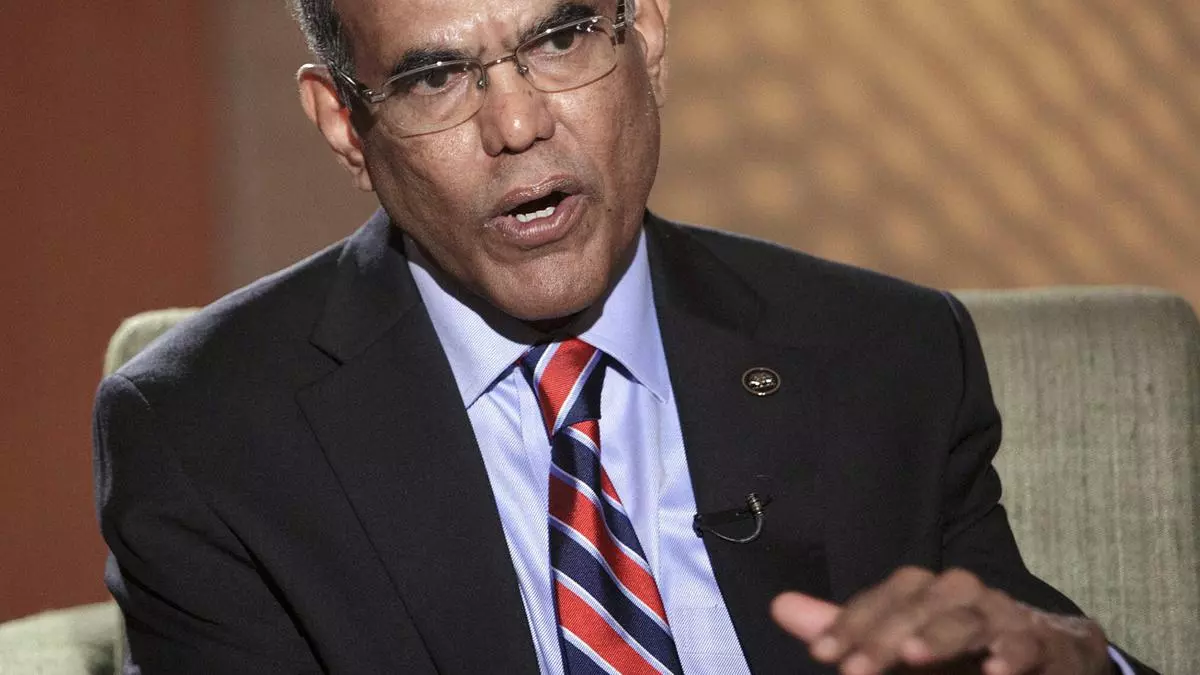

Emphasising that the burden of assembly India’s $5-trillion financial system goal will fall on banks, Dr Duvvuri Subbarao, Former Governor, RBI and visiting school, Yale College says prime quality banking is essential for the nation. Edited excerpts:

What’s the function of banks and banking in India’s march to a $5-trillion financial system?

We all know from improvement expertise that the credit score depth of GDP will increase as the dimensions of the financial system expands. This implies the financial system will demand extra credit score per unit of GDP because it grows in dimension. The burden and duty of assembly this rising credit score demand will fall on the formal monetary sector, and particularly on banks.

In assembly this problem, banks should concentrate on three areas. The primary is extra environment friendly monetary intermediation in channelling financial savings into funding. Distressingly, family monetary financial savings, the mainstay of our financial savings, have been falling in recent times and one of many causes for that’s that banks haven’t been capable of reward savers adequately. In an effort to fulfil the $5-trillion dream, banks should reverse this development, develop the bottom of savers and scale back their intermediation prices.

The second focus space is to channel credit score to funding and commerce. It’s inconceivable that we are able to maintain a $5-trillion financial system with out a lot bigger non-public funding in manufacturing and providers. Banks should be revolutionary in scouting for alternatives. One of many huge challenges going ahead will probably be to generate job intensive development and right here banks should pay particular consideration to the ‘lacking center’ – the MSME sector which creates extra jobs per unit of funding than the big company sector. What this implies is that banks should work on your complete vertical chain of personal funding.

Equally, elevated commerce – increased exports and imports – will probably be essential to quicker development. We have to diversify each our export basket and export markets. Equally, our import basket too will develop and diversify. Commerce enlargement too can’t occur with out banks taking a lead function. They should behave like enterprise capitalists in financing commerce whereas fastidiously balancing dangers and rewards.

The third focus space for banks in our march to $5-trillion GDP needs to be monetary inclusion. It’s doable to get to $5 trillion with the advantages of development being cornered largely by the excessive earnings segments with the underside segments left behind. That will probably be a shallow victory; it will likely be self-defeating and in the end unsustainable. Many issues should fall in place to engineer the ‘trickle down’ and one in all them is monetary inclusion. What the poor need just isn’t doles, however alternatives to lift their incomes. It’s a mistake for banks to see monetary inclusion as an obligation; they need to see it as a possibility. We all know that the chance on the backside of the pyramid is immense; those that go searching will probably be amply rewarded.

What are the challenges and alternatives that banks will face in supporting quicker development?

The listing on each side of the ledger is lengthy. Foremost on the alternatives aspect is digital applied sciences which have modified banking in methods we couldn’t even think about. Even barely literate individuals are capable of do UPI transactions on WhatsApp and Paytm; QR codes are essentially the most

ubiquitous sight on our city streets; and bespoke ‘sachet’ loans to swimsuit particular person buyer calls for are gaining forex. Digital applied sciences have decreased the price of banking – the prices of appraising credit score purposes, onboarding clients, disbursing credit score, monitoring and recovering loans have all declined. Large knowledge and AI are making it doable to apprise the creditworthiness of even folks with no prior footprint within the formal monetary sector. Moreover, banks have the chance to tie up with fintechs to mix their expertise with the latter’s area of interest experience to ship credit score optimally.

On the challenges aspect, let me point out simply three necessary ones. The primary is local weather change which is able to pose recognized and as but unknown dangers to banks and banking. The second is monetary globalization which suggests, as we properly know by now, {that a} risk to monetary stability wherever is a risk to monetary stability all over the place. The third is cyber safety which for apparent causes will probably be a rising problem.

It’s usually stated that for a $5-trillion financial system, India wants extra banks. Do you agree?

That’s an ‘apple pie and motherhood’ assertion. You possibly can’t actually disagree with it. However as I stated earlier than, extra necessary than extra banks is extra and better high quality banking.

Improvement expertise evidences a powerful correlation between monetary sector improvement and financial development, with the causation probably working each methods. Financial development generates demand for monetary providers and spurs monetary sector improvement. Within the reverse path, the extra developed the monetary sector, the higher it is ready to allocate assets and thereby promote financial improvement.

In India, we have now skilled causation in each instructions. Shortly after the 1991 reforms, we realized that the expansion impulses generated by the liberalizing regime couldn’t be sustained except we additionally undertook monetary sector reforms. That’s an illustration of development triggering monetary sector improvement. For an instance of the causation within the reverse path, we have now to look no additional than India’s exceptional development acceleration within the interval 2003-08 after we clocked development of 9+ per cent.

Many elements have been cited as being accountable for this – increased financial savings charges, improved productiveness, rising entrepreneurism and exterior sector stability. However one of many unacknowledged drivers of that development acceleration has been the spectacular enchancment within the high quality and quantum of economic intermediation in India, evidencing how monetary sector can spur development.

This expertise illustrates the significance of banks and banking in fulfilling our $5 trillion aspiration.

Revealed on April 4, 2024

#Banks #revolutionary #scouting #alternatives #Subbarao