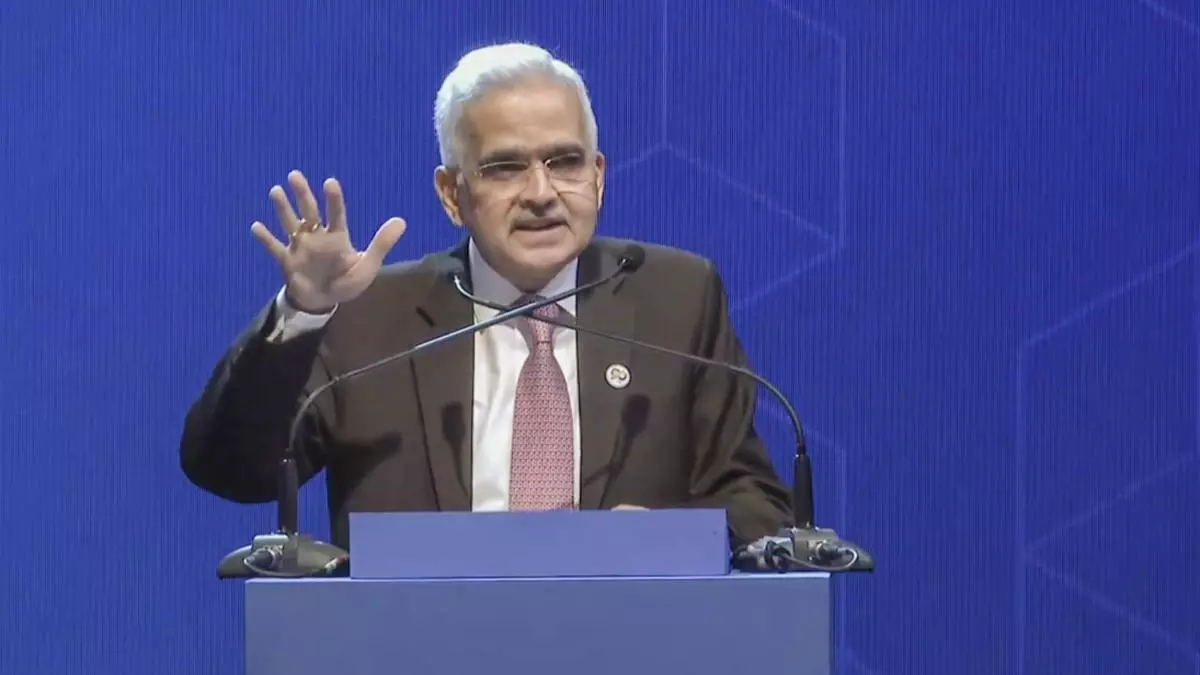

Primarily based on RBI’s expertise with the pilot of the aforementioned know-how platform (Public Tech Platform for Frictionless Credit score/PTPFC), which was launched final 12 months, its nation-wide launch might be carried out sooner or later, Governor Shaktikanta Das stated. To any extent further, the central financial institution plans to name the platform “Unified Lending Interface (ULI)”.

“Identical to UPI (Unified Funds Interface) remodeled the funds ecosystem, we count on that ULI will play an analogous function in reworking the lending house in India. The ‘new trinity’ of JAM (Jan Dhan, Aadhar, Cell)-UPI-ULI might be a revolutionary step ahead in India’s digital infrastructure journey,” Das stated on the RBI@90 World Convention on Digital Public Infrastructure and Rising Applied sciences.

- Additionally learn: RBI Governor foresees UPI system as a game-changer in cross-border remittances

“This cuts down the time taken for credit score appraisal, particularly for smaller and rural debtors. The ULI structure has widespread and standardised APIs (utility programming interfaces), designed for a ‘plug and play’ method to make sure digital entry to info from various sources. This reduces the complexity of a number of technical integrations. It allows debtors to get the advantage of seamless supply of credit score, faster turnaround time with out requiring in depth documentation,” he stated.

Das emphasised that by digitising entry to buyer’s monetary and non-financial knowledge that in any other case resided in disparate silos, ULI is anticipated to cater to massive unmet demand for credit score throughout numerous sectors, significantly for agricultural and MSME debtors.

Ajay Rajan, Nation Head – Authorities, Multinational & Worldwide Enterprise, Transaction Banking & Information Models at Sure Financial institution, stated, “ ULO is ready to revolutionize India’s monetary panorama. By offering consensual entry to monetary knowledge, ULI streamlines credit score assessments for lenders. When mixed with JAM and UPI, it kinds a strong digital trinity. This trio will rework India’s monetary ecosystem, enhancing monetary inclusion and enabling data-driven lending. Collectively, they’ll speed up our nation’s progress in the direction of a totally digital economic system, making monetary companies extra accessible and environment friendly for all Indians.”

- Additionally learn: Nationwide launch of Unified Lending Platform sooner or later: RBI Governor

The PTPFC, developed by the Reserve Financial institution Innovation Hub (RBIH), seeks to step up digital monetary inclusion in India. It leverages open APIs and requirements to streamline availability of knowledge in a ‘plug and play’ mannequin to allow disbursal of credit score in a frictionless method.

The lowered value of operations for lenders because of the ease of availability of knowledge could assist them supply credit score at inexpensive charges, per RBI’s Report on Forex and Finance.

The PTPFC pilot, launched in 2023, centered on merchandise similar to totally digital Kisan Credit score Card (KCC) loans as much as ₹1.6 lakh per borrower, dairy loans, MSME loans, private loans, automobile loans, tractor loans, digital gold loans, and residential loans via taking part banks.

Given the end-to-end digital processing, PTPFC has demonstrably lowered the turnaround time of KCC loans from just a few weeks to lower than an hour, the Report stated.

#UPI #success #RBI #nationwide #launch #Unified #Lending #Interface