At one other degree, subtle and prosperous Indians are actually pushing the boundaries with a distinct class of funding.

When monetary main Goldman Sachs lately launched a report stating that there can be 10 crore prosperous Indians by 2027 from six crore at the moment, there appears to be a rub-off on the avenues chosen for investments by the excessive net-worth people (HNIs), too.

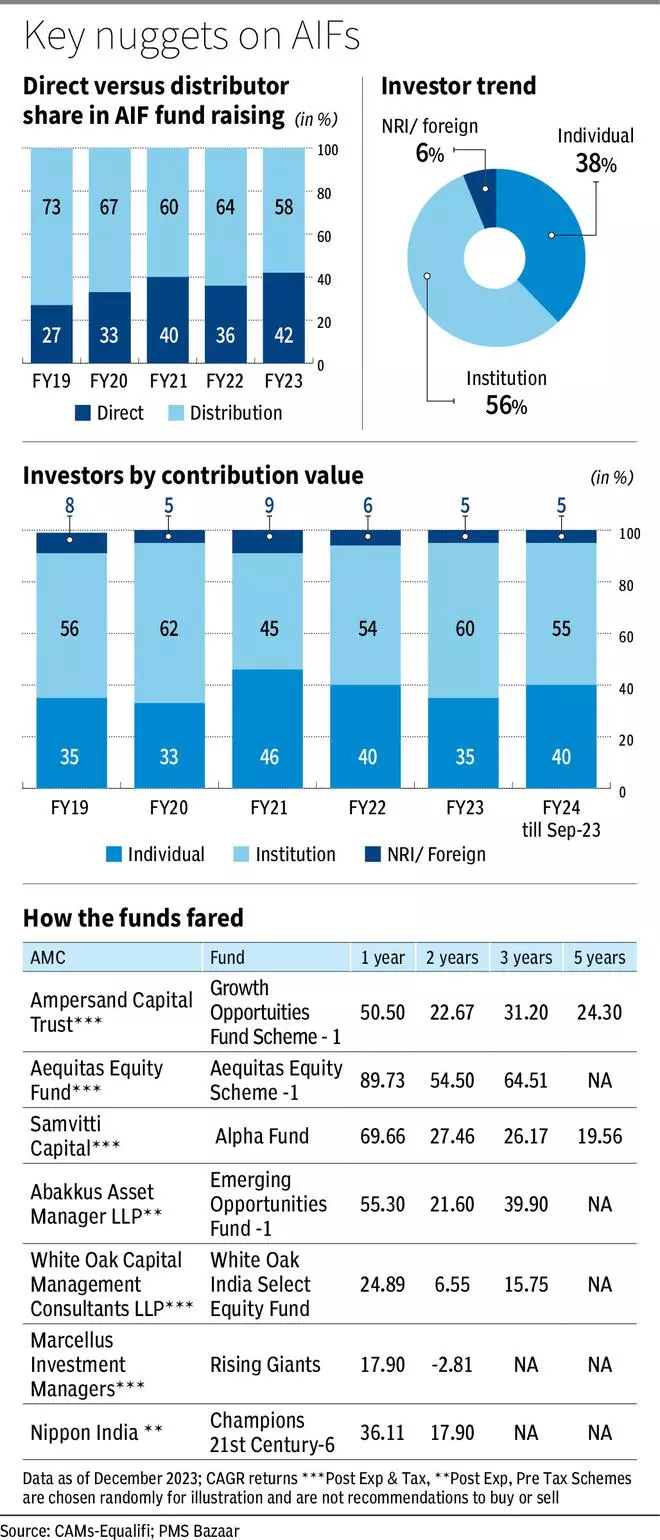

Investments in AIFs (Different Funding Funds) have been on a quickly rising path over the previous decade. The trajectory has been fairly robust prior to now 5 years as effectively – a lot quicker than the expansion in mutual funds and different merchandise.

Knowledge from market regulator SEBI (Securities and Alternate Board of India) signifies that the full commitments raised by AIFs throughout all three classes as of September 2023 was over ₹9.54-lakh crore.

Within the final 5 years (September 2018-September 2023), AIF property have grown at a compounded annual development charge (CAGR) of 34.5 per cent. This charge is greater than the 15 per cent ranges at which mutual fund property have elevated over the identical interval. CRISIL Analysis expects the business to develop at 27-29 per cent until FY2027.

Class II AIFs garnered the utmost funding curiosity and account for practically 82 per cent of the full commitments raised, a six-fold rise in simply the previous half-a-decade.

It’s clear that HNIs, NRIs and different rich people other than establishments are investing closely in AIFs. Many asset administration corporations (AMCs) that run mutual funds — ICICI Prudential, Axis, Nippon Life, Aditya Birla Solar Life — even have AIF merchandise. Abakkus Asset Supervisor, White Oak Capital, Alchemy Capital and Aequitas Fairness are another distinguished gamers. SEBI regulates these entities.

However what are these AIFs basically? How are the three AIF classes completely different from one another? What’s the minimal ticket measurement, the charges levied and the way are these investments taxed?

Learn on for extra readability on how AIFs are designed to cater to the wants of HNIs.

How alternate options are structured

Different funding funds are available in three completely different classes. Although there’s a particular funding mandate, AIFs will not be rigidly outlined as is finished with mutual funds. Merchandise will not be standardised within the case of alternate options. The fund names may give a broad-brush indication of the place the AIF invests. There are each particular person and institutional buyers in these merchandise.

These AIFs are privately pooled investments from Indian buyers and even NRIs. These can spend money on quite a lot of avenues and asset lessons with out restrictive mandates.

Buyers who want to go for AIFs need to commit no less than ₹1 crore, which is the minimal ticket measurement prescribed for such funds. There are some AIFs that demand a a lot larger ticket measurement for entry and are thus extra suited to the necessities of HNIs and Extremely HNIs.

AIFs will be each open and close-ended. Some schemes demand a lock-in for even 5 or extra years to achieve higher returns and to keep away from distress-selling as a result of comparatively illiquid nature of their property’ markets in sure circumstances, similar to actual property funds. Indian residents, NRIs and even overseas nationals can spend money on these schemes.

Three classes

Right here’s how every of the three classes stacks up and the completely different funds below every kind.

Class 1: Enterprise capital, social ventures, SME, start-ups and infrastructure funds fall below this class. Enterprise capital funds spend money on new companies with excessive development potential. They take fairness stakes in start-ups of their early or preliminary levels. HNIs who want to make substantial income in such ventures throughout exit by way of IPOs or buyouts from different institutional buyers, and with a excessive danger urge for food, go for such enterprise capital funds.

Then there are infrastructure funds that spend money on airports, highways and energy tasks. They’re anticipated to supply periodic and wholesome dividends because the tasks begin turning out money flows commonly.

Buyers eager on socially aware companies or who need particular environmental or social outcomes can go for funds that spend money on social ventures.

In some circumstances, the federal government could supply concessions for infrastructure venture funding and people catering to SMEs (small and medium enterprises).

Class 2: The preferred class homes personal fairness funds, bond funds, actual property funds and fund of funds. These schemes wouldn’t have too many restrictive or slender funding mandates, giving fund managers appreciable flexibility. This class receives the utmost inflows, given its wider ambit.

Non-public fairness funds spend money on late and even mid-stage companies within the unlisted house. In addition they spend money on corporations that search to faucet the IPO (preliminary public providing) market and want to capitalise on the pre-IPO attraction early on.

Then there are actual property and credit score alternatives funds that spend money on quite a lot of debt and realty avenues to generate regular coupons and better XIRR than regular bonds. Structured credit score funds (fund builders not catered to by banks) for larger coupons and substantial cowl (1.5-2X the underlying asset worth) are additionally supplied below the class.

Fund of funds spend money on different AIFs throughout segments to take advantage of completely different funding types, domestically and abroad.

Class 3: This class contains hedge funds, commodity funds and personal funding in public fairness (PIPE). Hedge funds use difficult buying and selling methods, short-selling strategies and dabble with derivatives as effectively.

Commodity funds spend money on gold, silver, oil and their derivatives.

Non-public funding in public fairness funds are the AIFs that fall on this class. Such funds can spend money on shares, bonds, commodities or different asset lessons and deploy any technique with none particular restrictions.

A number of the methods within the class III AIF in India are long-short and long-only, other than debt and SME targeted approaches.

Lengthy-only funds spend money on shares with a medium to long-term view like the best way mutual funds do. The long-short technique includes taking each lengthy and brief positions available in the market with shares or indices so that there’s a sure market-neutral place taken to generate affordable returns at low danger.

Key traits

Aside from the avenues themselves, AIFs additionally include a couple of inherent traits that make them splendid for HNIs.

First, there are not any restrictive mandates on investing solely in particular avenues, or in assigning of weightages to particular investments. For instance, mutual funds have restriction on most weightage that may be given to a inventory or sector, selection of market capitalisation and so forth. However AIFs haven’t any such compulsions. Due to this fact, an AIF fund supervisor can take concentrated or subtle exposures to numerous funding avenues as a way to ship the most effective returns.

Second, complicated methods, together with the usage of derivates for danger administration, are all allowed by way of AIFs.

Third, there’s the benefit of AIFs having the ability to supply bespoke or tailored funding options which can be geared to reaching all of the wealth objectives of HNIs. Curated merchandise and AIF constructions that match the necessities of HNIs are simply accommodated.

4, many AIF managers select to have a closed construction for the schemes they handle. They prohibit the movement of cash into, and the outflow of cash from the funds primarily based on their very own evaluation of the markets, the dynamics of asset lessons concerned, thus bettering their capability to ship wholesome risk-adjusted returns. On condition that some AIF property might not be that liquid or could have long-term pay-offs, this flexibility in construction helps fund managers by not having to make misery gross sales throughout turbulent markets.

5, since AIFs are locked for the long run, there are not any short-term redemption pressures and necessities when it comes to sustaining liquidity. There are restricted short-term efficiency pressures as effectively.

Lastly, these AIFs are run by skilled managers with deep experience, thus giving scope for constructing a well-diversified portfolio.

How taxation works

As with common mutual funds, equity-driven AIFs are additionally fairly tax-efficient in the best way they’re structured.

Since AIFs are pooled funding autos, there are completely different taxation guidelines relying on the class chosen.

For AIFs in classes I and II, a pass-through standing is given for the investments. So, the positive factors or revenue (apart from enterprise revenue) distributed by the AIF to buyers is taxable within the palms of buyers and never the fund home or AMC. If the investments are in listed shares, long-term capital positive factors — made on a holding interval of multiple yr — are taxed on the charge of 10 per cent.

Lengthy-term positive factors from unlisted shares are taxed at 20 per cent with indexation profit. .Any enterprise revenue distributed is taxed within the palms of the AIF itself. Surcharges and cess may also be relevant.

Within the case of class III AIFs, the pass-through construction just isn’t allowed. Due to this fact, the revenue earned by the AIF can be taxed on the AIF itself. Lengthy-term capital positive factors are taxed at 10 per cent, plus relevant surcharges and cess. Enterprise revenue and dividends are taxed on the most relevant slab charge.

On the debt aspect, there’s little or no distinction in taxation throughout fixed-income merchandise. Within the Finance Invoice handed in 2023, debt funds and market-linked debentures have been made absolutely taxable. That’s, the indexation profit was taken away and all distinction of lengthy and short-terms was achieved away with. All realized positive factors from such investments can be added to the general revenue of an investor and taxed on the slab relevant. For related taxation, it will be wiser to search for larger returns on the debt aspect from AIFs for HNIs with the next danger urge for food.

Non-standardised payment construction

When it comes to payment construction, AIF prices are fairly completely different throughout gamers. AIF payment will be structured primarily based on efficiency or asset measurement or another issue.

Since prices and charges will not be standardised by the market regulator SEBI, AIFs are free to cost what they deem match.

Since it’s only with class III AIFs that prices or charges are simply obtainable in public area, on condition that many HNIs spend money on it, a lot of the illustration pertains to that class.

Only a few AIFs cost a flat payment. Often, there’s a base payment charged that’s within the vary of 2-3 per cent.

Most AIFs additionally cost a performance-related payment.

These funds set a hurdle or a threshold charge for efficiency. So, a hurdle return charge (normally 10-12 per cent) is mounted. If the fund manages to ship returns larger than the hurdle charge, the efficiency payment kicks in. The efficiency payment or revenue sharing will be fairly steep. Some AIFs cost a big 10-15 per cent on the returns in extra of the edge or hurdle charge.

For instance, if the hurdle charge is 12 per cent and a fund prices 10 per cent efficiency charges and manages 15 per cent returns, then the ten per cent payment will apply on the surplus 3 share factors returns (15 per cent-12 per cent). That is along with the mounted payment.

The mounted payment is normally charged each day, whereas the revenue sharing or efficiency payment is levied on an annual assessment foundation.

Buyers thus have to know the payoffs effectively once they go for AIFs and get a way of post-expenses returns.

The place AIFs match for HNIs

AIFs are fairly handy and clear like mutual funds and might supply subtle methods of portfolio administration companies (PMS), thus making for a wholesome combine to optimise returns.

For an HNI with who has already achieved sufficient and extra asset allocation for objectives with the widespread monetary merchandise — mutual funds, bonds, direct shares, deposits and the like — creating generational wealth might be a objective price aspiring for. That’s the place AIFs can match the invoice as HNIs normally have a greater degree of economic understanding and wealth creation than common retail buyers.

They will then think about allocating part of their massive surplus to AIFs in pursuit of superior returns with the attendant dangers. Not that wealth can’t be generated simply with mutual funds. However AIFs function at completely different ranges and cater to a really completely different set of buyers and don’t compete with retail-focused merchandise similar to mutual funds.

#Different #Funding #Funds #Designed #Solely #Rich