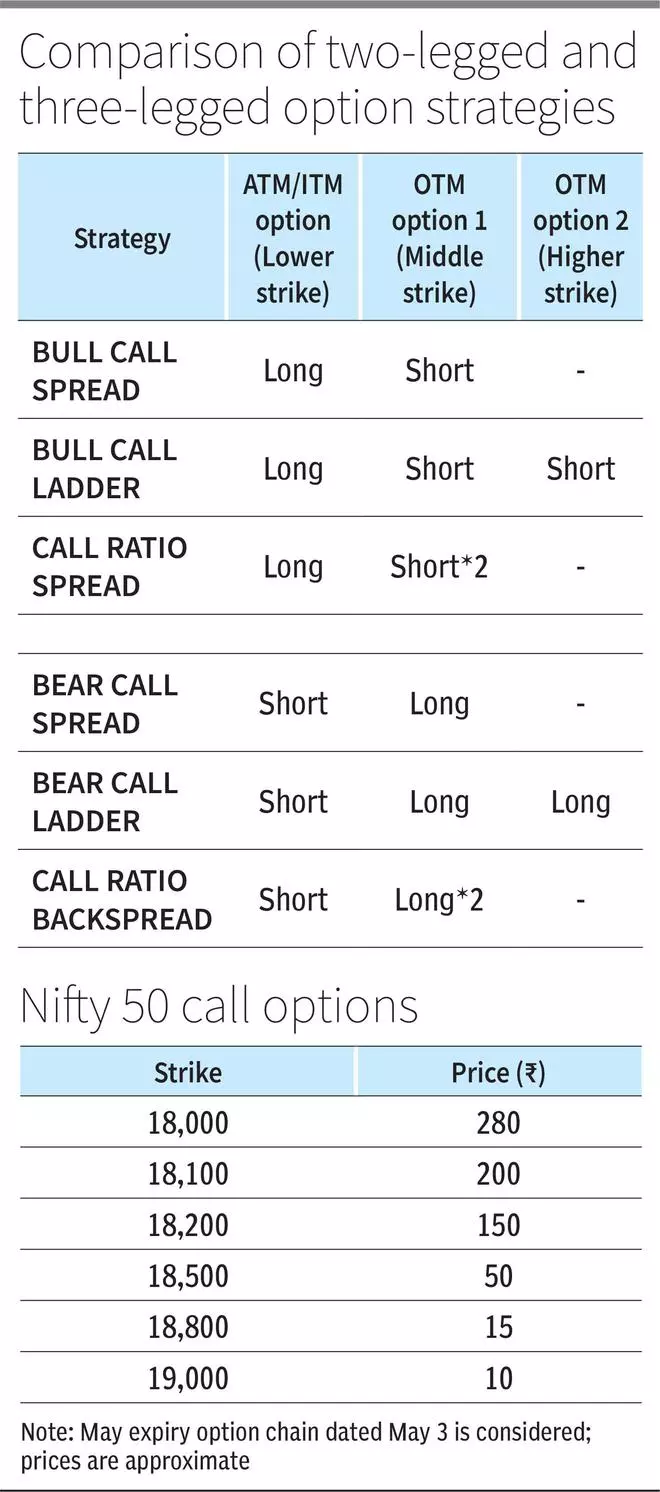

On this version, we are going to delve into methods with some modifications, which is able to take us from two-legged to three-legged possibility methods. Notably, we will likely be discussing right here methods which are extensions of bull name unfold and bear name unfold.

The attention-grabbing facet of choices is that it offers scope for quite a few methods one can develop/execute primarily based on market outlook and threat tolerance.

Bull name unfold is a commerce once you purchase at-the-money (ATM) and concurrently promote out-of-money (OTM) name possibility. As a substitute of ATM, the lengthy leg i.e., the choice that you simply purchase may also be an in-the-money (ITM) name. This technique is greatest suited when your outlook on the underlying safety is reasonably bullish i.e., a minor rally from the present degree.

Bear name unfold is the place you brief ITM or ATM name and concurrently go lengthy in an OTM name. Greatest suited once you imagine that an asset has hit a resistance and it’s prone to both consolidate or witness a minor decline in value.

Now, let’s see the variations of the above two methods.

With bull name unfold as base, we will execute bull name ladder and ratio name unfold.

Bull name ladder

It is a three-legged technique the place, like in bull name unfold, an ATM name is purchased and concurrently an OTM name is offered. Along with these two choices, yet one more name possibility, with increased strike value, will likely be brief. In essence, there will likely be a decrease strike, which is the lengthy ATM name; center strike, which is the brief OTM name and better strike, which is one other brief OTM name whose strike value is increased.

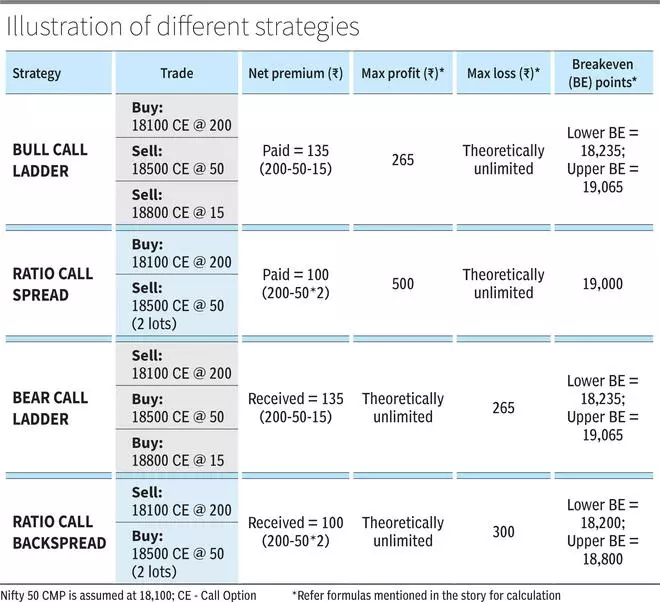

Typically, it is a internet debit technique and can work greatest when the underlying sees a minor rally after which stays flat. This may be arrange for internet credit score as properly.

So, when in comparison with bull name unfold, it additional reduces the price of the lengthy leg. Nevertheless, it comes with increased threat. In case the safety value sees a pointy rally, the losses might be big. This occurs as a result of, out of the three legs, one lengthy and one brief will cancel out one another however the extra brief that’s taken will result in losses if the value rises, particularly past the higher strike. Notably, in contrast to most investing methods which have a single breakeven level, this commerce has two breakeven factors.

Breakeven factors:

Decrease breakeven = Decrease strike value + Web premium

Higher breakeven = Increased strike + Center strike – Decrease strike – Web premium

Thus, in an upward trending market, this technique can transfer from loss to revenue (when it crosses decrease breakeven) and loss once more when it crosses the higher break even!

Most revenue:

Reward = Center strike – Decrease strike – Web premium

Most loss:

It’s theoretically limitless. As a result of one brief name is hedged by a protracted name. However the extra name that’s offered can enhance the loss to the extent to which the underlying appreciates till expiry.

When to implement:

An asset is in uptrend, however you imagine the rally is in its ultimate part and nearing its finish, following which it’s prone to consolidate for some time. Sometimes, the consolidation vary will likely be between the center and better strike value.

Ratio name unfold

One other technique that may be carried out when your view is impartial with slight bullish inclination is ratio name unfold. Right here, one ATM name is purchased and two OTM calls, with the identical strike value, are offered, whereas, within the bull name ladder, the brief calls had been of various strike costs.

Whereas this may also be arrange for internet credit score or internet debit, merchants normally choose internet credit score contemplating the chance profile. Since a higher variety of calls are written, a pointy rally may end up in increased losses.

This could generally be known as 1:2 name unfold as one lengthy name is initiated for 2 brief calls. You may fluctuate this ratio to 2:3 i.e., two lengthy legs for 3 brief legs relying in your outlook of the asset.

Breakeven level:

Breakeven = Increased strike + Distinction between the strike costs + Web premium

Most revenue:

Most reward = Increased strike – Decrease strike + Web premium

Most loss:

Theoretically limitless due to the upper variety of name shorts.

Thus, underneath this technique the dealer will likely be at revenue on the initiation of commerce if arrange for internet credit score, which is able to flip into loss if the underlying asset strikes above the breakeven level.

When to implement:

A safety has some extra upside left however is prone to keep beneath the closest key resistance. Sometimes, this resistance degree would be the strike value of the brief leg.

Like methods mentioned above, whose base was bull name unfold, we will additionally construct methods like bear name ladder and name ratio backspread primarily based on bear name unfold. Right here’s the best way to do it.

Bear name ladder

On this technique, an ATM or barely OTM name possibility is brief, which is the decrease leg. Concurrently, two calls are purchased with completely different strike costs. At initiation, this technique is bear biased however past a degree, this can grow to be a bullish place i.e., when the underlying begins to rally shortly.

The identify of this technique might be deceptive as a bearish one, however it may be worthwhile if the value of the underlying appreciates. It’s because you maintain two lengthy name choices and due to this fact, the revenue potential is usually limitless. Though that is generally arrange for internet credit score, we will additionally execute for internet debit relying on the strike value that you simply select initially.

General, merchants can achieve if the safety stays vary sure with bearish bias or if it witnesses a pointy upside.

Breakeven factors:

Decrease breakeven = Decrease strike value + Web premium

Higher breakeven = Increased strike + Center strike – Decrease strike – Web premium

Most revenue:

Doubtlessly limitless past the higher strike value. But when the safety goes down, the utmost revenue will likely be restricted to the web premium acquired.

Most loss:

Threat = Center strike – Decrease strike – Web premium

When to implement:

The asset is hovering close to a resistance (brief name’s strike value is matched to this resistance) and is prone to keep beneath this degree until expiry. But when there’s a breakout, it might see a pointy rally. Be aware that the potential of the rally ought to be above the upper strike. That is for internet credit score. If you happen to arrange for internet debit, you might be worthwhile provided that the asset rallies.

Ratio name backspread

This technique is employed by promoting an ATM or ITM name and parallelly shopping for two plenty of OTM name choices with the identical strike. Like all of the methods above, this may also be carried out as internet credit score or internet debit technique. Nevertheless, since there are two lengthy calls, inherently, there’s a bullish bias. As there are two lengthy requires one brief place, it’s known as 2:1 name backspread. Equally, you possibly can execute in 3:2 or in some other ratio as you deem match in keeping with your threat profile. In a 3:2 unfold, there will likely be 3 OTM lengthy calls and two ATM/ITM brief name.

This may be executed once you suppose the inventory will both consolidate with a bearish bias or see a pointy rally.

Breakeven factors:

Decrease breakeven = Decrease strike + Web premium

Higher breakeven = Increased strike + Distinction between increased and decrease strike – Web premium

Most revenue:

Past the higher strike, the potential for revenue is limitless, like in bear name ladder. However in case the value falls, the utmost revenue would be the internet premium acquired

Most loss:

Most loss = Increased strike – Decrease strike – Web premium

When to implement:

Suppose the asset is testing a resistance and also you suppose it’s both prone to finish the continued expiry beneath this hurdle or see a pointy upswing from the present degree. That is for internet credit score. If you happen to arrange for internet debit, you might be worthwhile provided that the asset goes above the lengthy leg by expiry.

Initially, the above mentioned methods can seem difficult. Nevertheless, if you happen to take a while and perceive how these methods work and underneath what circumstances they’ll yield the very best and the worst consequence, it could actually provide help to implement these trades with ease. And since there are each lengthy and brief legs, the margin requirement might be decrease in comparison with plain vanilla brief place on choices.

We reiterate that as a primary step, merchants ought to kind an outlook on each route in addition to volatility and attempt to make use of the technique that’s greatest suited.

One must also maintain a detailed watch on trades with increased numbers of brief legs as a single-sided motion in opposition to this may end up in increased losses. So, all the time have an entry and exit plan.

Within the subsequent Large Story on choices, we will talk about methods which are modifications of bull put unfold and bear put unfold.

#Exploring #Choices #Buying and selling #Methods #Bull #Name #Ladder #Ratio #Name #Unfold #Bear #Name #Ladder #Ratio #Name #Backspread