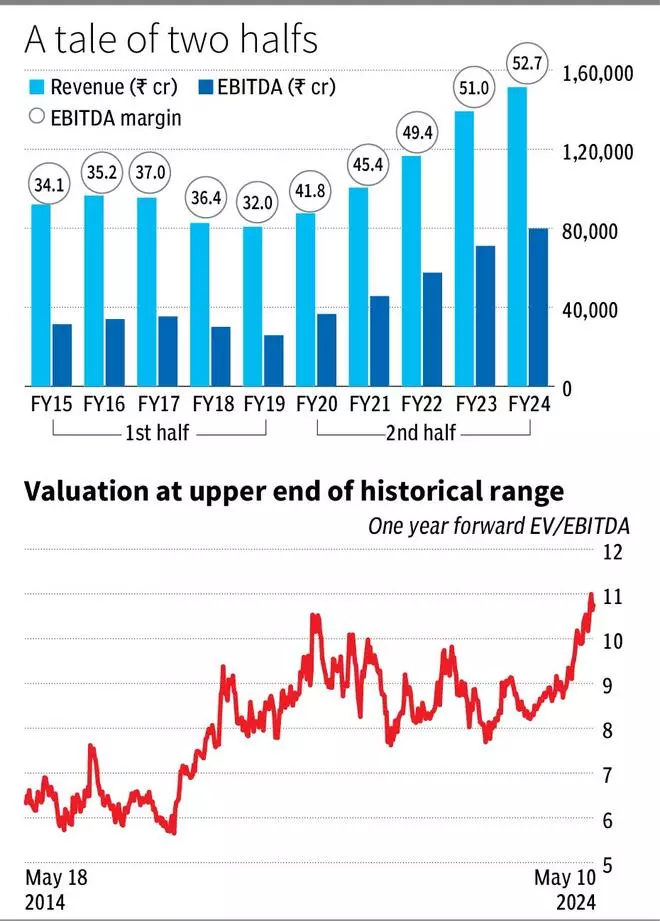

Nonetheless, we at the moment are shifting to a cautious stance on the inventory, purely on valuation. From a valuation perspective, the one-year ahead EV/EBITDA for Bharti Airtel has expanded from 8 occasions in April 2021, to 10.6 occasions as towards the five-year common valuation of round 8.9 occasions. Stretching past this a number of could also be problem for telecom shares, besides when within the midst of a turnaround.

Globally, massive telecom gamers commerce within the vary of 4-7 occasions EV/EBITDA, with few exceptions reminiscent of Indian telecom corporations and T-Cellular USA buying and selling at a premium to this vary. Whereas this premium can maintain, it could not develop a lot from right here, with dangers tilted to the draw back.

Within the final three years, the inventory has benefitted from two major elements – one, a optimistic reset in enterprise publish Jio and AGR-related disruptions, with Airtel rising stronger from the disaster within the sector. On this interval, Airtel has delivered robust EBITDA development pushed by market share good points, improve in tariffs, rising share of 4G subscribers in buyer base, and in addition by persevering with to execute effectively (one thing it has accomplished persistently during the last 25 years). The corporate’s steadiness sheet has additionally strengthened considerably on this interval as higher development resulted in increased free money flows, leading to web debt/EBITDA at a snug 2.9 occasions now .

Two, as the corporate delivered higher general efficiency, traders have additionally rewarded it with a number of growth as will be seen within the improve in EV/EBITDA a number of during the last three years. The 2 elements collectively have resulted within the inventory shifting up by 145 per cent since April 2021 as towards Nifty 50’s close to 50 per cent achieve.

With the inventory buying and selling on the higher finish of historic valuation vary and development for subsequent few years additionally more likely to taper versus latest years, the inventory seems to have priced in all of the positives, together with development from 5G and scope for tariff will increase, publish elections. Market share good points may additionally face some brick partitions publish Vodafone Concept’s profitable rights concern.

Therefore, we advocate that traders guide partial earnings and lock in on the good points. We’re not recommending a whole guide revenue as a consequence of the truth that Bharti Airtel can stay a core holding in a long-term portfolio, given its dimension, scale and good execution monitor file.

Enterprise

At a consolidated degree, Airtel is the most important telecom participant primarily based out of India, with operations in India (69 per cent of income), Africa (30 per cent) and South Asia (1 per cent). Its enterprise encompasses cellular companies (round 80 per cent of income), enterprise/enterprise companies (enterprise connectivity, submarine cables; round 14 per cent of income) and different companies reminiscent of DigitalTV/DTH, residence companies, and many others.

India cellular companies is the most important section and the important thing driver for enterprise and shares.. It accounts for 54/57 per cent of consolidated income/EBITDA respectively. It at present has round 33 per cent of the cellular subscriber market share in India vs Jio’s 39 per cent. As in comparison with two years again, Airtel has gained a lot of the bottom ceded by Vodafone Concept, with market share rising from 30 per cent, whereas Jio elevated its market share by 1 per cent in the identical interval.

Efficiency

The turnaround within the enterprise of Airtel, which underlies the outperformance in shares, will be greatest understood by evaluating its efficiency during the last 5 years with the five-year interval previous to that. The FY19-24 income and EBITDA CAGR for Airtel (contains consensus estimates for Q4FY24) is at 13 and 25 per cent respectively. As in comparison with this, the five-year interval of FY14-19 was one among painful readjustment to disruptions within the trade and the interval income and EBITDA CAGR had been at unfavorable 1 per cent.

Publish this turnaround, the corporate, whereas it’s anticipated to ship first rate development, is unlikely to repeat the expansion witnessed in FY19-24, over the subsequent 5 years. Consensus estimates primarily based on expectations of tariff will increase someday in FY25 point out development of 12 per cent in income and 26 per cent in EBITDA.

This seems fairly optimistic for 2 causes. One, since market share good points could taper or stall from right here, income must be primarily pushed by ARPU development and different enterprise segments. Two, given the truth that EBITDA margins are at all-time highs at 52.7 per cent, incremental margin good points might be tougher. Therefore EBITDA development considerably increased than income development could also be arduous. Nonetheless, at 10.6 occasions one-year ahead EV/EBITDA, this optimistic expectation is already factored, leaving a low margin of security at present ranges.

The 5G story is forward for Airtel. Nonetheless, the theme will take a couple of years to play out as it should require help from the ecosystem as effectively to make the expertise productive and significant. Cheaper 5G smartphones and improvement of different 5G use case units are important for the theme to achieve traction.

Whereas present traders can guide partial earnings, new traders can look ahead to extra readability on 5G theme choosing up and higher entry factors.

#Bharti #Airtel #Buyers