Sectoral outlook

On the constructive facet, markets within the US and Europe (generics, speciality and biosimilars) and rising markets (branded generics), cumulatively 60-70 per cent of revenues for prime pharma firms, are exhibiting robust development. US pricing strain has normalised, and US FDA observations are anticipated to wane, supporting renewed product launches.

Amongst blockbuster launches, if gRevlimid benefited most firms immensely final 12 months, patent expiry of a number one anti-diabetic molecule can ship on related strains in numerous markets in subsequent few years, however for first filers.

Money steadiness is one other robust constructive for the sector. Pushed by inflated money balances ranging upwards of $500 million to $1 billion (with out leverage) for a number of firms, M&A adopted by R&D ought to be a big driver within the trade regardless of excessive goal firm valuations.

Firms closely depending on Indian generics face a big problem. Though India’s branded generics market has persistently seen over 10 per cent development previously decade, latest traits point out a lower of 100-200 foundation factors previously 12 months.

Firm particular elements

Solar Pharma anticipates its flagship Ilumya to yield $750-1,000 million yearly by 2023. Moreover, two specialty molecules are nearing completion. A Section-III trial for a melanoma most cancers molecule (licensed for Europe, Australia, and New Zealand) and an alopecia areata remedy await approval after medical trials, with their success essential for Solar Pharma in 2024. Taro, a historic weak hyperlink for Solar Pharma, might even see a administration turnaround with the latest merger deal announcement. Divi’s witnessed enterprise contraction following Covid as orders for its customized synthesis (CS) enterprise have been on maintain and presently generics are going through excessive stock liquidation. CS tasks at the moment are recovering with two huge tasks and a bigger facility.

Torrent Pharma’s US plant clearance in Dahej and anticipated for Indrad ought to assist higher utilisation of vegetation.

In 2024, Zydus Lifesciences is anticipated to ship constructive information with the completion of Saroglitazar medical trials for 2 illnesses, and one main illness in 2025. Cipla, awaiting Advair and Abraxane, would possibly discover compensation in three anticipated advanced launches in inhalation and peptides in 2024. This 12 months might doubtlessly bridge the hole in Dr. Reddy’s valuation in comparison with friends as a consequence of a restricted market share in Indian branded generics.

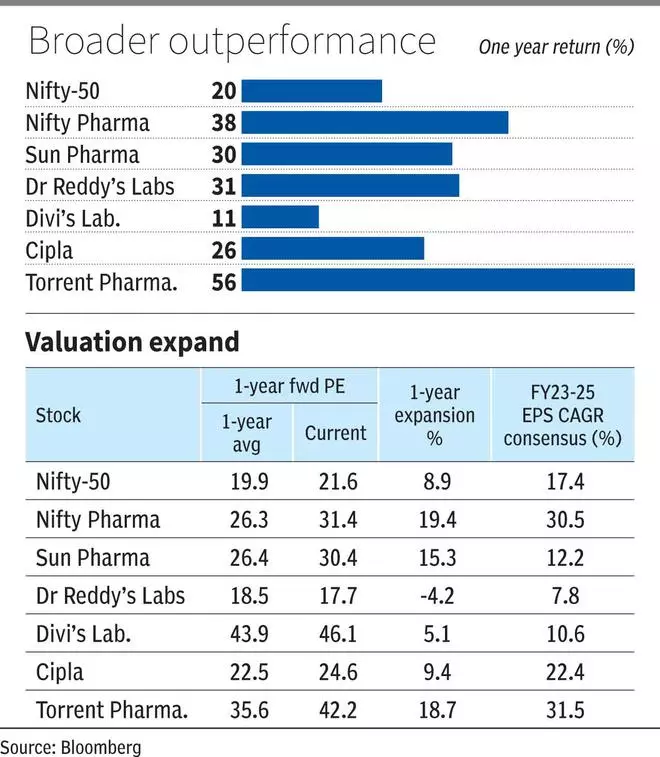

General, whereas the sector appears poised for development, with valuations factoring in expectations comprehensively, any slip up in execution can impression shares.

#Pharma #using #robust #tailwinds