Bharat Heavy Electricals Ltd (BHEL), an influence tools producer commanding a market share of round 70 per cent within the provision of thermal energy tools, has benefitted considerably from this developmental push.

Whereas the BSE Capital Items index has skilled a notable uptick of round 66 per cent over the previous one yr, the inventory of BHEL has surged by a formidable 187 per cent. Presently, the inventory is buying and selling at a comparatively lofty trailing P/E ratio of 158 instances.

Moreover even when factoring ahead estimates given the robust progress momentum, its valuation is kind of costly at one yr ahead PE and EV/EBITDA of 71 instances and 48.7 instances respectively. It needs to be famous that even through the FY2011 when the order e-book peaked at ₹1,64,145 crore, the inventory was buying and selling at less expensive ranges (see chart). Therefore, whereas the order e-book stays good, given the inventory’s dear valuation, it supplies its buyers with little margin for security, which makes a case for reserving earnings.

Enterprise

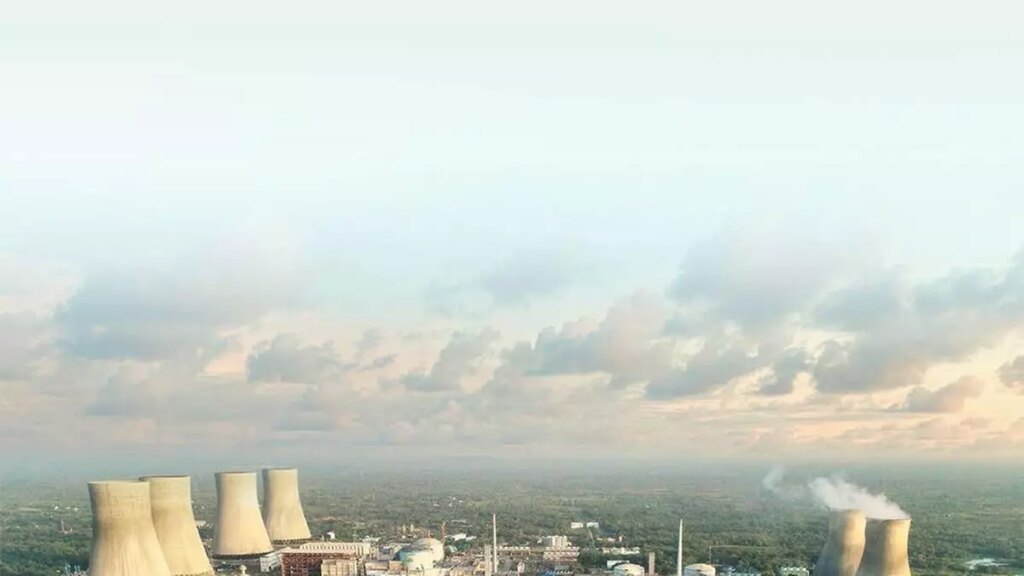

Endowed with Maharatna standing, BHEL, a capital items Public Sector Enterprise (PSU), engages in design, engineering, manufacturing, building, testing, commissioning, and servicing throughout a various array of services and products inside the energy and business segments. The ability section instructions a major share, contributing near 79 per cent, whereas the business section contributes the remaining 21 per cent.

Inside the energy section, the corporate specialises within the provision of energy plant tools, together with turbo mills, boilers, generators, and related equipment, and undertakes the erection of a number of sorts of energy crops spanning gas-based, coal-based, hydroelectric, nuclear, and solar energy technology. Though the corporate extends its experience to tools catering to different power sources, thermal energy stays its predominant space of focus. Within the business section, BHEL serves a broad spectrum of sectors, together with course of industries, railways, energy transmission and distribution, and defence.

Order e-book

As of December 31, 2023, the corporate has an order backlog totalling ₹1,08,618 crore. The ability section accounts for a considerable 70 per cent share of the full order e-book, whereas the commercial and export-oriented orders contribute 26 per cent and 4 per cent, respectively.

In the course of the first 9 months of FY2024, the corporate witnessed a sturdy surge so as inflows, registering a Y-o-Y improve of 137 per cent to ₹36,048 crore. This progress was fuelled by contracts from distinguished PSUs comparable to NTPC and NHPC, in addition to personal entities comparable to Mahan Energen, a wholly-owned subsidiary of Adani Energy.

BHEL has diversified its portfolio, securing contracts with the Ministry of Defence for upgraded weapon techniques and forming a three way partnership with Coal India for a chemical manufacturing facility. Regardless of this, latest contracts in 2024 totalling over ₹30,000 crore within the energy section underscore its near-term reliance on the cyclical thermal energy sector, topic to financial fluctuations.

Efficiency and outlook

In 9MFY24, the corporate noticed a average 5 per cent Y-o-Y progress in income from operations, totalling ₹15,037 crore. This progress was primarily pushed by the commercial segments, which rose by 8.2 per cent over the identical interval. Nevertheless, regardless of the income uptick, EBITDA margin skilled a contraction, declining by greater than 600 foundation factors to -6.2 per cent. This decline will be attributed to escalating uncooked materials prices, which surged by 13.2 per cent Y-o-Y through the interval, and the execution of previous thermal orders with mounted value contracts. Consequently, the corporate’s PAT margin additionally skilled a decline, reducing from -0.9 per cent to -4.9 per cent over the interval.

From a valuation perspective, the inventory is presently buying and selling at a one-year ahead P/E ratio of 71.2 instances, representing a premium of 117 per cent over its five-year historic common of 32.9 instances. Regardless of the corporate being anticipated to realize an earnings progress of round 50 per cent in absolute phrases in FY2021-2024E, the corresponding surge within the inventory value exceeds 300 per cent.

Inspecting the interval between 2009 and 2012, characterised by a growth in thermal energy technology and peak order e-book ranges, BHEL’s EBITDA and PAT margins usually ranged at 16-21 per cent and 11-15 per cent, respectively. Conversely, contemplating what Bloomberg consensus estimates for FY24E and FY25E earnings challenge, these margins could not attain these ranges. It needs to be famous that BHEL has been securing the previous couple of vital contracts by aggressive bidding processes which can exert stress on profitability margins, as per the score company CRISIL. In addition to that, the corporate has an elongated working capital cycle due to substantial receivables being due from the central PSUs and State utilities.

Given these components, the forthcoming progress prospects within the thermal and industrial house for BHEL seem like largely priced into the inventory, leading to an unfavourable risk-reward proposition at present valuation ranges.

#BHEL #Buyers