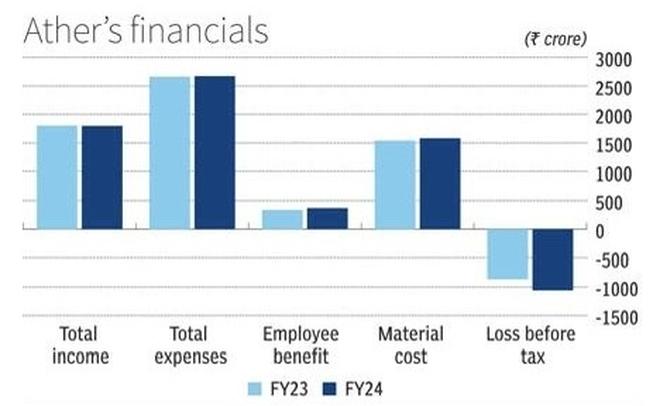

As per the corporate’s DRHP, in FY24, it reported revenues of round ₹1,700 crore however confronted vital losses of roughly ₹1,000 crore.

These losses had been partly attributed to the corporate’s dependence on the Sooner Adoption and Manufacturing of Hybrid and Electrical Autos (FAME) scheme, which resulted in monetary setbacks as a consequence of delays, slender gross revenue margins, or elevated prices that the subsidies didn’t totally offset.

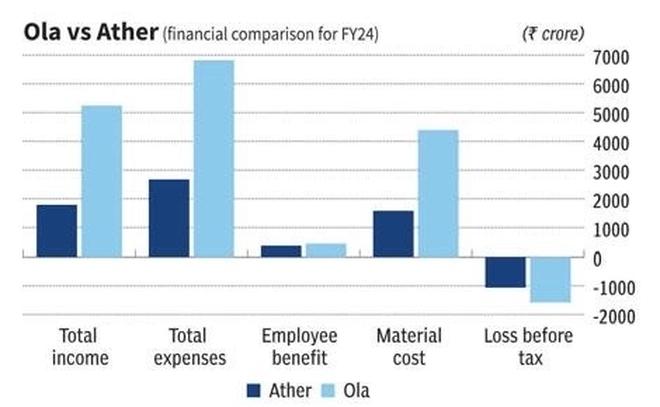

Word: The entire bills are inclusive of worker profit and materials value.

Electrical two-wheeler gross sales in India surged from 30,000 items in FY19 to 9.4 lakh items in FY24, pushed by the FAME scheme aimed toward selling EV adoption and infrastructure.

FAME II, launched in 2019 with a ₹10,000 crore price range, was aimed to assist 15 lakh electrical automobiles throughout classes.

After the second scheme, which expired on July 31, the federal government has now launched the PM E-Drive scheme, successfully a rebranded model of the FAME III coverage, with a price range of ₹10,900 crore over two years.

A blended bag of outcomes

Regardless of earlier uncertainty concerning the continuation of subsidies, the federal government has determined to increase them beneath the brand new program, although the rationale behind this choice stays considerably unclear.

Furthermore, whereas FAME II had a five-year span, the PM E-Drive goals to attain its targets in simply two years, marking an formidable timeline.

Curiously, the scheme excludes electrical vehicles from receiving subsidies, as a substitute specializing in two-wheelers, three-wheelers, buses, vehicles, and even ambulances.

A complete of ₹3,679 crore is earmarked to incentivise the adoption of 25 lakh e-two-wheelers and over 3 lakh e-three-wheelers.

The broader influence of excluding electrical vehicles from subsidies on the EV market stays unsure.

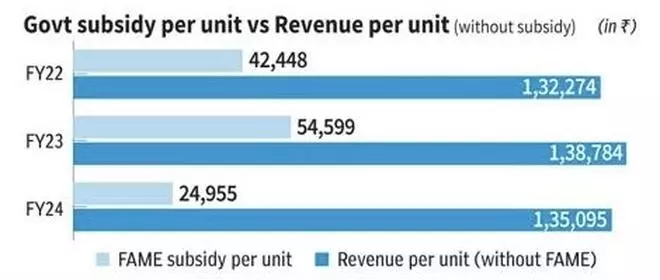

A noteworthy commentary from the DRHP was the divergence between the subsidy supplied by the federal government and the precise income that firms are producing from the sale of electrical automobiles.

The subsidy per automobile value via the part of FAME II really decreased.

This was largely as a result of beneath FAME II, subsidies had been calculated primarily based on battery capability, and capped at 40 per cent of the automobile’s value, leading to decrease monetary assist in comparison with FAME I.

The PM E-Drive scheme may streamline this subsidy course of by simplifying its construction, enhancing assist for smaller automobiles, eradicating inflexible caps, and bettering the effectivity of software and disbursement.

Patrons will obtain an Aadhaar-verified e-voucher on the time of buy, clearly detailing the subsidy quantity, which addresses a key problem from earlier schemes. This method is predicted to align subsidies extra intently with market wants and cut back the hole between authorities assist and the precise income generated from EV gross sales.

Amid these shifts in coverage, Ather is closely investing in increasing manufacturing capacities to faucet into the market’s rising demand.

The funds raised via the IPO, in line with the submitting, can be used to extend manufacturing capability, with a major ₹2,000 crore funding already made in a 3rd plant in Aurangabad.

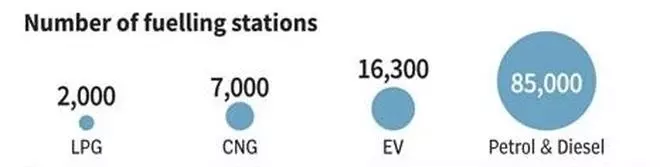

Whereas economies of scale may help cut back per-unit prices, making electrical scooters extra reasonably priced, the absence of widespread charging networks and ample services limits the trade’s potential for development.

Charging infrastructure

In a price-sensitive market like India, the place affordability drives gross sales, the necessity for strong infrastructure turns into much more essential to foster shopper confidence and adoption.

As of 2024, the nation has roughly 16,300 public charging stations, stated a CareEdge Rankings report.

Nevertheless, it’s unclear what number of of those stations cater to two-wheelers or whether or not all are operational.

Shift in gross sales and gas selections

One other attention-grabbing development is that the general two-wheeler market has grown as a result of rise in electrical two-wheeler gross sales, regardless of a 4 per cent decline in petrol two-wheeler gross sales between FY19 and FY24.

In 2024, 50-55 per cent of two-wheeler purchases had been made via financing, up from 40 per cent in 2019, indicating that the elevated availability of financing has facilitated this development.

In keeping with the CareEdge Rankings report, different gas automobiles, together with CNG, LPG, EVs, and hybrids, skilled a 400 per cent improve in gross sales in CY23 in comparison with CY20, largely pushed by electrical automobiles.

Regardless of this substantial development, electrical two-wheelers nonetheless account for under 6-7 per cent of the overall market.

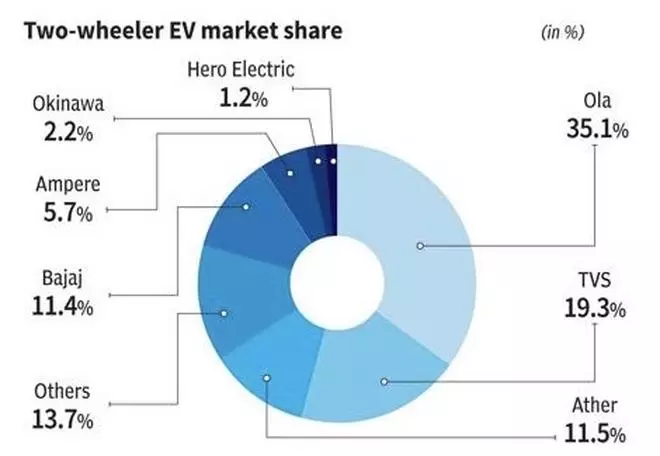

Aggressive panorama

The electrical two-wheeler house in India has undergone vital modifications since 2019. Again then, Hero Electrical and Okinawa held greater than 80 per cent of the market.

Nevertheless, the market has diversified, with firms like TVS and Bajaj getting into the fray, with Bajaj now holding a market share similar to Ather.

Ola Electrical formally entered the electrical two-wheeler market in 2021 with the launch of its first scooter, the Ola S1, and has since captured the most important market share.

Word: The entire bills are inclusive of worker profit and materials value.

With respect to gross sales, Ather offered 1.1 lakh scooters, whereas Ola recorded gross sales of three.3 lakh scooters.

Possession and affordability

A standard query that usually arises, amongst patrons, about electrical automobiles (EVs) is whether or not they’re reasonably priced.

In keeping with Ather’s DRHP, in India, lower-income households incomes round ₹1.25 lakh yearly have a 34 per cent two-wheeler possession price, and are constrained by the excessive upfront prices of electrical automobiles. Whereas wealthier households, with a 75 per cent possession price, are extra inclined to spend money on electrical two-wheelers as a consequence of their decrease long-term prices.

Whereas electrical two-wheelers presently value about 40 per cent extra upfront than petrol bikes, they’re roughly 37 per cent cheaper to personal over time for 8,000 kilometres of annual utilization.

With subsidies, this value benefit would rise to 52 per cent.

In keeping with Ather, by 2031, electrical two-wheelers can be 52 per cent cheaper than petrol bikes even with out subsidies, highlighting their long-term value effectivity regardless of increased preliminary prices.

Components such because the potential decline in battery prices, growing petrol costs, and steady developments in EV know-how may improve effectivity and sturdiness, additional reducing possession bills.

#Athers #IPO #Attention-grabbing #gleanings #trade #DRHP #EDrive #give #booster #dose