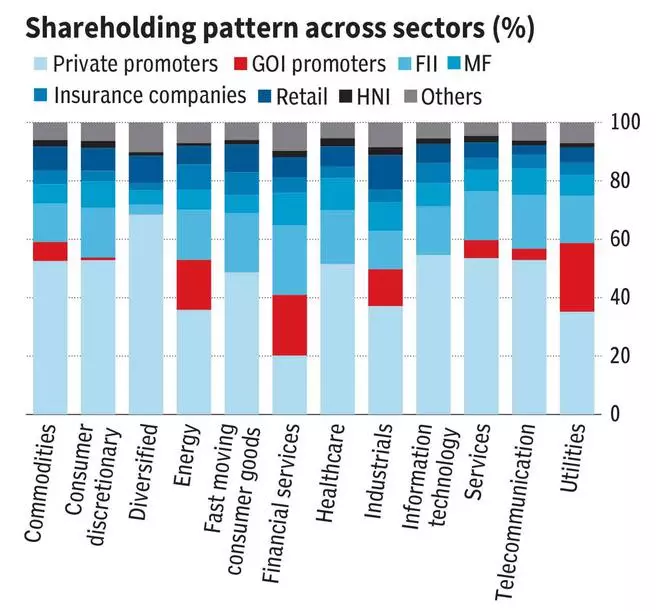

The current traits in funding allocation are noteworthy, with home Mutual Funds (MFs) witnessing a surge in holdings to an all-time excessive. This uptrend will be attributed to sturdy internet inflows. Sector-wise, mutual funds have the best market cap allocation in direction of the healthcare sector, whereas Overseas Institutional Traders (FIIs) maintain their highest allocation inside the Monetary Companies sector, albeit with a discount noticed throughout the quarter. Conversely, each entities exhibit minimal market-cap holdings inside the diversified sector.

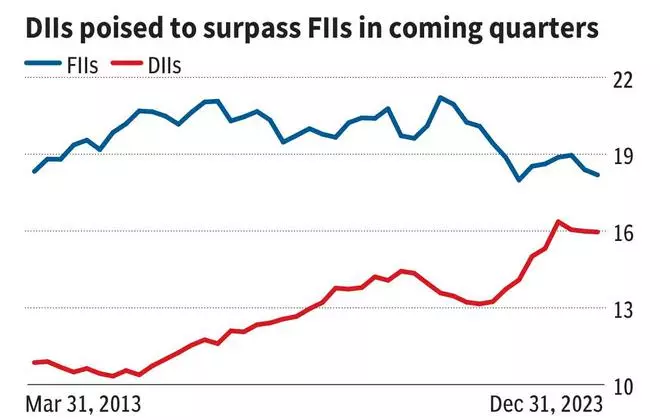

The disparity between FII and DII holdings touched an unprecedented low throughout the quarter. Reflecting this pattern, the FII to DII possession ratio has plummeted to an all-time low of 1.14 in Q3FY24, in comparison with its peak of 1.99 in Q4FY15. This additionally displays home flows turning into as dominant as FIIflows for the markets.

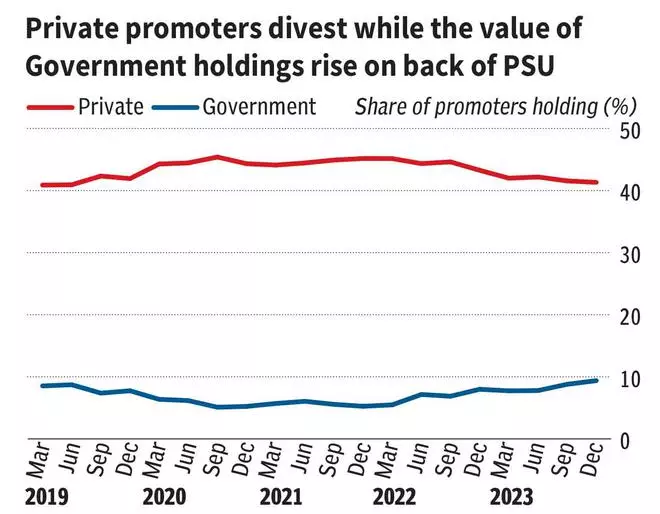

Personal promoters’ possession has been declining over the previous few quarters resulting from divestment. Conversely, the share of the federal government has been on the rise, propelled by the sturdy efficiency of quite a few Public Sector Undertakings (PSUs).

#FII #DII #Possession #Ratio #Decade