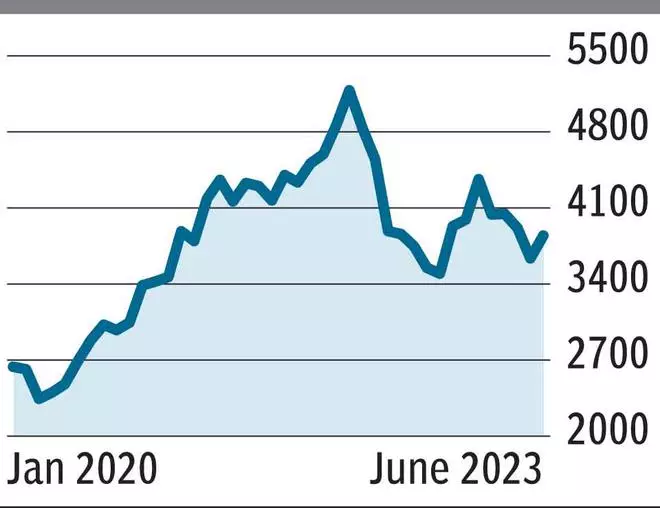

The London Metallic Trade Index (LMEX), a weighted index calculated from the closing value of the six base metals — Aluminium, Zinc, Copper, Lead, Nickel, and Tin — rose from a low of round 3,453 in finish September 2022 to a excessive of 4,403 in January this yr. However with progress and demand from China not choosing up as anticipated, costs have moved sharply decrease once more. To date, the LMEX has tumbled about 13 per cent from its January excessive of round 4,403.

Among the many particular person metals, barring copper, which is marginally up for the yr by slightly over 2 per cent, different base metals are down for the yr. Nickel has been crushed down badly, falling about 23 per cent. That is adopted by Zinc, which sports activities a 16 per cent slip. The excellent news from that is the easing of uncooked materials value pressures for India Inc, whilst commodity producers could face weak realisations. However, how a lot of a tailwind does the cooling off even have? What’s in retailer, for the remainder of the yr, for base metals? Right here’s our take, primarily based on basic in addition to technical evaluation.

What lies forward

The image shouldn’t be wanting very rosy for the remainder of 2023. Base steel costs are prone to see yet one more leg of fall earlier than a robust revival occurs. Weak spot within the Chinese language economic system, excessive inflation and rates of interest are among the main components that may proceed to maintain base metals subdued.

China: No indicators of restoration

Whereas the western world continued to extend rates of interest, China has been on the opposite aspect. Whilst just lately as final week, the Folks’s Financial institution of China (PBOC) reduce its short- and medium-term coverage charges by 10 foundation factors (bps). Whereas these measures are prone to take a while to have a rub-off impact on the financial restoration, for now, the financial situation in China continues to be anaemic.

China’s property and industrial sectors — the most important shoppers of base metals — proceed to stay weak. China’s housing market has been in hassle since mid-2021. The info level on newly began homes exhibits that it has come down — from a excessive of 269 million models in June 2021 to 85 million in Could this yr.

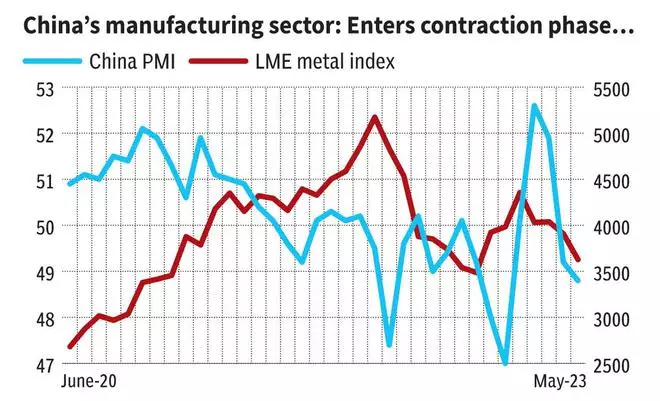

Equally, China’s manufacturing Buying Managers’ Index (PMI) has come again into the contraction section after briefly getting into the growth section in February this yr. The PMI is at the moment at 48.8. So, except each the sectors get well, steel costs will not be prone to rise this yr.

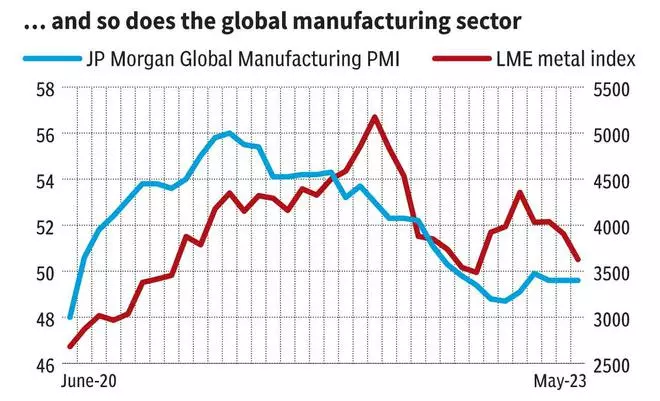

Even globally, the manufacturing exercise is slowing down. JP Morgan International Manufacturing PMI is at the moment at 49.6. Although it has risen from the low of 48.7 in December final yr, it’s nonetheless struggling to rise above 50 — the growth section.

Excessive inflation, rates of interest

Aggressive charge hike from the US Fed was one of many main causes for steel costs to crash in 2022. After ten consecutive charge hikes, the Fed opted for a pause in its June assembly final week. Nonetheless, the central financial institution has left the door open for one more 50-basis factors charge hike for the remainder of the yr. That’s, within the subsequent 4 conferences, the Fed may increase charges by 25-bps in two of them.

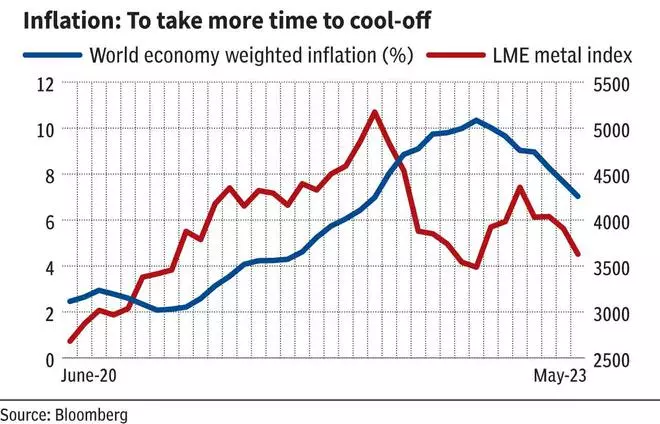

On the inflation entrance, there may be extra room left to achieve the worldwide central banks’ goal, particularly that of the Fed. International Shopper Value Index (CPI) knowledge from Bloomberg exhibits that inflation has cooled to six.6 per cent after peaking at 10.4 per cent in November 2022. Nonetheless, wanting again at e historical past, the common world inflation charge in the course of the pre-Covid interval from 2015 to 2020 has been 3.5 per cent. So, for the worldwide CPI to come back down into its common zone, it should take time. Till then, rates of interest are prone to stay greater.

So, each the excessive inflation and excessive rate of interest situation, which is prone to prevail for the remainder of 2023 not less than, is not going to permit steel costs to rally.

Demand-supply imbalance

Base steel complicated is forecast to be in deficit — that’s, demand is prone to exceed provide in 2023. Nonetheless, this isn’t going to create a constructive affect on the costs. As a result of the speed of improve in provide goes to be greater than that of the demand. As an example, the Worldwide Copper Research Group (ICSG), in its forecast launched in April, expects a deficit of 1,14,000 tonnes in refined copper for 2023. Nonetheless, that is a lot decrease than a deficit of 4,31,000 tonnes witnessed in 2023. It’s because the demand is prone to improve by simply 1.4 per cent as in comparison with a 2.6 per cent improve in manufacturing.

Equally, in Zinc, the demand is prone to develop by 2.1 per cent whereas the availability will improve by 3.1 per cent. Refined zinc market is forecast to finish 2023 with a small deficit of 40,000 tonnes. So, slower tempo of rise in demand as in opposition to a sooner improve in provide can hold the upside capped in steel costs. Until the demand picks up robustly, overshadowing the rise in provide, steel costs will not be anticipated to extend.

Verdict

As seen from the charts above, the components mentioned above have robust directional correlation with the steel costs. Total, base steel costs will not be prone to transfer greater instantly. Quite the opposite, weak demand, sluggish Chinese language economic system, excessive rates of interest and inflation situation, all collectively, can drag base steel costs additional decrease within the second half of this yr.

Technical Outlook

LMEX (3,837)

The outlook is bearish. The index has robust resistance within the 3,900-4,000 area. Within the close to time period, the possibilities look brilliant for an increase to check this resistance zone. Nonetheless, an increase previous 4,000 is unlikely. As such, the LMEX can reverse decrease once more wherever from the three,900-4,000 area and resume the broader downtrend. That leg of downmove can take the index down to three,400 and even 3,300 within the coming months. Thereafter the worth motion will want a really shut watch — as a result of 3,300-3,400 is an excellent help zone. The downtrend can halt, and a contemporary rally is feasible from this help zone.

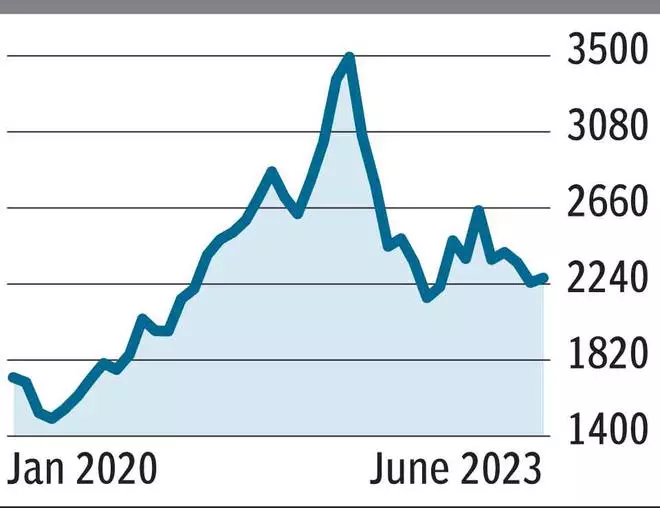

LME Aluminium ($2,271 per tonne)

The image seems slightly combined. The broader development is down. However the latest value motion on the charts leaves the construction much less weak. However on the identical time, there isn’t a robust constructive signal for a development reversal as effectively. Essential resistances are at $2,450-2500 and $2,600. Fast help is at $2,200. Under that, $2,150 and $2,000 are the following necessary helps. So, general, $2,000-2,600 would be the broad vary of commerce for Aluminium within the coming months. Inside this, we are able to count on the worth to fall and take a look at $2,150-2,000 first from present ranges. Thereafter a reversal is feasible.

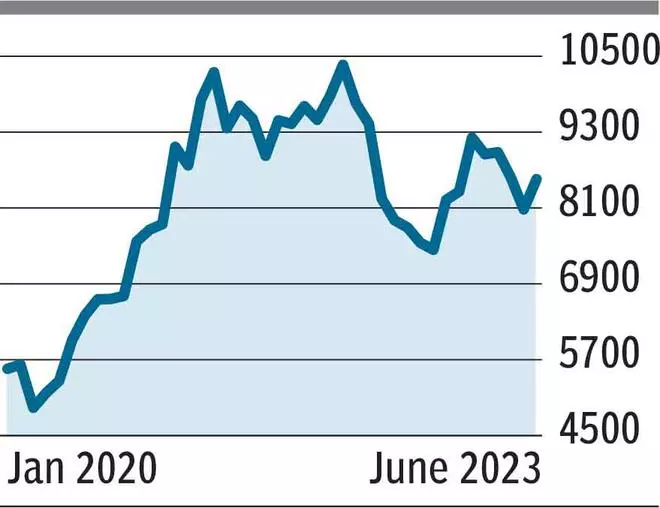

LME Copper ($8,566 per tonne)

The extent of $8,000 is at the moment giving good help. An increase to $8,900-9,000 is feasible within the close to time period. However thereafter, the worth can reverse decrease once more. That may take it all the way down to $8,000 ranges once more. A break under $8,000 can drag the worth decrease to $7,200. Thereafter the possibilities are excessive for the worth to reverse greater. To negate the above-mentioned fall to $7,200, copper has to rise previous $9,000 decisively first after which breach $10,000 subsequently. That can want some robust constructive set off, which seems very troublesome at the moment. So, for now, the possibilities are excessive for copper costs to stay at $9,000.

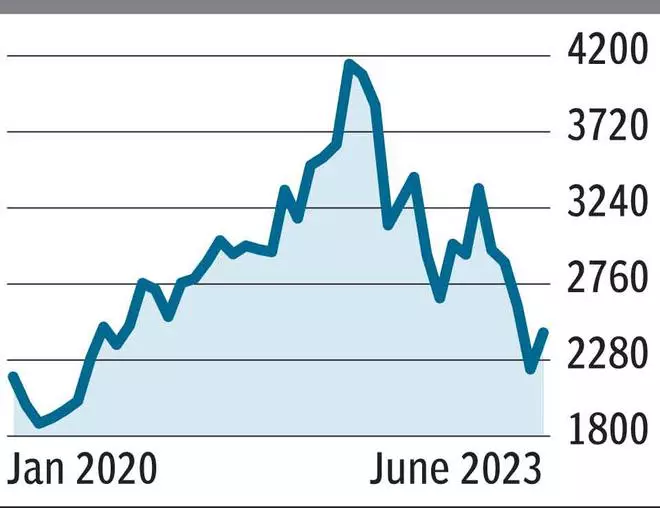

LME Zinc ($2,478 per tonne)

The general development is down and this downtrend seems robust. Amongst all the bottom metals, zinc seems the weakest. It has extra room to fall from present ranges than others. The latest bounce from the low of $2,215 is only a corrective bounce. Robust resistance at $2,700 will be examined now. However it will probably cap the upside as contemporary promoting can emerge once more at that degree. A contemporary leg of fall from round $2,700 can drag the worth all the way down to $2,000-1,900. Nonetheless, that could possibly be the final leg of fall. From a long-term perspective, the $2,000-1,900 is a robust help zone. The present downtrend can halt there, and development reversal is feasible thereafter.

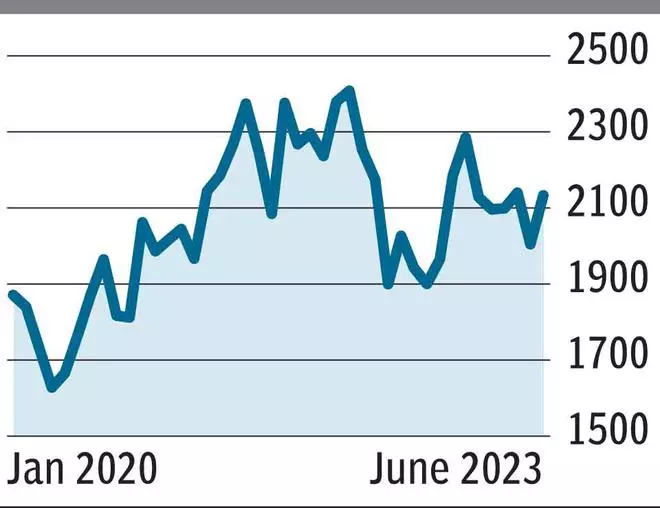

LME Lead ($2,141 per tonne)

The worth has been in a chronic sideways vary for greater than a decade. $1,500-$2,900 has been the broad buying and selling vary since 2010. Inside this, the worth is poised across the midpoint. So, this leaves equal likelihood for it to maneuver both manner throughout the vary. Fast resistance is at $2,200. Assist is at $2,000. Failure to breach $2,200 from present ranges can set off a break under $2,000. Such a break can drag the worth all the way down to $1,700-1,600, going ahead. However, a break above $2,200 will be bullish. It could set off an increase to $2,400-2,500. Total, it’s a wait and watch scenario. A breakout on both aspect of $2,000-$2,200 will decide the following transfer.

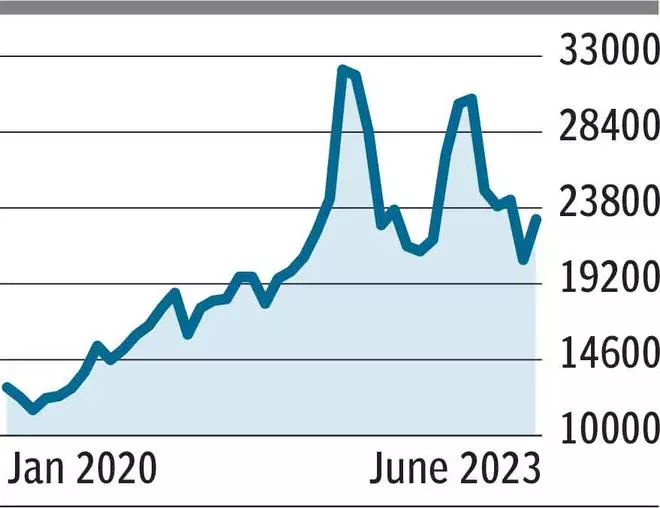

LME Nickel ($23,034 per tonne)

A robust bounce occurred final week. However key resistance is at $23,500-$24,000. An increase within the close to time period to check this resistance zone is feasible. Nonetheless, an instantaneous break above $24,000 won’t be very simple. It’s going to want some robust set off. So, the possibilities are excessive for nickel value to reverse decrease once more from $24,000. That reversal can take the worth all the way down to $20,000 and even $19,400. Thereafter the worth motion will want an in depth watch. The $20,000-19,400 area is an effective long-term help zone. So, a contemporary rally is feasible from there.

#Base #Metallic #Costs #Components #Impacting #Market #Outlook #Future #Traits