- Additionally learn: Federal Financial institution board to think about exterior candidates for MD succession

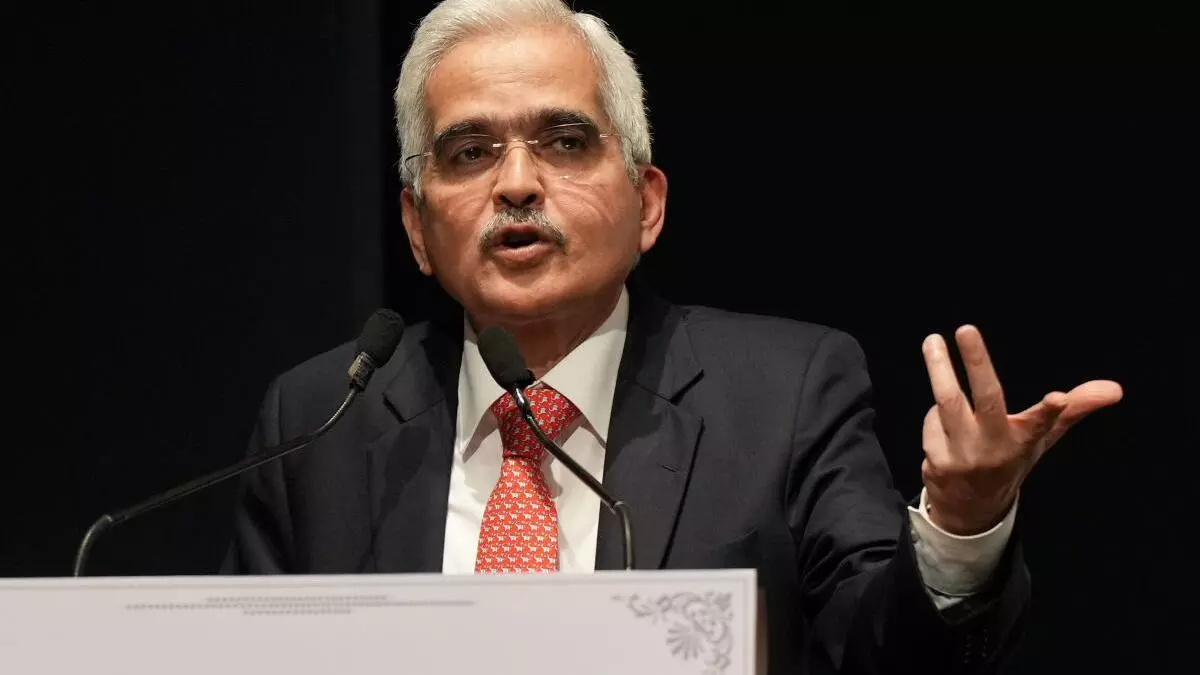

If this GDP progress have been to materialise, then it will be the fourth straight 12 months when India’s GDP progress would have touched 7 per cent ranges, stated Das at a CII session on ‘Excessive Progress, Low Danger: The India Story’ at Davos in the course of the ongoing World Financial Discussion board Annual Assembly.

Das additionally stated that retail inflation for subsequent fiscal is predicted to print at a median 4.5 per cent.

“Subsequent 12 months (2024-25) we’ll obtain GDP progress of seven per cent. We’re very optimistic about it. There may be each chance we’ll obtain 7 per cent subsequent 12 months.

“India has been in a position to make a profitable journey from disaster to confidence. Our progress momentum is nice. Nevertheless, there isn’t a room for complacency. We’re utterly targeted on attaining inflation goal and supporting progress,” stated Das.

He famous that India’s financial exercise has sustained its robust momentum with each city and rural demand supporting progress. The robust thrust by the federal government on capital expenditure coupled with indicators of choose up in personal funding and wholesome combination demand circumstances, are anticipated to elevate the actual GDP progress to 7 per cent within the subsequent fiscal 12 months of 2024-25, he stated. Amid a difficult world macroeconomic setting, India presents an image of progress and stability, he added.

India had recorded 9.1 per cent GDP progress in 2021-22; it was 7.2 per cent in 2022-23 and is prone to be 7.3 per cent this fiscal (NSO advance estimate). The RBI had formally pegged its GDP progress estimate for present fiscal at 7 %.

Noting that common CPI inflation in 2024-25 is predicted to be 4.5 per cent, Das stated that the central financial institution could be very a lot dedicated to attaining the inflation goal of 4%.

“Provided that our inflation tolerance band is 2-6 (4+/-2 proportion factors), we don’t have a grim prospect of displaying a failure in inflation concentrating on framework. Goal is 4 % and We’re utterly targeted on attaining this 4 per cent goal,” stated Das.

Commenting on the worldwide headwinds, Das famous that the current heightened uncertainty has resulted in rising market (EM) economies being on the receiving finish of extreme volatility in US greenback and the bond yields. “In such a scenario, the EM economies which have their very own home challenges can’t be held hostage to worldwide monetary cycles. EM economies should act to safeguard their very own pursuits. Accordingly, the multilateral establishments might do effectively to take a extra nuanced and balanced view of coverage perspective of the EM economies”, he added.

On the rising prowess of India’s Fintech sector, RBI Governor stated that the Fintech ecosystem in India has tremendously improved, with the adoption price of Fintech in India rising to 87 per cent, which is effectively above world common of 67 per cent. India’s Fintech market is projected to achieve $150 billion by 2025, a big leap from $50 billion in 2021, he added.

Das additionally highlighted that RBI by means of acceptable coverage actions and liquidity measures have helped India to realize a fast and sustained restoration from the pandemic.

These actions have been supplemented by structural reforms within the areas of taxation, banking, ease of doing enterprise, boosting bodily & digital infrastructure introduced by the federal government in the previous couple of years, which collectively have boosted the medium- and long-term progress prospects of Indian economic system, he stated.

With the subsequent financial coverage overview assembly slated for first week of February, there’s a chance that RBI might on the upcoming assembly revise up its progress forecast for present fiscal to 7.3 % consistent with authorities advance estimate, say economic system watchers.

#RBI #sees #India #rising #FY25