The merger is being proposed to consolidate the enterprise and variety of entities, rationalise and simplify the Group construction, enhance monetary stability, pool the data and experience of each events, align their enterprise plans, improve stakeholder worth, improve operational effectivity, the corporate notified the exchanges.

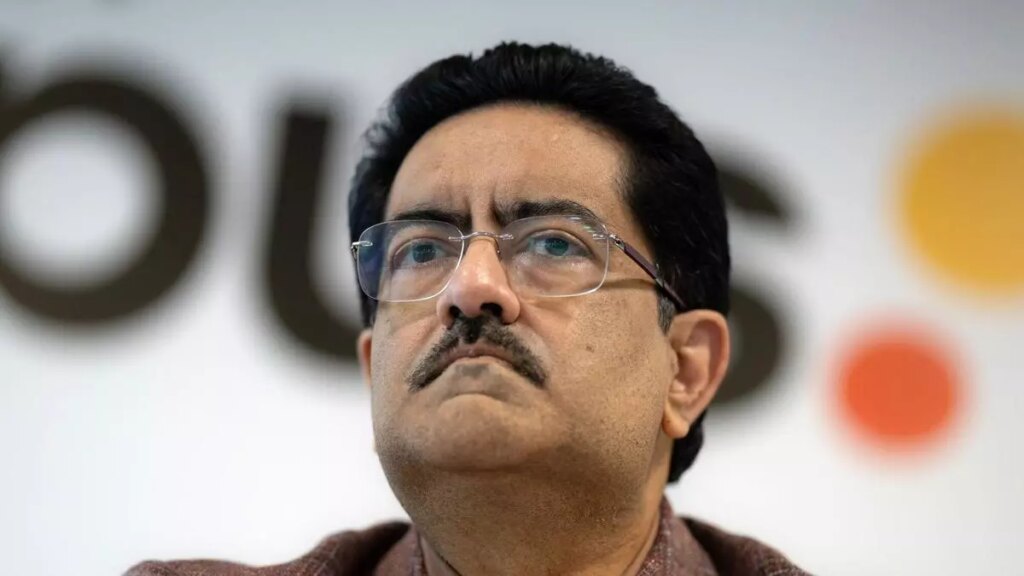

“Our monetary companies enterprise has scaled well to emerge as a core development engine for the Aditya Birla Group. The proposed amalgamation will create a robust capital base for Aditya Birla Capital to develop its enterprise,” stated Kumar Mangalam Birla, Chairman, Aditya Birla Group.

- Additionally learn: Aditya Birla Capital ramps up digital capabilities to drive development

Scale-based laws

The plan for amalgamation can be in-line with RBI’s scale-based laws, which required Aditya Birla Finance to be listed by September 30, 2025. The amalgamation is topic to regulatory and different approvals from NCLT, RBI, inventory exchanges, SEBI, shareholders and collectors.

Aditya Birla Capital is a listed systemically essential non-deposit taking core funding firm (NBFC-CIC), and has been labeled as a Center Layer NBFC (NBFC-ML) underneath the Scale-Primarily based Laws. Aditya Birla Finance is a non-deposit taking systemically essential NBFC (NBFC-ICC), labeled as an Higher Layer NBFC (NBFC-UL). It gives end-to-end lending, financing and distribution of monetary merchandise, together with mutual funds and insurance coverage.

The merged entity, on professional forma foundation, is anticipated to have lending belongings value Rs 1.1 lakh crore and its CRAR is anticipated to enhance by 150 bps.

Submit amalgamation, Aditya Birla Capital will get transformed from a holding firm to an working NBFC. It’s fairness funding in Aditya Birla Finance can be cancelled. There’ll no change within the shareholding, administration and management of the dad or mum firm, which is able to proceed to carry present investments in subsidiaries and associates.

“This may create a unified massive entity with larger monetary power and suppleness enabling direct entry to capital. This will even assist the Firm to maximise alternatives by environment friendly utilisation and allocation of capital,” it stated including that the proposed amalgamation is tax impartial for each entities.

Enterprise verticals

The proposed merger will even allow operational synergies and result in enlargement and

long-term sustainable development via seamless implementation of coverage modifications and discount within the multiplicity of authorized and regulatory compliances.

The merged entity can be engaged into the lending enterprise (NBFC enterprise of Aditya Birla Finance and housing finance enterprise via its subsidiary), and varied non-lending monetary companies and ancillary companies, immediately and not directly, via subsidiaries and associates.

Aside from Aditya Birla Finance, Aditya Birla Capital’s subsidiaries embody wholly-owned arms Aditya Birla Housing Finance and Aditya Birla ARC. Aditya Birla Solar Life Insurance coverage, Aditya Birla Well being Insurance coverage, Aditya Birla AMC and Aditya Birla Insurance coverage Brokers are subsidiaries the place the corporate has 46-51 per cent shareholding, and Aditya Birla Cash the place it maintain 74 per cent stake.

“At Aditya Birla Capital, we observe a ‘One ABC, One P&L’ strategy and are dedicated to drive high quality and worthwhile development by harnessing the ability of information, digital and know-how,” stated Aditya Birla Capital CEO Vishakha Mulye, including that the merger will even assist the NBFC serve its clients higher.

Following the merger, Mulye will assume the function of MD and CEO, and Aditya Birla Finance CEO Rakesh Singh can be appointed Government Director and CEO (NBFC).

As of December 2023, Aditya Birla Capital had an mixture AUM of Rs. 4.1 lakh crore and a lending AUM of Rs 1.15 lakh crore. Gross written premium underneath the life and medical insurance enterprise was Rs 13,500 crore.

#Aditya #Birla #Finance #merge #dad or mum #months