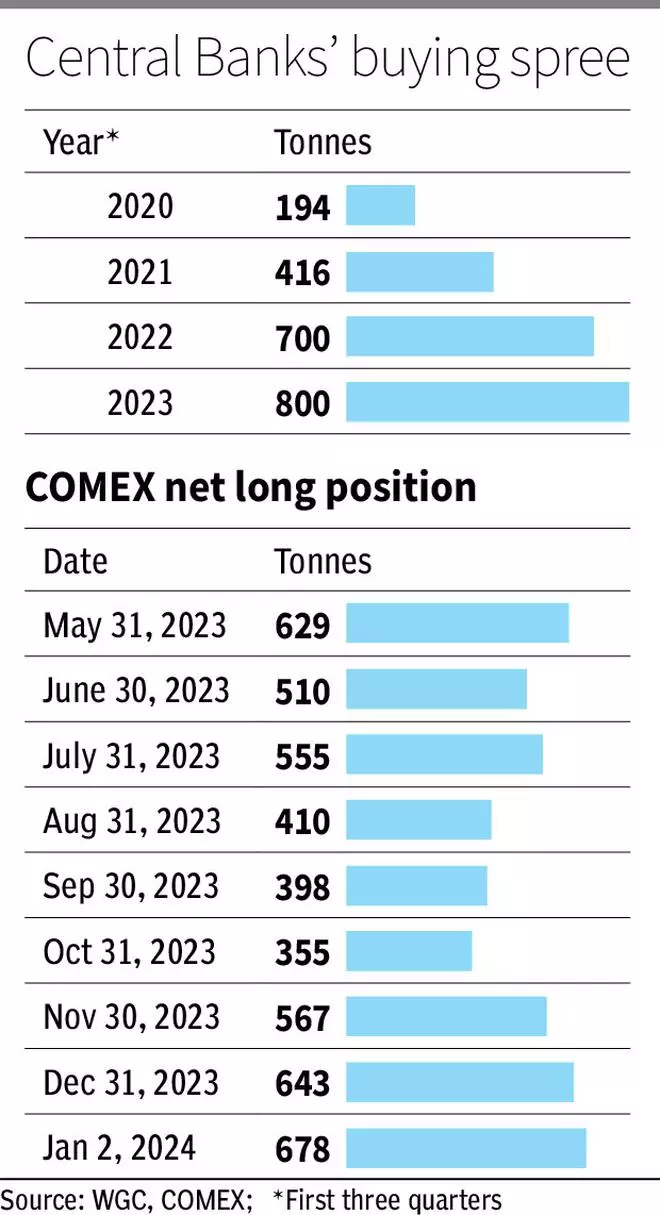

On the demand entrance, central banks throughout the globe continued so as to add gold to their reserves. In keeping with World Gold Council (WGC) information, central banks purchased about 800 tonnes of the yellow steel within the first three quarters of 2023 as in opposition to 700 tonnes within the corresponding interval of the earlier yr.

In direction of the top of final yr, speculators contributed considerably. The online lengthy place on gold futures on the COMEX has been steadily growing over the previous few months. It stood at 678 tonnes on January 2, 2024, the best since April 2023.

Key elements for 2024

All eyes are on the Fed. The most recent financial projections launched in December trace that the Fed is more likely to minimize charges thrice, 25 foundation factors every, in 2024. A fee minimize within the US can drive the treasury yields and the greenback down.

A fall in bond yields reduces the chance value. As a result of, when bond yields are excessive, it means buyers can search security along with the curiosity revenue and vice-versa. So, a decline in yields on bonds makes gold, one other protected haven, extra enticing.

Softening US yields can lead to greenback depreciation, which may result in a rally in commodities. These elements are probably to offer upward strain on gold costs.

One other beneficial issue for gold could possibly be the slowdown in financial development. The Fed forecasts the actual GDP development within the US to drop to 1.4 per cent in 2024 versus 2.6 per cent in 2023. Equally, China, the most important client of gold, is more likely to see its development slowing to 4.2 per cent in 2024 as in opposition to 5 per cent in 2023, as per the World Financial Outlook by the Worldwide Financial Fund (IMF). But, India, the second largest client for gold, stays a vibrant spot.

Broadly, a slowdown in international development may push buyers to search for security. Notably, in line with a bit of economists and analysts, the recession just isn’t off the desk but. Ought to the economic system face a recession, it could possibly increase gold costs. Thus, if inflation runs too scorching (stronger than anticipated economic system) or falls far more than anticipated as a consequence of recession — each are optimistic for Gold. However, a ‘smooth touchdown’ within the US will increase the risk-on sentiment and this stays the most important danger for gold costs.

In addition to, the geopolitics just isn’t secure. The Ukraine struggle and the Israel-Hamas battle are persistent dangers to the market and the economic system. Whereas the danger premia of those occasions seem to have softened, any escalation is more likely to set off a protected haven rally in gold. China-Taiwan tensions are additionally a tail danger in geopolitics. Simmering geopolitical tensions can present flooring to draw back in gold costs

Other than this, the US and India are dealing with elections, and this might result in demand for gold as a hedge in opposition to unexpected outcomes.

Whereas the above are potential elements that may push gold value up, ought to there be not a lot deviations from the broader present market expectations of sentimental touchdown and no geopolitical escalations, there are probabilities for contributors to e-book earnings in gold, which may result in some correction in costs.

General, the draw back in gold value seems restricted. How far the costs can go up relies on how the occasions pan out, which for the time being, is very unsure. In spite of everything, the Fed itself has hinted that fee cuts usually tend to come however the path stays unsure.

However, buyers can look to park a few of their financial savings in gold to take care of a well-balanced portfolio. Any of the choices — Gold ETFs, Sovereign Gold Bonds or direct shopping for — may be thought of to spend money on gold with a long-term perspective.

Gold-Silver ratio

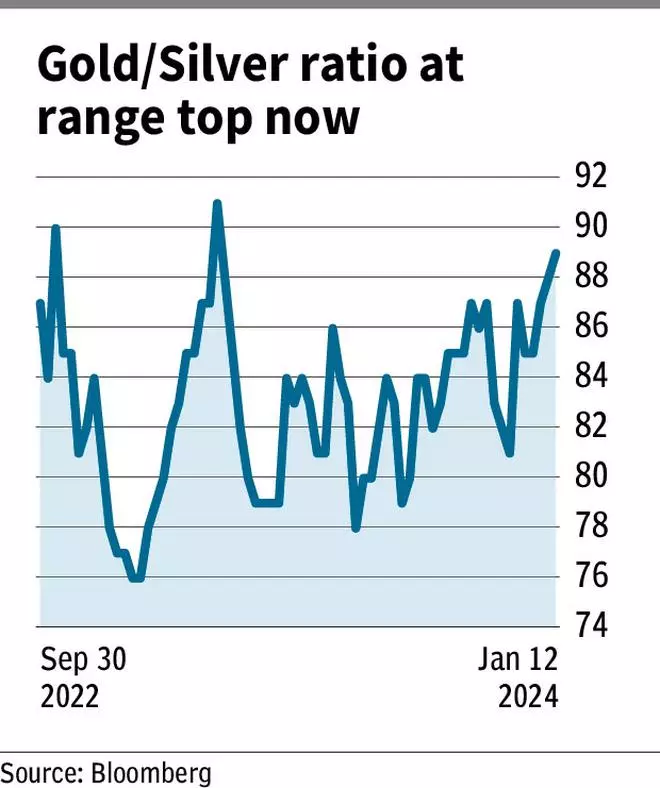

Gold-Silver ratio exhibits the relative efficiency of gold and silver in opposition to one another. It’s arrived by dividing the worth of gold by the worth of silver. Therefore, when gold outperforms silver, the ratio will go up and vice-versa. Since October 2022, the ratio has largely been staying sideways, between 75 and 90, as a result of the returns of gold and silver had been largely the identical. The purpose-to-point return of gold and silver since October 2022 is 24 and 20 per cent, respectively.

Presently, at 89, the ratio is close to the higher restrict of the vary. So, this ratio means that silver is more likely to outperform gold from right here. Therefore, buyers may give extra weight to silver, for the quick time period, throughout the valuable steel funding. However do word, this ratio on no account signifies that gold costs are more likely to fall. Simply that silver may outperform the yellow steel within the quick time period.

Technical evaluation

Gold’s long-term bull pattern is unbroken. However now, it’s hovering round a psychologically necessary stage of $2,080. It is a potential barrier as a result of the worth has fallen off this stage thrice previously — August 2020, March 2022 and Might 2023. So, on the again of this resistance, there could possibly be a drop in value.

Nonetheless, a fall under the worth vary of $1,900 and $1,950 is much less probably as this can be a appreciable demand zone. So, the 2 doable value trajectories are as follows. One, the worth moderates to the above-mentioned value band after which resumes the rally. Such a rally can elevate the gold value to $2,200. Two, if gold breaks out of $2,080 and not using a dip in value, the worth may contact $2,300 not less than as soon as earlier than the top of this yr.

Within the home market, the uptrend is much more outstanding due to the depreciation of rupee versus the greenback. Gold futures on the MCX hit a report excessive of ₹64,460 earlier than softening to the present stage of ₹62,362.

MCX gold futures is forecast to proceed the rally and more likely to hit ₹68,000 in 2024 if there’s a correction from the present stage. Such a decline in value is anticipated to be restricted to the worth of ₹58,000-60,000. It is a robust help in opposition to which gold futures is more likely to resume the upswing.

Alternatively, a breakout of $2,080 in greenback phrases immediately can push MCX gold futures above ₹68,000. In such a case, the rally can elevate the worth to the area between ₹70,000 and ₹72,000.

#Large #Story #Gold #Units #Sights