Portfolio Podcast | Impression of Price range tax axe on insurance coverage shares

The timing couldn’t have been worse because the trade is nearly readying for the following section of progress and its monetary parameters are at a close to multi-year greatest. Valuations of listed life insurance coverage firms have additionally corrected considerably, making them enticing like by no means earlier than. However will fundamentals cushion these shares?

Price range implications

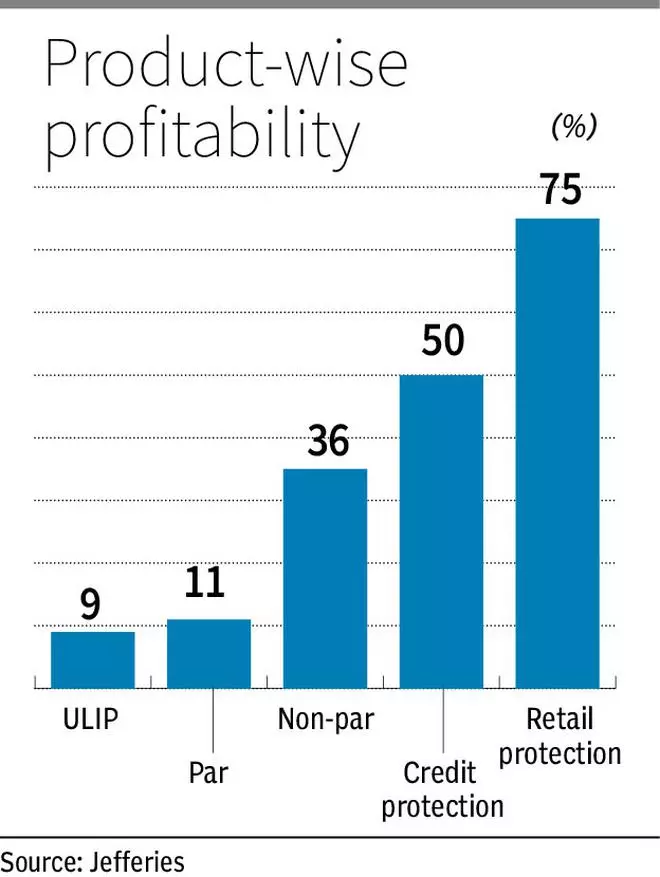

Worth of recent enterprise margins is at an all-time excessive for listed life insurance coverage gamers. Chart 1 depicts that profitability is the very best for defense insurance policies and lowest for ULIPs or unit linked insurance coverage insurance policies. However check out what’s driving progress for the life insurers and you’d be shocked that retail safety as a element of annualised premium equal (APE) is merely 11-17 per cent. As a substitute, progress is essentially coming from conventional merchandise which provide larger stage of financial savings return vis-à-vis life cowl. They’re additionally characterised as high-value merchandise, focused on the higher center class and the creamy excessive web price people (HNIs).

.jpg)

.jpg)

To sum up, barring a really transient section between April and July 2020 when demand for defense plans shot up owing to the pandemic, safety plans are barely the expansion driver for the life insurance coverage sector. In essence, the transfer might reverse or a minimum of alter this development.

The federal government’s intention has been to make insurance coverage a mass market product and never only for the elite or propagate it as a tax planning software. The bulletins made this Price range may assist realise this aim. Pattern this: in international locations equivalent to China, the US, the UK and Germany, that are the developed markets for all times insurance coverage, the penetration of safety plans is greater than 80 per cent. In India, it’s barely 15 per cent. But, life insurers use the purpose on under-penetration as a promoting proposition when, in actuality, they typically chase the low hanging fruit on fats margins yielding merchandise.

Due to this fact, within the subsequent 3-12 months, firms shall be pressured to re-calibrate their operations and advertising and marketing methods to adapt to the brand new methods of working. However right here’s the excellent news. In the long term, they might nicely profit, on condition that safety plans supply the very best margins and can instil sustainability and predictability on this enterprise.

Impression on financials

The brand new norms will come into impact potential from April 1, 2023. Additionally, it’s going to affect the non-ULIPs financial savings section — particularly, the par and non-par merchandise. Due to this fact, within the order of affect, LIC, HDFC Life and Max Life might bear the utmost brunt whereas SBI Life and ICICI Prudential Life (I-Pru Life) could also be comparatively much less affected.

The affect shall be felt on worth of recent enterprise (VNB). Nevertheless, these merchandise, on a mixed foundation, account for 30-65 per cent of VNB. Likewise, combination premiums exceeding the ₹5-lakh mark are sized practically a fourth of whole premiums for the trade. The ₹10-50 lakh premium bulge accounts for 10-15 per cent of the entire premiums. Therefore, on a web foundation, total top-line affect could possibly be 10-16 per cent in FY24.

Two points should be factored right here.

Firstly, a lot as firms declare that their premium progress is steadily de-linking from tax-related incentives, the months of January-February-March account for 30-35 per cent of whole APE. Secondly, that is additionally the ripe interval for firms to push their high-ticket merchandise, together with single-premium plans.

With each getting curbed on the identical time, it will be attention-grabbing to see how rapidly firms reorient their companies. As an example, higher center class and HNI prospects account for 40-50 per cent of whole buyer base. SBI Life, catering predominantly to prospects of State Financial institution of India, which has a cross-section of consumers, could possibly be much less impacted, although not insulated, from the developments.

With revenues coming beneath stress, VNB margins may additionally take a 100-150 foundation factors hit whereas at an total stage, the prices incurred to re-tune the distribution networks and workers would additionally weigh on the near-term profitability of life insurers.

But, this isn’t as a lot a priority, on condition that in the long run, if the share of retail safety will increase, VNB margins can also enhance from the present ranges.

What to do with the life insurance coverage shares?

Let’s do a fast rewind to learn the way and why insurance coverage shares turned well-liked in India.

The primary itemizing of a life insurance coverage firm occurred in September 2016, when I-Pru Life debuted on the bourses. It didn’t have a fantastic itemizing for a protracted interval, it didn’t catch traders’ fancy. However it paved the way in which for the itemizing of HDFC Life and SBI Life. These had been blockbuster IPOs and there have been two crucial the explanation why traders acquired thinking about these shares.

Firstly, the banking sector wasn’t having a superb run. The sector was nearing the height of asset high quality disaster and one wasn’t certain whether or not the worst days had been nearing an finish or not. Life insurance coverage shares supplied a window the place traders didn’t need to be involved of such dangers. Secondly, they purchased into the story of under-penetration propagated by the trade. Due to this fact, life insurance coverage shares had been seen as regular ships.

.jpg)

The place can we stand at present?

For starters, the earnings high quality and the trajectory of banks is much more secure than what it was about 4 years in the past. That is reflecting of their valuations as nicely, which have appreciated by 30-60 per cent since FY17. However, shares of life insurance coverage firms haven’t completed so nicely, significantly within the final yr. There are stock-specific points and macro points weighing on them. As an example, in case of HDFC Life and I-Pru Life, it isn’t clear but whether or not their bank-led guardian entities can proceed to carry the current stakes as promoters. This can be a technical overhang on the shares.

Essentially, traders are starting to name out that the under-penetration theme isn’t taking part in out for the sector as promised. For many of FY22, traders had been instructed that insurers are promoting what their prospects need and if they need extra of financial savings possibility in a low rate of interest regime, then so be it. However this technique isn’t long-term optimistic and with this Price range, it will be severely challenged.

What’s additionally inetersting is that international life insurers equivalent to Aviva, AIG, Axa commerce at 1-2x one-year ahead embedded worth and that is regardless of having a considerably larger stage of safety penetration. Quite the opposite, Indian life insurers, barring LIC, commerce at vital premium. Due to this fact, with a possible reset in earnings, margins and enterprise methods, traders might need to wait to see how FY24-25 pans out for the sector. If there’s a seen shift in favour of safety, then we may see a spherical of re-rating in valuation. However till then, traders could also be higher off being on the sidelines.

In the meantime, with banks on a greater footing, the relative benefit that insurance coverage firms had can also be narrowing, making the funding case not so beneficial for the insurers.

Actually, on a aggressive foundation, common insurers equivalent to ICICI Lombard or Star Well being Insurance coverage seem extra enticing than life insurers. With fewer regulatory adjustments, they appear extra insulated within the close to time period. Nevertheless, the introduction of composite licences, which can allow life insurers to advertise different traces of companies presently specialised by non-life gamers could possibly be a basic menace for the latter.

But, if an investor is eager to broadbase the choices within the monetary providers sector and is taking a look at life insurance coverage shares, I-Pru Life and HDFC Life might prime the pecking order. At bl.Portfolio, now we have a ‘maintain’ advice on Max Monetary Companies, the holding firm of Max Life. We proceed to take care of a not so bullish view on the inventory. As for SBI Life, which has outperformed friends up to now yr, valuations seem steep beneath the present circumstances. LIC, purely primarily based on valuation and contemplating the quantitative enchancment in earnings, stays a beautiful choose within the sector.

#Thinning #cowl #life #insurance coverage #shares