Nevertheless, of late, the ‘Defence’ sector appears to be on a quicker monitor. Defence, the market darling in 2022, is probably going be the dominant theme of Finances 2023. Defence is quick rising as an business vertical by itself, with a number of personal sector firms specializing in provides both to the Defence Ministry immediately, or to defence PSUs or to international governments and international MNCs that cater to the defence wants of different international locations.

The Indian defence business has been within the highlight in the previous few years, notably since 2020, with the inventory costs of firms that offer services and products to this business having grown multi-fold, on the again of sturdy order guide growth, wholesome income, and revenue progress. The inventory of Hindustan Aeronautics Restricted (HAL), which is into defence plane manufacturing and upkeep, has gained 110 per cent within the final 12 months. Likewise, the inventory of Bharat Electronics, which is into design and manufacture of specialized digital parts, has seen 130 per cent bounce because the begin of 2022.

Whereas the Indian’s authorities’s flagship Atmanirbhar Bharat programme — which has incentivised sure segments akin to drone manufacturing, with schemes akin to PLI (production-linked incentive) — has put extra emphasis on strengthening the nation’s indigenous manufacturing capabilities, intermittent border skirmishes with China and Pakistan and, extra considerably, the Russia-Ukraine warfare disaster have led India to beef up its funding within the defence sector.

The funding isn’t just to amass arms, ammunition, and tools but additionally to strengthen the nation’s functionality to construct its personal defence techniques and cut back dependence on different international locations. With strategic independence as its key objective, the Indian defence business is at an inflexion level and is poised for wholesome progress within the medium time period, for 4 causes.

Attaining self-reliance

First, the main focus of the Indian authorities to scale back dependency on Imports and obtain self-reliance by the use of growing home manufacturing is the largest progress set off for firms catering to the Indian defence Trade. Traditionally, India has been one of many world’s largest importers of arms and ammunition, accounting for nearly 11 per cent of the whole international arms market.

In line with information stories quoting Lt Common Shantanu Dayal, Deputy Chief of Military Employees (Functionality Improvement and Sustenance), of the whole capital acquisition contracts price ₹90,000 crore within the final three monetary years, about 83 per cent was awarded to Indian firms. The Ministry of Defence has launched three constructive indigenisation lists within the final two years, first one comprising 101 objects notified in August 2020, second record of 108 objects in June 2021 and the third certainly one of 101 objects in April 2022. These things might be procured solely from home sources as per the provisions of the Defence Acquisition Process (DAP) 2020.

The most recent record, launched in April 2022, consists of extremely complicated techniques, sensors, weapons and ammunition akin to like Gentle Weight Tanks, Mounted Arty Gun Programs and Subsequent Era Offshore Patrol Vessels (NGOPV). The Indian Military, in response to public sources, has, within the final three years, processed 256 business licences for supplying to the Indian Military, and 366 export licences, from firms trying to provide items and companies to the Indian armed forces.

Growing capital spend

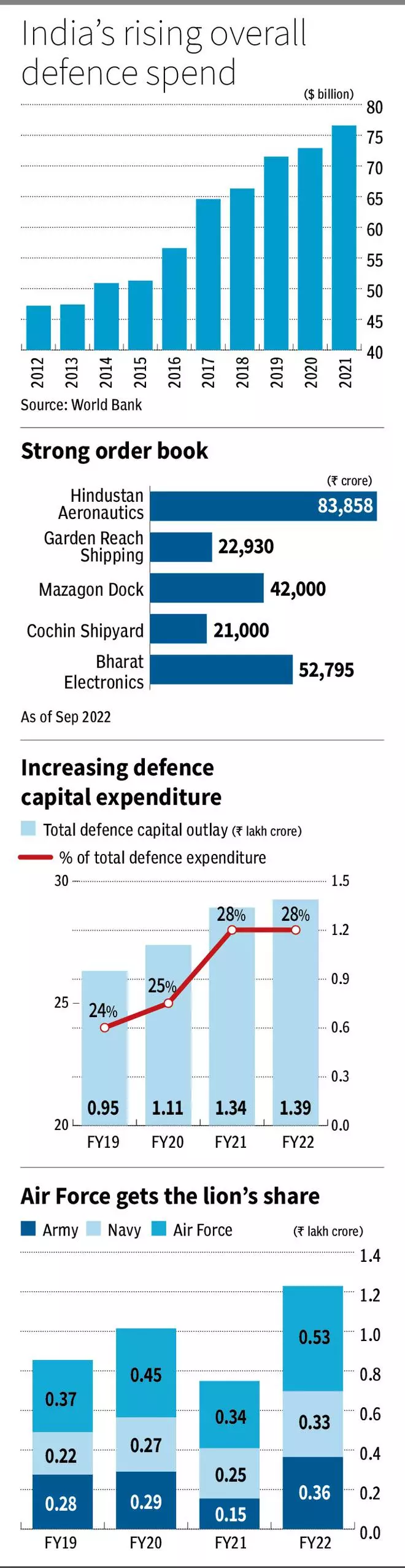

The second motive for being sanguine on the sector is the numerous improve in defence spend by the Authorities, over the previous few years. In line with information compiled by the World Financial institution, India’s complete defence spend has elevated from $47.2 billion in 2012 to $76.6 billion in 2021, implying an annualised progress of 5.5 per cent. USD depreciation over this era is about 4.6 per cent. This interprets into an over 10 per cent annual improve in spend in rupee phrases. And In 2021, India, with $76.6 billion, ranked third by way of its absolute defence spend and accounted for 3.6 per cent of the worldwide spend. The US ($801 billion) ranked first, adopted by China ($293 billion), making up 38 per cent and 14 per cent of the worldwide defence expenditure, respectively.

The defence capital outlay has elevated from ₹0.95 lakh crore in FY19 to ₹1.39 lakh crore by FY22, implying a powerful 13 per cent annual improve over the past three years. Of this, the Indian Military, Navy, and Air Drive accounted for 88 per cent of the whole capital outlay in 2022. This has grown at an annualised 12 per cent since FY19, outpacing the general defence spend.

Ramping up exports

Third, India not solely goals to realize self-sufficiency in defence manufacturing but additionally seems to be to capitalise on the massive export alternative out there in neighbouring international locations, South Asia, West Asia and some European international locations. The Authorities has an export goal of $5 billion in defence by 2025, from about $1.6 billion in 2021-22, pushed largely by personal gamers and in addition micro, small, and medium enterprises.

About 50 firms are at the moment licensed for defence exports. Main markets for Indian exporters embrace Italy, Maldives, SriLanka, Russia, France, Nepal, Israel, Mauritius, Egypt, Bhutan, Ethiopia, and the UAE, to call a couple of.

A number of small and mid-sized firms are already catering to the defence wants of different international locations. As an example, Paras Defence and House Applied sciences, which designs and manufactures crucial imaging parts akin to giant house optics and diffractive gratings, serves not solely Indian defence PSUs but additionally multinationals akin to Rafael Superior Protection Programs Ltd and Israel Aeronautics Industries. A number of such listed firms are exporting defence items.

Apart from personal gamers, defence PSUs have additionally been stepping up exports. As an example, Backyard Attain Shipbuilders and Engineers, who’ve largely focussed on Indian Navy enterprise, are eyeing export alternatives as nicely.

PPP for execution

The fourth motive for our optimism is that defence PSUs have been forging private-public partnerships to make sure speedier execution and in addition improve the synergies from the indigenous capabilities. This may assist the defence Trade as an entire. It’s going to even be a giant constructive for firms on this house and can foster stronger partnerships. As an example, In August 2021, Photo voltaic Industries’ group firm, Financial Explosives Restricted manufactured and delivered multi-mode hand grenades, underneath expertise switch association with Terminal Ballistic Analysis Lab of DRDO.

The Defence Ministry is fostering innovation and making out there applied sciences akin to AI, blockchain and quantum computing, which is able to support navy decision-making and improve fight effectivity. As an example, autonomous weapon techniques can increase defence power whereas information from these techniques might be translated into actionable intelligence. The Defence forces — Military, for example — is collaborating with academia in top-tier institutes akin to IIT to develop and deploy new applied sciences.

Whereas all this bodes nicely for the nation as an entire, what does this imply for Indian firms?

Properly, for one, greater indigenisation will assist firms within the defence house by the use of greater order inflows, which is able to finally translate into stronger income and revenue progress. FY23 noticed a number of defence PSUs report document order guide. Hindustan Aeronautics Restricted tops the record with a whopping ₹83,858 crore as of September 2022. That is 3.4 instances the corporate’s FY22 reported income of ₹24,620 crore. Bharat Electronics Restricted (BEL) and Mazagon Dock Shipbuilders with order guide of ₹52,795 crore and ₹42,000 crore, share the second and third spot. BEL and Mazagon reported gross sales of ₹15,368 crore and ₹5733 crore in FY22. The present order guide is about 3.4 instances and seven.3 instances their respective FY22 gross sales.

However whilst order guide is spectacular and instils confidence on the expansion visibility for these firms, the actual recreation is execution that interprets into revenues and earnings. The tempo of execution must improve now, given the Authorities’s imaginative and prescient to make India a world manufacturing hub for defence.

To attain this, a number of PSUs have already launched into partnerships with personal gamers to outsource the non-critical portion of the work. Backyard Attain Ship builders and Engineers (GRSE), for example, with a document order guide of over ₹22,930 crore, outsources some fundamental development akin to ship hull to L&T Shipyard.

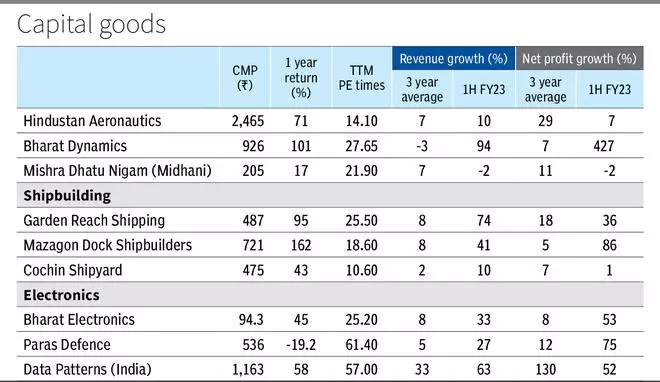

The improved execution monitor document of those firms can also be evident from their monetary efficiency within the present 12 months. The accompanying desk highlights how gross sales and revenue progress have accelerated within the first half of FY23, in comparison with the typical progress of the previous three years. However for Mishra Dhatu Nigam Restricted, all different firms listed within the desk have seen their income in 1HFY23 surpass the typical progress price within the final three years. Within the PSU house, Bharat Dynamics, GRSE and Mazagon posted robust income progress of 94 per cent, 74 per cent and 41 per cent year-on-year within the 1HFY23 interval. Within the personal sector, firms akin to Zen Applied sciences (174 per cent) and Information Patterns (India) (63 per cent) have additionally posted wholesome progress.

On the revenue entrance, PSU firms akin to Bharat Dynamics, Mazagon and GRSE recorded greater revenue progress within the first half of FY23.

Hindustan Aeronautics (HAL) and Midhani have been outliers, posting slower revenue progress in comparison with the final three years, largely as a consequence of elevated prices. For HAL notably, the massive orders are in mobilisation stage and can translate into income starting FY24.

Within the personal sector, Zen Applied sciences, Paras Defence, and Information Patterns (India) have reported distinctive progress within the April-September 2022 interval with revenue progress of 1,698 per cent, 75 per cent and 52 per cent, respectively.

Outlook

The expansion visibility stays robust for firms on this house with double-digit gross sales and revenue. HAL, although it has the very best order guide, has seen a moderation within the income progress tempo this 12 months, as giant orders have been already executed. Nevertheless, with a number of giant orders anticipated to conclude over the following few months, administration expects 10-12 per cent annualised progress to proceed over the following two years. .

Bharat Dynamics, which is into manufacturing of missiles, is anticipated to develop income and revenue by over 20 per cent over the following two years. Equally, shipyard firms akin to Mazagon, GRSE and Cochin Shipyard, with a wholesome order guide, are anticipated to maintain wholesome double-digit revenue and income progress over the following two years. There may be additionally important room for margin enchancment for Mazagon and GRSE, given the massive order guide and good visibility, and depressed margins up to now.

Within the present excessive rate of interest regime, defence PSU firms with robust steadiness sheet, negligible debt and improved money move technology as executiongains tempo, are well-positioned to additional increase their return ratios. This may add to the attractiveness of those companies from an funding perspective. Additionally, the working capital cycle, which can be at the moment greater largely as a consequence of stock, will enhance because the execution will get higher and the turnaround time comes down.

General, we consider defence firms to be on a robust footing with good progress visibility. Nevertheless, execution and talent to sustainably enhance turnaround time have to be watched. It might pay to maintain tabs on the efficiency of shipyard firms akin to Mazagaon Dock, GRSE and PSUs akin to Bharat Electronics and Bharat Dynamics and personal gamers like Information Patterns

Finances expectation

As India seeks to carve a distinct segment for itself as a self-reliant nation and as a dependable export associate, there may be want to speculate extra in defence, not only for manufacturing but additionally to enhance analysis capabilities. Along with the standard 12-15 per cent greater allocation for defence expenditure, the next capital outlay and, extra importantly, long-term incentive to speculate capital into strengthening technological capabilities is the necessity of the hour. Spurring funding in R&D will assist the nation develop its proprietary expertise platforms, in flip lowering import dependence and saving on foreign exchange outgo. It’s going to assist realise our imaginative and prescient to turn out to be the popular defence associate for international locations throughout the globe. Additionally, there may be an expectation to convey extra defence-related capital items underneath PLI scheme as that may spur capex investments on the manufacturing entrance.

#causes #defence #shares #radar