Whereas Indian shares benefited from resilient fundamentals and de-coupling from international sentiments, the market was held collectively by year-to-date home institutional flows. This counterbalanced the heavy outflows from risk-averse foreigners ( ₹1.22-lakh crore), in accordance with NSDL FPI knowledge, after the US Fed’s most aggressive interest-rate hike in a technology.

For traders, this 12 months shall be bitter-sweet, and never due to the looming fears of a redux Covid. At one finish, home indices, together with many of the sectoral ones, have touched new highs. However on the similar time, fairness portfolios will lack the identical pomp and enthusiasm, given the unequal participation from all shares. Here’s a nuanced take a look at how the 12 months formed up for market pockets, greatest performing shares, in addition to the disappointing laggards, the IPO phase, and way more.

World-beaters

If there may be one phrase that personifies Indian inventory markets in 2022, that needs to be RESILIENCE. The geopolitical pressure triggered by the Russian invasion of Ukraine in February, ensuing oil worth rise, rising value of debt due to US Fed’s inflation combating and copious outflows failed to tug Indian benchmark indices down.

Whereas India’s outperformance has been pushed by authorities coverage and a structural rise within the home fairness saving pool, company earnings have helped too. At an mixture degree the 900-odd corporations in BSE AllCap index have proven 28 per cent y-o-y rise in 12-month internet gross sales and 15 per cent y-o-y soar in reported PAT, in accordance with Capitaline knowledge.

Whereas the valuations of benchmark corresponding to Sensex at worth to earnings of 23.4 occasions (trailing) is costlier than international markets and its personal 10-year common (22.6 occasions), as per Bloomberg knowledge, wholesome earnings have helped to cement the India outperformance story.

This aside, higher macros have helped Indian authorities corresponding to RBI to run financial coverage that’s much less delicate to the US Fed, and this has additionally aided in decreasing the fairness market’s sensitivity to international development circumstances and oil costs.

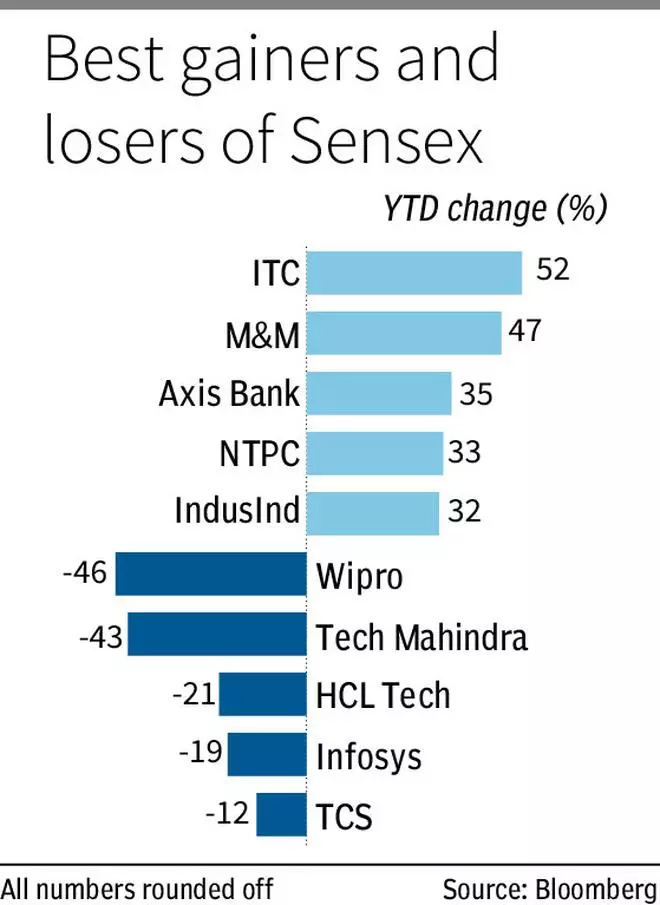

Serving to Indian benchmark indices (Sensex) preserve their outperformance had been the market movers, which included ITC, M&M, Axis Financial institution, NTPC and IndusInd. Had it not been for the laggards corresponding to tech pack, India features would have been larger.

Market at highs, however not all shares

The Indian market has managed to remain within the inexperienced with 4 per cent rise this 12 months (as much as December 21) and that is the seventh straight calendar 12 months of gravity-defying features. Nevertheless, in contrast to the bull runs of earlier years, there have been no fireworks in mid-cap and small-cap house. The BSE Midcap index has gained 1.3 per cent YTD whereas BSE Smallcap truly fell 3.5 per cent.

In contrast to 2021 when ‘ATH’ or all-time highs gained forex for each shares and indices, 2022 wasn’t comparable. The Sensex (on a closing foundation) hit ATH 9 occasions out of 242 periods this 12 months, a slice of what it had finished in 2021. This serves as a broad illustration of what was occurring beneath, the place many shares confronted an identical destiny. So, inventory choice did repay.

As a basket, large-caps i.e., the 100 greatest shares when it comes to market cap, noticed 20 per cent hit respective all-time highs this 12 months in comparison with 75 per cent within the previous 12 months. Examples embrace SBI, ITC, M&M, Eicher Motors, Cipla, Tata Energy, Indian Resorts and Ashok Leyland.

Within the mid-cap house i.e., a hundred and first to 250th in mcap, simply 15 per cent of shares — together with Linde, Vinati Organics, CRISIL, Grindwell Norton, Sundram Fasteners, Blue Dart, CUMI, Elgi Equipments, Radico Khaitan — zoomed to their all-time highs. This compares to 69 per cent in 2021.

The shortage of buoyancy was evident in small-caps too. Lower than 1 in 10 small-caps, corresponding to HBL Energy, Automotive Axles, Unichem, India Glycols, Sandur Manganese, Dhampur Sugar, Goodluck and Everest Industries, hit life-time highs in 2022. In 2021, almost 5 out of 10 small-caps hit life-time highs. This represents the risk-averseness that set in and traders enjoying on this low-liquidity bucket of the market.

Portfolio Podcast | Key developments of 2022 Indian inventory market

Portfolio Podcast | Key developments of 2022 Indian inventory market

Valuation a differentiator

For these traders investing purely primarily based on valuation metrics corresponding to Worth to Earnings (P/E), 2022 had a transparent course. On condition that the market temper was cautious amid heavy promoting by foreigners, shares with excessive PE didn’t do in addition to shares with low PE. Worth-investing made a comeback of types.

For example, the basket of 200 shares with highest PE (common PE 126) in 2022 gave a median return of -2.5 per cent whereas a bunch of 200 shares with lowest PE gave a median return of 15.1 per cent. So, there was a pointy outperformance of over 17 share factors in favour of low PE shares (common PE of 8).

Low PE shares corresponding to CPCL, Bengal & Assam, Jindal Drilling, West Coast Paper, Rail Vikas, JK Paper, Mazagaon Dock, GE Transport, HAL, Apar Industries and so on. doubled investor cash. General, 53 per cent of low PE shares clocked constructive returns.

Although excessive PE shares corresponding to Adani group scrips, TajGVK Resorts, Hindustan Meals, JMC Tasks, Tejas Networks, Mahindra Holidays and so on. have finished properly in 2022, 65 per cent of the 200 most valued shares made losses this 12 months. The largest losers on this checklist are Deep Polymers, Tanla, Metropolis, Gland, FSN E-Commerce, Nazara, Quess Corp.

Traders in loss-making corporations (primarily based on 2021 numbers) Future Client, Sintex Plastics, Dhani Providers, Gayatri Tasks, Xelpmoc Design, One 97, Sadbhav Engg. and Zomato had been the worst-hit when it comes to YTD losses.

Aatmanirbhar market strengthens

2022 is an 12 months the place FPIs, a dominant drive, had been internet sellers for 8 months out of 12. In whole, they bought ₹1.22 lakh crore of equities i.e. ₹10,000 crore a month. This means a a lot soured temper in comparison with 2021 the place they poured simply ₹25,000 crore and ₹1.7 lakh crore in 2020.

A troika of things corresponding to Fed’s charge hike missives, traditionally excessive valuations in Indian shares and profit-booking might have led the international hand to weaken its maintain. However what stands out is the resilience proven by home establishments, led by huge present of confidence by home traders in merchandise corresponding to mutual funds. That is Aatmanirbhar Bharat impact! Be aware that in 2008 FPIs pulled out over ₹52,000 crore and Sensex fell 52 per cent.

At the same time as FPIs bought Indian shares in droves, fairness funds in India acquired mixture internet flows of ₹1.53 lakh crore or ₹13,900 crore odd every month. This has helped counterbalance the relentless promoting by FPIs all year long. Thoughts you, the MF inflows are solely part of home institutional investments as pension funds, insurance coverage cash in equities just isn’t captured in these figures.

Newest shareholding knowledge for additionally confirms the strengthening DII development. FPI possession, when it comes to worth, fell by 169 foundation factors (bps) from 20.72 per cent in December 2021 to 19.03 per cent in September 2022, in accordance with an evaluation overlaying 1,776 NSE-listed shares by primeinfobase. Throughout the identical interval, DII possession rose by 158 foundation factors from 13.21 per cent to 14.79 per cent, pushed by each MF and insurance coverage possession features. Nevertheless, direct retail investor holding stayed flat at 7.33 per cent.

Greatest and worst

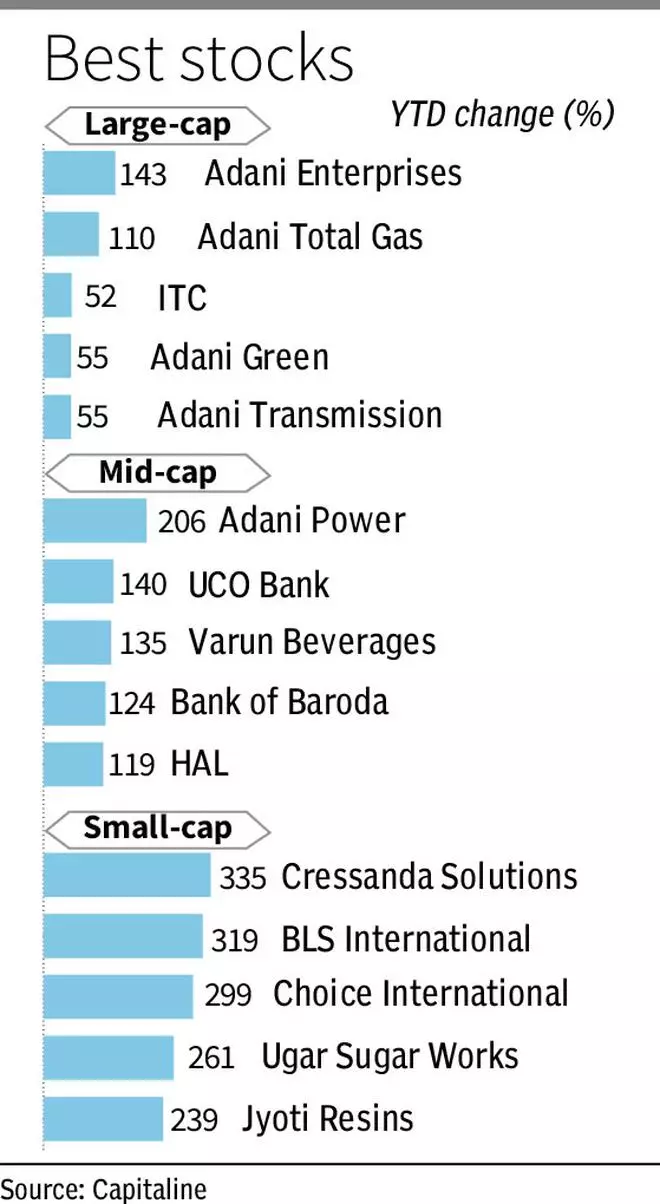

When you take a look at the BSE Allcap index that has about 1,070 shares, investor wealth elevated by over ₹16 lakh crore or 6 per cent in 2022. This compares with 35 per cent in 2021. Adani group shares led the large-cap winners checklist, whereas pharma and tech names lead the laggards.

Mid-cap winners checklist was led by Adani Energy, UCO Financial institution, Varun Drinks, BoB and HAL, Indian Financial institution and Union Financial institution. Mid-cap laggards had been led by Brightcom Group, Metropolis Well being., Tanla Platforms, Tata Tele. Mah. and Vodafone Concept. The promoting was way more pronounced in mid-caps in comparison with large-caps.

Small-caps kind the most important basket in BSE Allcap, with over 800 shares. At a complete investor wealth degree, small-caps didn’t add something materials this 12 months. This exhibits the uneven nature of features of the home market. On condition that small-caps are most dangerous in cap spectrum, the variety of shares which have doubled in 2022 stood at over 50 in comparison with over 200 in 2021. Greatest performers embrace Cressanda Options, BLS Worldwide, Selection Worldwide, Ugar Sugar Works, Jyoti Resins, Mazagaon Dock, and Vadilal Industries. About 400-odd small-cap shares destroyed investor wealth in 2022.

Although Indian markets noticed their largest ever public situation (LIC), whole fund-raising from IPOs this 12 months dropped by over 50 per cent to ₹55,146 crore (Jan-Nov 2022) in comparison with ₹1.18 lakh crore in 2022. Newly-listed shares didn’t try this properly. Of the about three dozen newly-listed shares on BSE mainboard, about one-third are buying and selling under their respective IPO worth. The very best performers embrace Adani Wilmar, Venus Pipes, Hariom Pipes, Veranda Studying, Vedant Fashions and Prudent Company Advisory. IPO shares such AGS (down 61 per cent), Delhivery (-32 per cent), Inox Inexperienced (-30 per cent), LIC (-28 per cent) and Dharmaj Crop (-16 per cent) misplaced massive.

However, SME IPOs noticed their greatest time in 4 years, with a complete of ₹1,660 crore mopped up in 2022 by way of 96 choices. That is greater than double of almost ₹750 crore garnered in 2021. The very best-performing SME IPOs this 12 months have been Rachana Infra (up 716 per cent), Varanium Cloud (up 646 per cent) and Cool Caps (up 596 per cent). However over two dozen SME IPOs are buying and selling under their respective situation worth, with the largest laggards being Tempo E-commerce, Ishan Worldwide, International Longlife Hospital, Silver Pearl Hospitality and Naturo Indiabull.

#Massive #Story #key #inventory #market #developments