As one would possibly recall, Punjab Nationwide Financial institution not too long ago introduced a mega public sale of properties the place debtors had did not pay their dues. This isn’t a singular train, in fact. Many banks periodically conduct e-auctions of residential and industrial properties when there are mortgage defaults. Particularly on residential properties comparable to residences, unbiased villas and bungalows, for example, banks use the SARFAESI Act 2002 when debtors default past 90 days. First a discover is served, and if repayments don’t observe, banks finally proceed with auctioning the properties.

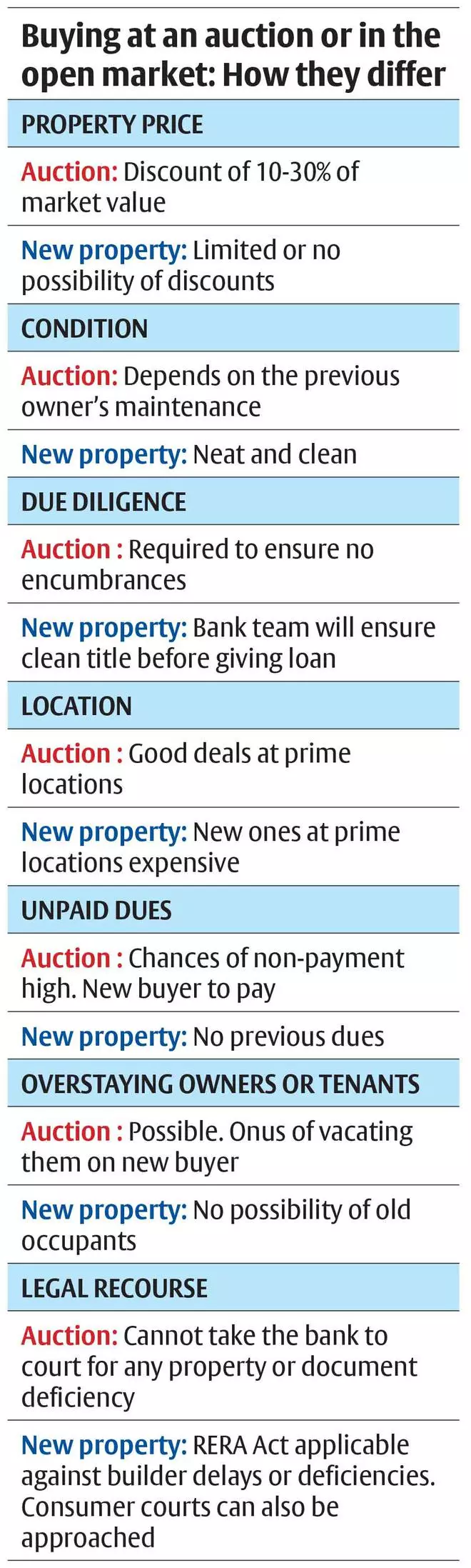

Many house consumers are drawn to such auctioned properties as they change into accessible at engaging costs — typically at 10-30 per cent low cost to the prevailing market charges.

However is a steep low cost alone adequate to make that all-important shopping for determination?

In case you are a purchaser, the place should you search for all the data? What are the steps concerned in taking part within the public sale? What are the elements — monetary, authorized and procedural — that it’s essential to take care of earlier than venturing into shopping for a bank-auctioned property? What are the dangers?

Right here’s all it’s essential learn about shopping for foreclosed properties.

Information about public sale

Banks usually promote public sale of properties by means of newspapers, their very own web sites, and thru third-party aggregators as properly

A key portal the place a variety of info is out there on properties up for public sale is the IBAPI (Indian Banks Auctions Mortgaged Properties Data). It’s a collective initiative of the Indian Banks Affiliation. There are 11 taking part public sector banks and as many as 11,698 properties which can be up for public sale are a part of the portal.

The IBAPI portal has particulars of properties in a reasonably user-friendly method. It’s fairly simply manoeuvrable. You’ll be able to seek for properties throughout classes — residential, industrial, agricultural and industrial. Search choices permit you to navigate State-wise, city-wise and even pin code-wise. Filters are additionally accessible by nature and measurement — bungalows, villas, residences (one, two, three BHK and so forth) and farmhouses. Registration is freed from value.

You’ll be able to zero in on a property of your alternative by utilizing the search choices accessible. The small print of the public sale date, reserve worth set by the precise financial institution and the EMD (earnest cash deposit) are additionally accessible.

Other than IBAPI, there are various personal third-party aggregators as properly. Foreclosureindia.com, eauctionindia.com, findauction.in and bankeauctions.com, for example, give particulars of foreclosed property auctions in simply navigable and user-friendly methods.

Most of those websites in addition to IBAPI present {a photograph} of the property and likewise primary particulars pertaining to the defaulting proprietor, whether or not the residence is in leasehold or in freehold with none encumbrances.

Registering and bidding

The movement chart beneath explains the method to register within the IBAPI. It’s good to begin the process 2-3 months earlier than the public sale date so that you just get an opportunity to go to the location bodily, if allowed by the financial institution. Plus, you could want time to get mortgage approvals for the property you want to bid for. If attainable, taking sanction of a pre-approved mortgage earlier than making the bid could also be helpful.

.jpg)

The registration is straightforward. It’s good to give particulars of your cellular quantity, e mail, PAN and Aadhaar, amongst different info. You’ll be requested to add the paperwork and as soon as authorized by IBAPI, your registration can be full.

After you choose a property, you’ll be able to bid for a similar by way of the MSTCecommerce web site. You’ll be able to pay the EMD for the property, which is often 10 per cent of the bid quantity, by way of NEFT alone presently.

On the public sale day, you’ll be able to place your bid beginning on the reserve worth. In case you are the very best bidder or if there aren’t any different bidders, you can be notified by way of an e mail concerning the profitable bid. You can too verify the ultimate particulars of the very best bidder.

There may be an choice to pay the ultimate quantity, too, by way of the portal.

In case there’s a sudden court docket order or a authorized growth on account of any celebration having reservations concerning the public sale, and also you want to withdraw from the bidding course of, you could possibly achieve this.

Readying the funds and taxes concerned

Each property up for public sale has a reserve worth hooked up to it by the financial institution, based mostly on its valuation metrics.

As a result of the property would finally be second-hand and likewise the truth that banks typically look to get better as a lot of the dues as attainable, such residences or homes are made accessible at a reduction. This might vary from 10 to 30 per cent beneath the market worth.

As a potential purchaser, it’s essential cough up 10 per cent of the reserve worth as earnest cash earlier than taking part within the public sale, as identified earlier

For those who make the profitable bid, the remaining quantity needs to be paid inside strict timelines. Banks typically search for the whole cost to be made inside a month of the completion of the public sale.

In case you want to purchase the property by way of a mortgage, it’s essential to guarantee that you’ve a pre-approved mortgage, in order that disbursals will be executed at brief discover. Extra so if the auctioning financial institution and your personal financial institution are completely different entities.

For those who win the public sale, however are unable to make the steadiness cost, you might have to forfeit the EMD paid initially. That may show very expensive.

The opposite key side to notice is the deduction of tax at supply. In case the property you want to buy is valued at greater than ₹50 lakh, it’s essential pay 1 per cent of the property worth as TDS.

This should be executed at every stage of cost, in order that 1 per cent is deducted on the whole transaction quantity.

Key authorized and operation elements

Title deed and paperwork

When properties are bought from a financial institution by way of an public sale, you’ll anticipate the title deeds of the property to be excellent and with none defect or encumbrances. Within the best-case situation, a clear title deed can be transferred to your identify from the financial institution, with no encumbrances.

Whereas this can be so typically, there will be cases the place issues could not go easily.

For instance, there may very well be encumbrances related to the property. There may very well be different authorized claimants to the property, who could problem the public sale course of or cease the switch of title to you.

Then there are instances the place different lenders might have given loans to the defaulter and will lay declare to the public sale proceeds.

Other than these, there may very well be conditions the place banks could have lent to debtors regardless of the title being unclear or faulty. Or there could also be illegality the place a builder could have constructed with deviations or put up greater than the sanctioned variety of flooring or limits after a financial institution lent the cash.

Due to this fact, it’s essential to make your personal enquiries, take the assistance of a property lawyer to make sure that the paperwork are clear and that there aren’t any authorized hurdles afterward.

You can not take the financial institution to court docket over any such subject that crops up.

Vacating tenants or present homeowners

Banks typically take ‘symbolic possession’ of a property as soon as there’s a default from the mortgage borrower. This implies the financial institution has authorized rights over the property, however has not taken bodily possession, so the current proprietor could also be residing within the house or home even because the public sale course of is on. The opposite risk is that there could also be tenants residing within the property of the mortgage defaulter.

In each instances, the onus of getting the occupants vacated falls on you, the public sale winner. That may be fairly problematic.

Unpaid municipal taxes, payments and society dues

The financial institution auctions the property on an ‘as is the place is’ foundation and absolves itself of any future prices associated to the property.

On condition that the earlier proprietor has defaulted on the mortgage, there’s a robust risk that there could also be a number of statutory dues as properly.

So, there could also be unpaid property and water taxes and electrical energy payments too. Moreover, whether it is an house, upkeep and different society dues should be factored in.

Such dues should be settled by you – the brand new purchaser of the property.

Bodily situation of the property

As defaults on loans occur on account of inadequate cashflows or job losses, it’s fairly attainable that the earlier proprietor could not have had sufficient cash to take care of the property properly.

There could also be appreciable restore and upkeep works required to make the house or the unbiased home habitable once more.

This might necessitate extra expense and legwork in your half. If these prices are added as much as the reserve worth and the general worth nonetheless is smart, you’ll be able to go forward and buy the property by way of an public sale.

Who can purchase repossessed properties?

A very powerful issue to notice is that it is best to ideally not be shopping for your first home by way of an public sale course of. Extra so whether it is for self-occupation.

If there are authorized hurdles, you don’t wish to shell out all the cash solely to seek out that the title is defective or that there another court-related points.

Shopping for a property by way of the public sale could also be a good suggestion if you buy it for renting it out once more. That means, you’ll have the ability to get common cashflows.

If the home is in a complicated locality or in a a lot sought-after space, it could make good funding sense. You’ll be able to promote the property purchased at a reduction at a significantly better worth as soon as market situations enhance.

Within the case of pretty rich homebuyers, villas or farmhouses could make sense because the low cost would make the acquisition engaging. They will full the required upkeep and restore works and use it for themselves or lease them out.

The power to boost funds rapidly is one other key requirement.

Lastly, any purchaser by way of an public sale should be ready for appreciable authorized and bodily groundwork. Due to this fact, you should be keen to have interaction a lawyer for all of the paperwork, get all of the related paperwork from the financial institution and numerous different authorities companies for verification, make enquiries about any claims of family members or lenders and so forth. Paying previous statutory dues and interesting with employees to restore the property are different duties.

In case you are assured about dealing with these points and might spare appreciable time, you’ll be able to go forward and purchase property by way of an public sale.

#information #shopping for #foreclosed #properties #financial institution #auctions