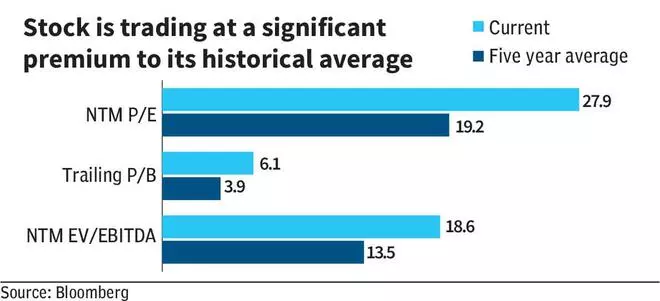

With cargo volumes of 339 MMT, it’s the largest business ports operator in India, accounting for almost one-fourth of the cargo motion within the nation. Income CAGR for the final 5 years (FY18-23) was 13 per cent and EBITDA margin for the ports section of the enterprise is over 70 per cent (general margin of round 60 per cent). It ticks all of the containers for an fairness funding, effectively nearly. The inventory has rallied ~65 per cent since December 2023 and is at present buying and selling at ~18.6x NTM EBITDA (Bloomberg consensus), ~38 per cent premium to its five-year common. These valuation ranges provide buyers alternative to guide income as suppressed return profile and money conversion will not be considered favorably when there’s a reversal in optimism

Enterprise segments

APSEZ operates three fundamental enterprise segments: 1) Ports – home and worldwide (round 90 per cent of 1HF24 income), 2) logistics (round 7.5 per cent), and three) SEZ and port growth ( round 2.5 per cent). APSEZ at present has 14 strategically positioned ports and terminals in India (seven every on the West and East coast) and the not too long ago acquired Haifa port in Israel. By its subsidiary Adani Logistics, APSEZ operates three logistics parks (in Haryana, Punjab and Rajasthan) and has the power to deal with 500,000 twenty foot equal items (TEUs) yearly. It’s evolving from a port firm to an built-in transport utility offering end-to-end resolution however ports proceed to be the first income driver.

Amrit Kaal Imaginative and prescient 2047

India’s Maritime Amrit Kaal Imaginative and prescient 2047 goals to considerably enhance the nation’s maritime functionality and effectivity. It has proposed the event of six mega ports by 2047, which can assist improve the nation’s cargo dealing with capability (quadruple from round 2,600 MMT to round 10,000 MMT by 2047) and the site visitors quantity dealt with (5x from round 1,400 MMT to round 7,000MMT, a CAGR of 6.8 per cent).

Prior to now, APSEZ has been in a position to seize market share and develop forward of the business (share rose from round 11.6 per cent in FY14 to an estimated round 26.2 per cent in FY24). Since FY14, cargo quantity dealt with by APSEZ has grown at a CAGR of 13 per cent in comparison with the business CAGR of 4.4 per cent. Because the clear market chief (share of 26 per cent in comparison with the second-ranked JSW infra with a share of 6 per cent), APSEZ is greatest positioned to seize a serious share of the elevated volumes from the 2047 imaginative and prescient.

Does progress justify the price?

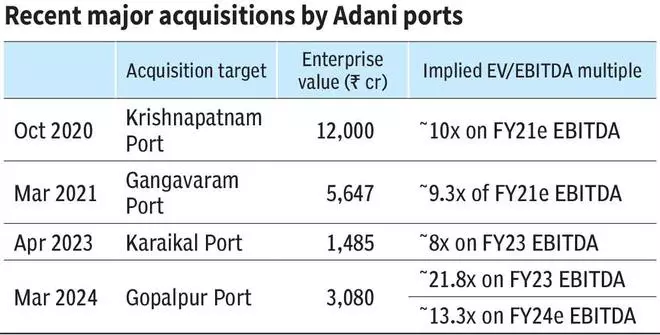

That mentioned, you will need to contemplate the price related in reaching this progress. Round 94 per cent of the present East capability (236 out of 252 MMT) has been by way of inorganic acquisitions.

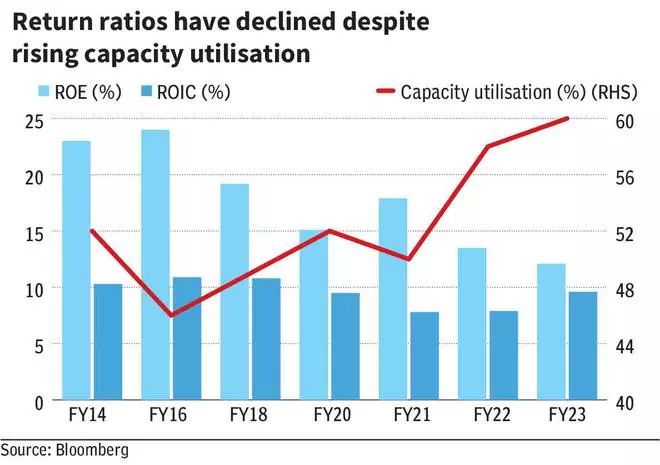

Despite the fact that APSEZ has managed to enhance the efficiency of the acquired ports (improved utilisation and profitability), the excessive value of acquisition has suppressed return ratios in the previous few years. Return on Fairness (RoE) and Return of Invested capital (RoIC) have dropped from round 24 per cent and round 11 per cent in FY16 to round 12 per cent and round 9.5 per cent respectively in FY23.

That is regardless of the general capability utilisation for the corporate’s home ports growing from 46 per cent in FY16 to 60 per cent in FY23. To place that into perspective, main ports achieved utilisation of solely 48 per cent in FY23 whereas the general business common was round 55 per cent. EBITDA margin for the ports section reached round 70 per cent in FY22 and FY23 in comparison with round 66 per cent in FY21. The corporate has been concentrating on decreasing ts internet debt to EBITDA ratio to ~2.5x by FY24 from 3.1x in FY23. We anticipate return ratios to stay suppressed within the medium time period, which will not be considered favourably by the market when the tide turns.

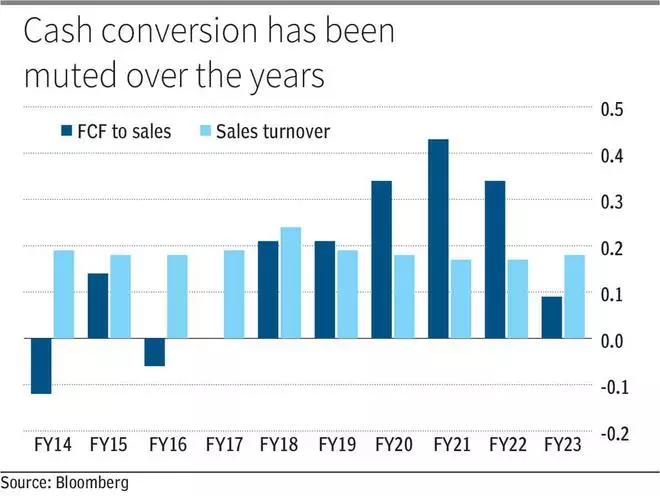

Muted FCF conversion

Given the capital-intensive nature of the business, the common capex-to-operating money circulation averaged about 50 per cent throughout FY19-23. Gross sales turnover has been within the vary of 0.17-0.24x averaging lower than 0.2x within the final decade. FCF conversion has largely been muted with FCF-to-sales averaging simply 0.16x. The corporate has an formidable goal to succeed in cargo volumes from round 340 MMT in FY23 to 1,000 MMT by 2030 (round 17 per cent CAGR). APSEZ’s money technology will stay below strain whereas the corporate builds its capability and capabilities over the subsequent few years.

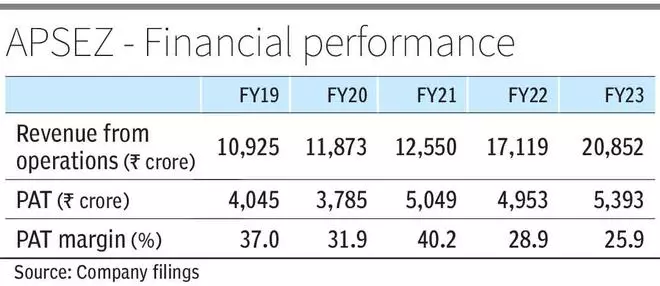

APSEZ reported income from operations of ₹20,852 crore in FY23 (22 per cent YoY progress) and ₹19,814 crore in 9MY24 (32 per cent YoY). For the complete yr FY24, Bloomberg consensus estimates top-line YoY progress of round 26.5 per cent Wanting forward, APSEZ is forecast to attain income/EBITDA YoY progress of 15-17 per cent in FY25. On the present value, the inventory is at present buying and selling at 18.6x FY25 EBITDA, ~38 per cent larger than its five-year common of 14x. Along with suppressed return ratios, the inventory is at present buying and selling at a value to guide ratio of 6.1x, ~56 per cent larger than its long-term common, indicating that it has absolutely priced in all of the optimism, thereby leaving little or no margin of security. We imagine it’s a good alternative for buyers holding the inventory to guide income at these ranges.

#APSEZ #Traders