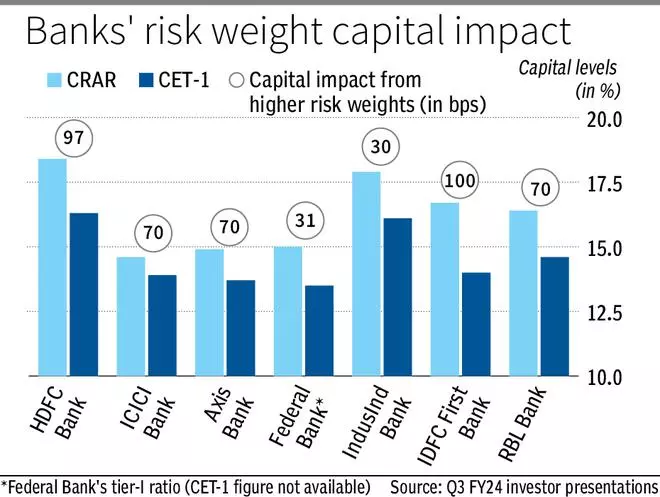

Among the many massive banks, HDFC Financial institution reported the very best capital affect of 97 bps in Q3 FY24, adopted by ICICI Financial institution and Axis Financial institution which noticed capital being hit by 70 bps. IDFC First Financial institution and RBL Financial institution, each with excessive shares of unsecured retail credit score noticed capital being impacted by 100 bps and round 70 bps, respectively.

- Additionally learn: Bank cards, dwelling mortgage high quality deteriorates

Even so, strong total capital ratios, and desire for larger yielding retail belongings amid muted company credit score development and slower deposit accretion, has led to banks posting sturdy development within the retail credit score phase, together with unsecured retail, through the reporting quarter.

Within the Q3 earnings name, Kotak Financial institution CFO Jaimin Bhatt stated the upper danger weights are usually not seen “placing the brakes” on unsecured mortgage development, whereas Federal Financial institution stated that it has reviewed its pricing on private loans and made a couple of modifications.

Private loans of personal banks grew 10-86 per cent on yr, with development for lenders equivalent to ICICI Financial institution, Kotak and Axis Financial institution at 28-37 per cent and for small gamers like IndusInd and Federal at 57-86 per cent.

- Additionally learn: How Financial institution of Maharashtra charted its comeback

Threat weights

The central financial institution, in November 2023, elevated the chance weights on shopper credit score of banks and NBFCs by 25 per cent. This largely pertains to unsecured loans, and excludes housing, schooling, automobile and gold loans.

Taking the capital hit of their stride, banks stated development throughout Q3 was supported by the truth that the round was launched midway by the quarter. Whereas retail credit score might decelerate to some extent going forward, moderation will likely be restricted aided by banks’ capability to extend lending charges by 15-30 bps, strong portfolio high quality, and the sturdy demand for private loans and bank cards.

HDFC Financial institution CFO Srinivasan Vaidyanathan stated the financial institution has a robust pipeline of pre-approved and eligible and excessive credit score high quality clients. The financial institution will proceed to give attention to extra margin accretive segments and the share of retail loans will proceed to rise, he added.

ICICI Financial institution stated it has reviewed its NBFC portfolio and is “snug with the standard of the e-book”. Group CFO Anindya Banerjee stated the financial institution has taken some steps to refine credit score parameters from some mortgage segments however stays to stay strong.

- Additionally learn: Utkarsh Small Finance Financial institution Q3 revenue jumps 24% to ₹116 cr

Good visibility

IndusInd Financial institution and RBL Financial institution stated that whereas development in retail and private loans has been accelerated, unsecured loans comprise solely a small portion of their total portfolio and thus doesn’t pose any important dangers. Most banks stated that a lot of their unsecured lending is to exist and companion clients, which supplies good visibility on portfolio high quality. Thus, shopper credit score is predicted to proceed to develop at round 25-30 per cent for FY24 and FY25, sooner than total mortgage development of 18-20 per cent.

Nevertheless, a current RBI paper stated private loans grew at CAGR of 17 per cent in excellent quantity and 15 per cent in borrower accounts between 2015 and 2023. They constituted the only largest class of financial institution credit score at 49 per cent of complete borrower accounts and 30 per cent of excellent non-food credit score as of June 2023.

The total affect of the measures is more likely to be felt over one other two quarters as banks realign their unsecured lending methods. Even so, any discount in credit score provide will likely be minimal owing to the sturdy capital adequacy ratios, wholesome risk-adjusted returns and decadal low NPA ranges, analysts stated. They added that any slowdown will solely be in small ticket loans – the place banks don’t have a big publicity – as each demand and provide of enormous ticket private loans continues to rise.

#Banks #unsecured #loans #develop #bps #capital #danger #weight #hit