- Additionally learn: IPO screener: Madhu Kela-backed Rashi Peripherals supply ends immediately

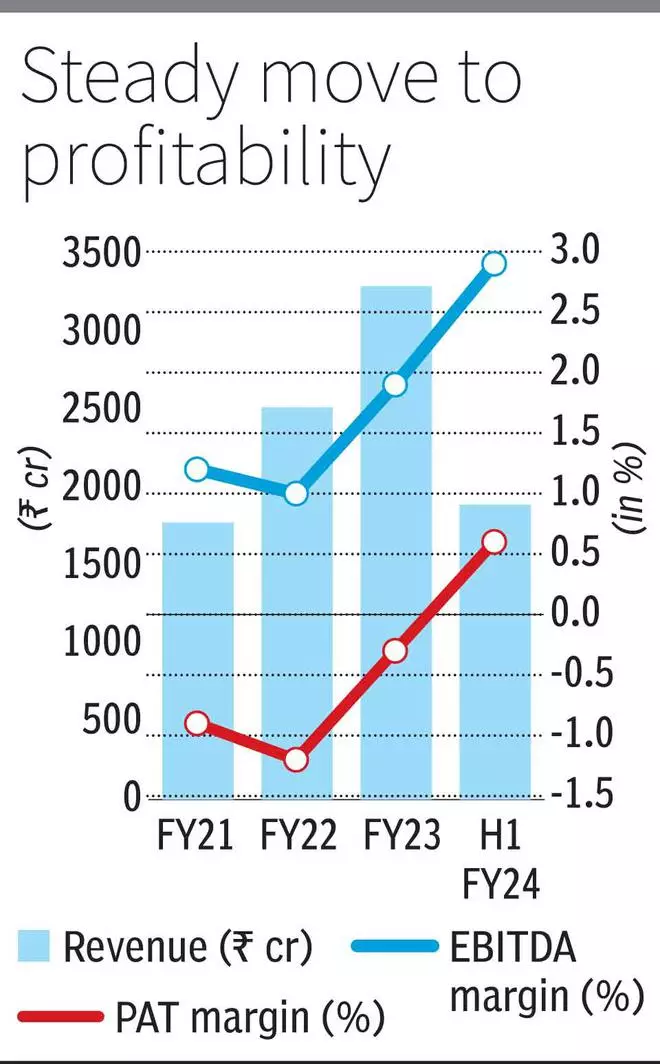

Established in 2018, the corporate has reported 36 per cent income CAGR within the final three years, to ₹3,300 crore in FY23, pushed by natural and inorganic progress levers. However it is just in H1FY24 that the corporate reported its first income since FY21 (the earliest reported interval) at 0.6 per cent PAT margin. Even assuming a conservative 2-3 per cent PAT margins on the annualised H1FY24 operations (income of ₹1,895 crore), the inventory could also be valued at 48-72 occasions FY24 earnings.

Regardless of the structural components supporting excessive progress, we suggest that traders wait until a monitor document of profitability, which can also be proportional to the valuation, is established, earlier than getting into the inventory. The IPO will increase ₹1,600 crore of which contemporary subject is ₹1,000 crore.

Scope for prime topline progress

The Indian pharmaceutical business’s home arm will develop at a brisk 9-10 per cent in FY23-28, in line with Crisil’s report within the RHP. Throughout the business and particular to Entero, natural and inorganic progress levers additional elevate the expansion profile. Natural growth accounted for two-thirds of the 36 per cent income CAGR in FY21-23, in line with the corporate.

Entero generates excessive natural progress from enhancing pockets share, growing geographic attain in present markets and getting into new markets. Entero’s SKU rely has elevated from 44,400 in FY21 to 64,000 now and retail pharmacists rely doubled from 39,500 in FY21 to 81,400 now. Entero, established solely in 2018, is within the nascent part of progress and may expertise excessive natural progress charges.

- Additionally learn: Do you have to examine into Apeejay Surrendra Park Accommodations IPO?

Business consolidation supplies the opposite lever for progress. The pharmaceutical distribution section is very fragmented, with 65,000 distributors dealing with 900,000 retail shops; organised distribution handles solely 8-10 per cent of the quantity, in line with the RHP. With effectivity of stock administration, one-stop resolution for retailers, digital expertise, and excessive fill charges, organised distribution could enhance its penetration, going ahead.

Entero has acquired 34 distributors since its inception and the administration expects to additional heighten the tempo with IPO funds. The synergy advantages for an unorganised participant integrating into the organised fold supplies a safe progress lever to Entero.

Margins but to increase

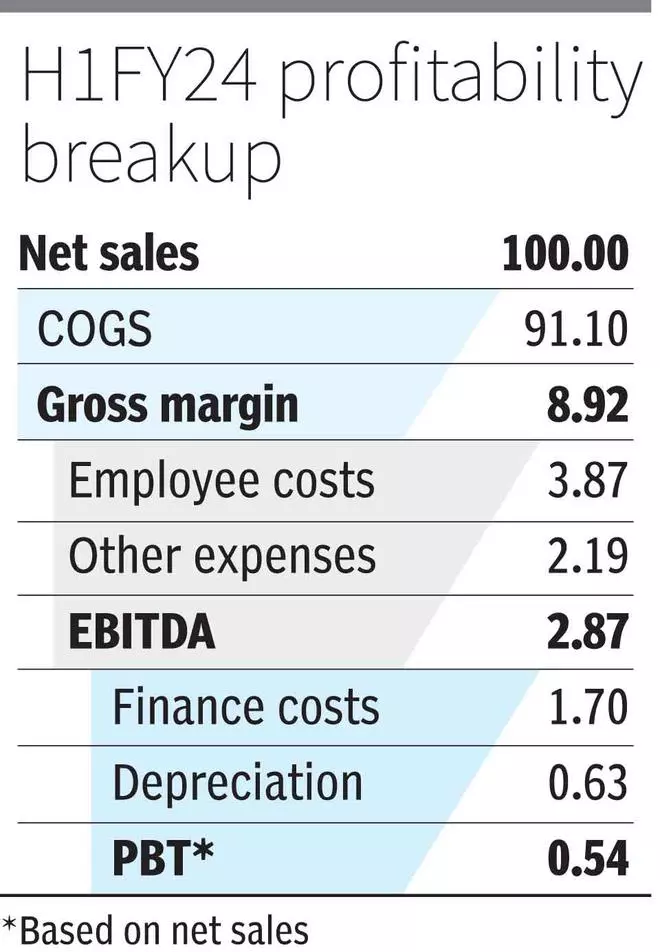

After reporting common Gross/EBITDA/PAT margins of 8.1/1.4/-0.8 per cent in FY21-23, H1FY24 noticed margin enchancment to eight.9/2.9/0.6 per cent. Entero administration highlighted three levers to enhance margins —worth added providers and personal label gross sales other than procurement efficiencies. On the final lever, the scope could also be restricted, although, with COGS itself accounting for 90-92 per cent of gross sales within the distribution business. Entero, on scaling up, can work on the present 6 per cent overhead prices to enhance backside strains.

Non-public labels (for surgical consumables, medical gear and healthcare merchandise) hitched onto Entero’s distribution community can generate 18-20 per cent gross margins. However scaling it to a sizeable portion of revenues is a troublesome activity. Worth added providers embrace taking up a contract to advertise a pharmaceutical portfolio, as finished with Roche’s 4 nephrology merchandise’ promotion in FY24. The administration signifies that the 90-bps enchancment in H1FY24 gross margins might be ascribed to this initiative and on additional scaling can enhance the margin profile.

Stability sheet as a driver

Development aspirations may have a bearing on the steadiness sheet of Entero and the corporate has to handle progress effectively to boost shareholder worth. Entero will flip cash-positive with IPO proceeds from 3.3 occasions web debt to EBITDA in H1FY24. The corporate intends to once more leverage the post-IPO steadiness sheet for inorganic growth, together with inner accruals. This may occasionally restrict the margin positive factors from operational leverage, if Entero onboards debt just like pre-IPO ranges.

Within the final three years, the corporate has raised ₹250 crore from convertible shares (no excellent convertible shares now) and ₹267 crore from debt to finance its progress. However put up the IPO, fairness increase might be restricted to limit dilution and value of debt ought to mood borrowing urge for food. At already low EBITDA margins, a excessive net-debt would have a stronger influence on EBITDA margin pass-through to the underside line.

However, the ₹1,000 crore contemporary subject can almost double its income base. This might be used for compensation of debt (₹142.5 crore), working capital funding (₹480 crore), inorganic initiatives and basic company functions (GCP). Apart from GCP, the opposite three heads are geared in direction of acquisition as working capital accounts for roughly 70 per cent of acquisition prices, in line with the corporate.

Assuming Entero stays course with its common 0.25 value to gross sales ratios for acquisitions, these contemporary funds can add ₹4,000 crore revenues or double the FY24 income base. Quite the opposite, the IPO proposes 1.4 value to gross sales for Entero. Entero can glide on a excessive progress owing to business progress, natural and inorganic alternatives. However the path to profitability will rely upon operational leverage, worth added and personal label contribution and monetary leverage post-IPO. As the corporate delivers readability on margin glide path two-three quarters after itemizing, traders can look into the inventory.

#subscribe #Entero #Healthcare #IPO