It famous that emphasis on digital public infrastructure has additionally led to a rise in personal consumption, whereas Unified Cost Interface has aided the expansion of e-commerce within the nation.

Additionally learn: CoWin, Aarogya Setu had been game-changers: FinMin report

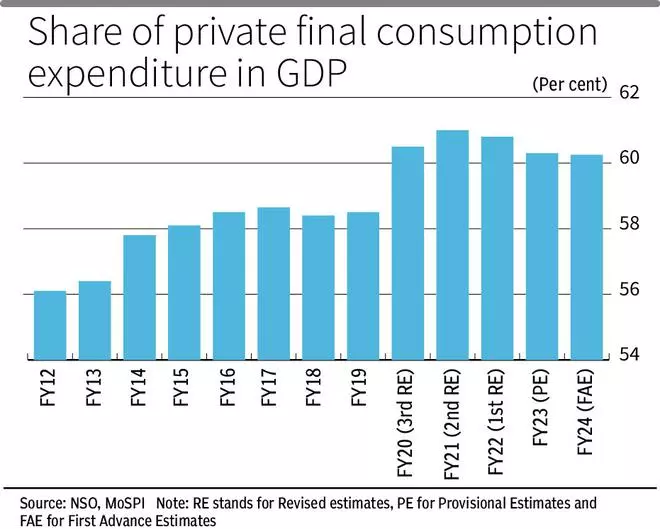

The DEA’s evaluation report said that the “all-inclusive welfare method of the federal government” is anticipated to additional gas the rise of the consumption base and growth of the center class. “The share of Non-public Closing Consumption Expenditure (PFCE) in GDP at present costs elevated from a mean of 58.4 per cent within the eight years previous the onset of the pandemic to 60.8 per cent within the final three years ending FY24,” the report said. The rise has been balanced throughout all elements together with durables, semi-durables and providers. “Nevertheless, it was not simply the discharge of pent-up demand that strengthened PFCE. Astute administration of Covid-19 constructed a optimistic financial outlook and led folks to consider in greater future incomes, inducing them to extend spending,” the evaluation report famous.

Development driver

It famous that PFCE has emerged as a serious development driver in post-Covid instances, enjoying a key position in sustaining the financial system amidst exterior challenges corresponding to geopolitical shocks, financial tightening, and sluggish world demand. “As PFCE can also be contributing to the reinvigoration of personal capital funding, it has lent resilience to the home demand within the Indian financial system. This has aided India to emerge because the fastest-growing main financial system previously few years,” the report added.

It added that this “secured consumption base” resulted from the strong improve in Per Capita Actual Gross Nationwide Earnings (GNI) within the 9 years previous the onset of the pandemic. It attributed this to the federal government’s deal with macro-level development, lowered compliance, easing of rules and strategic disinvestment amongst others. “ All these reforms have ensured strong financial development within the pre-pandemic years, which in the end yielded beneficial properties for your entire inhabitants, as mirrored within the sustained improve in per capita revenue, “ it famous.

Additionally learn: Air journey again to pre-Covid ranges: FinMin report

Whereas increase to infrastructure funding by the federal government enabled creating employment, the report added that emphasis on creation of public digital infrastructure has enhanced the financial potential of companies and residents.

Digitalisation immediately helped to extend personal consumption, each throughout the pre and post-pandemic phases. “Digital cost methods like Unified Funds Interface (UPI), which has one of many largest platforms on the earth, have aided the expansion of e-commerce,” the report famous.

The report has credited authorities’s schemes aimed toward financial and social inclusion as having lowered the rural-urban divide and elevated the aspirations of the agricultural inhabitants, resulting in greater spending on aspirational items.

#Resilient #consumption #demand #key #development #driver #postpandemic #instances #Financial #Evaluation