India being a rain-fed nation, thesouth-west monsoon — which is the predominant monsoon season contributing practically 85 per cent of the nation’s rainfall — may be very vital for the nation’s agriculture.

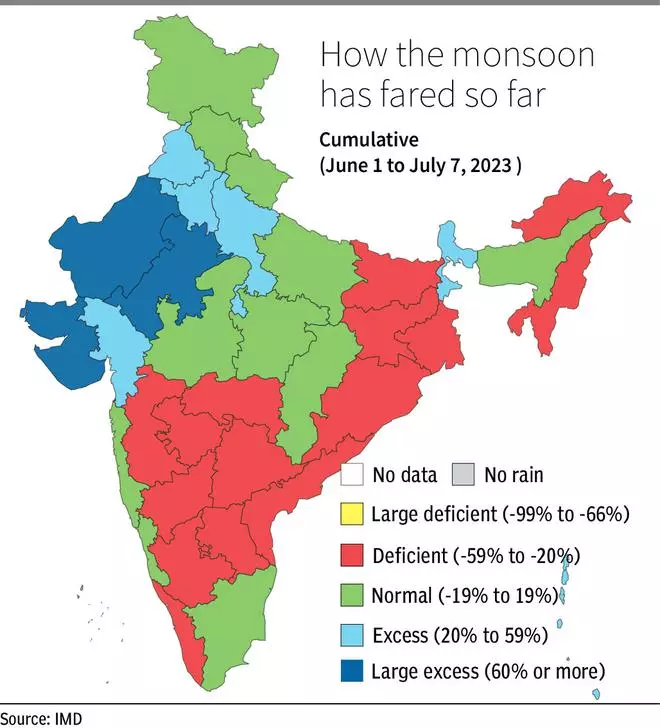

This yr, whereas the monsoon has progressed over the past two weeks and has now coated virtually your complete nation, erratic distribution, coupled with development of El Nino and a possible unfavourable Indian Ocean dipole, can disrupt the monsoon rainfall sample over the subsequent two months. India ocean dipole (IOD) is the distinction in temperature between two poles within the western indian ocean and the jap indian ocean. When the temperature within the western pole is greater than the jap pole, it’s referred to as a constructive IOD, which leads to extra rainfall in India. THe converse known as detrimental IOD sometimes is dangerous for monsoon rainfall in India.

Portfolio Podcast: Inventory markets, Monsoon, Tax return submitting and extra

How large a priority is that this for agri and associated sectors? How has India Inc fared in earlier years when confronted with the same state of affairs? Listed here are some takeaways.

Affect on meals grain manufacturing

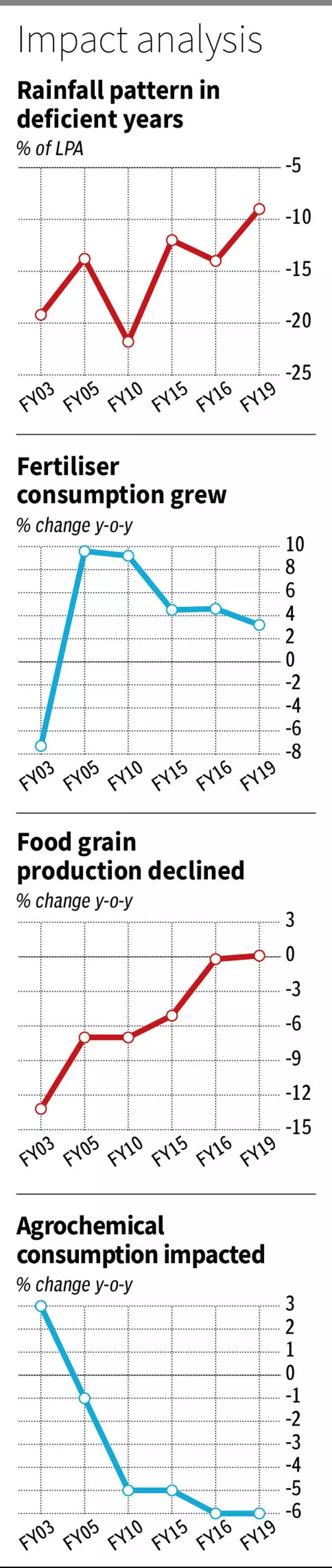

Wanting on the historic information, one can conclude that poor rainfall at all times doesn’t imply decrease foodgrain manufacturing. Within the final 22 years, India has had surplus rainfall solely throughout eight monsoon seasons, whereas the nation has obtained rainfall decrease than the lengthy interval common (LPA) within the remaining 14 years. Nevertheless, the rainfall deficiency was over 10 per cent of the LPA solely in 5 years, specifically 2002, 2004, 2009, 2014 and 2015. Apparently, foodgrain manufacturing noticed a significant decline solely in these years when the rainfall was poor by 10 per cent or extra, as in comparison with the LPA (see chart).

In years when the rainfall deficiency was beneath 10 per cent, resembling in 2012 and 2018 — 8 per cent and 9 per cent under LPA — foodgrain manufacturing was solely marginally decrease (-0.8 per cent in 2012-13) or flat (0.1 per cent progress in 2018-19).

Howvever, historical past might or might not repeat itself as there are additionally different components pertinent for agricultural output. As an illustration, it will be significant for the distribution of rainfall to be even for agriculture to thrive. As an illustration, whereas the rainfall over the previous week has been pretty good in western elements of the nation, with some areas receiving extreme rains, key rice-growing State Bihar is but to obtain satisfactory rainfall. Therefore, the development, protection and distribution of the rainfall over the subsequent few weeks and sowing progress in these areas should be monitored carefully.

One other vital facet is the timing of the rainfall. Extreme rainfall throughout flowering or harvest season could also be detrimental to the crop. Therefore, amount and timing of the rains is essential for agriculture.

Fertilisers resilient

Evaluation of historic fertiliser consumption information in India reveals that the consumption has not been impacted a lot even in years of poor monsoon. Quite, throughout three of the 4 poor monsoon years, fertiliser consumption has really managed to develop over the earlier yr.. Aside from yr 2002, when consumption of fertiliser per hectare declined 7.3 per cent year-on-year, the determine grew throughout 2004 (9.6 per cent), 2009 (9.2 per cent) and 2015 (4.6 per cent). The rainfall was 19.2 per cent, 21.8 per cent and 14 per cent under LPA throughout these years.

The low sensitivity of fertiliser consumption to monsoon rainfall could be on two counts. First, fertiliser purchases occur forward of the beginning of the season and the appliance of fertilisers continues regardless of the rainfall pattern. Even when the rainfall is delayed or is poor throughout the season, farmers have to make up for the productiveness loss. Therefore there is probably not materials impression on that yr’s gross sales. Second, availability of presidency subsidy on fertilisers has additionally helped preserve the demand regular, as farmers pay solely a portion of the full price.

Nevertheless, even inside the fertiliser business, the subsidy part and the construction for urea is totally different from that of phosphatic fertilisers. Whereas urea continues to stay beneath authorities management —(pricing, distribution and gross sales,), complicated fertilisers – NPK grades have been partially decontrolled. Urea has the best subsidy proportion, with 3-4 occasions of the retail worth of ₹5,360 a tonne being paid by the federal government to producers as subsidy. This insulates farmers in opposition to volatility in uncooked materials costs. This has additionally made urea demand resistant to the vagaries of the monsoon.

Therefore, if we have a look at the efficiency of urea gamers, their gross sales haven’t been impacted by weak monsoon. Chambal Fertilisers, a number one personal participant within the urea section with a capability of three.4 million tonnes, noticed the working revenue of its manufactured fertiliser section develop by 10 per cent year-on-year in FY10. That is due to the sturdy demand for the product and environment friendly operation of the plant, provided that the business is energy-intensive.

Likewise, in FY15 additionally, which was a weak monsoon yr, Chambal Fertilisers reported a 14 per cent progress year-on-year. Although its personal manufactured section’s revenue declined in FY14, this was as a consequence of greater vitality prices as gasoline availability was a problem and the corporate had to make use of costly RLNG to provide ammonia.

Phosphatic fertiliser gross sales have had some impression, submit the partial deregulate of the business in 2010. Below this, the federal government determined to maintain the subsidy mounted and permit firms to repair promoting worth because the distinction between totally loaded price and subsidy. Regardless of this, firms with superior price construction and a powerful product portfolio have managed to develop earnings even in poor rainfall years. Coromandel Worldwide, as an illustration, grew its income two out of 5 occasions, when the nation skilled poor rainfall in FY05 and FY15.

In FY10, when the corporate reported a decline in earnings by over 10 per cent, the rationale for the weak spot was decrease subsidies as a consequence of drastic fall in enter costs and consequential stock write-down. Even when monsoon rains had been poor by over 21 per cent, fertiliser gross sales volumes grew by a powerful 34 per cent year-on-year. Thus, greater than monsoon, uncooked materials prices, provided that a number of uncooked supplies, together with gasoline and phosphoric acid, are imported, trade charges and quantum of subsidy are the important thing determinants of efficiency of the fertiliser business. Additionally, for Coromandel, a differentiated product portfolio with NPK grades resembling 20:20:0:13, bio fertilisers and micronutrients, moreover agrochemicals, has helped maintain profitability even throughout weak monsoon years.

Sturdy correlation for agrochem

Whereas monsoon has largely been a non-event for fertilisers, agrochemicals gross sales’ correlation to monsoon appears sturdy. Historic information means that agrochemical gross sales are extra susceptible to deficiency in rainfall and the resultant fall in farm incomes. Not like within the case of fertiliser, the place important amount is bought forward of the season, for agrochemicals, solely the preventive sprays are procured initially of the season.

Usually, gross sales are sturdy for agrochemical producers when there are incidents of latest pest assaults or important rise in pest (current) incidence. Which is why we see that agrochemical utilization/consumption was decrease in 4 out of 5 weak monsoon years. Take into account Pesticides India, a small sized firm. In FY16, the corporate’s income was flat, whereas working revenue declined 18 per cent, on account of below-normal rainfall.

Nevertheless, for PI Industries, which has a globally diversified enterprise with important contribution coming from export gross sales, the impression of weak monsoon was restricted. The corporate grew income and earnings over the FY15-16 interval, at the same time as India witnessed two consequent years of poor monsoon. That stated, just like fertilisers, monsoon is just not the singular determinant of the prospects of the business. A number of different components, resembling uncooked materials costs — most of that are crude linked — foreign money motion for export gross sales, imports of uncooked supplies and pest incidence, a impression the efficiency of agrochemical producers.

Farm gear

Farm gear is one other section whose prospects are straight linked to rainfall. Tractors, tillers and different gear resembling rice transplanter are key farm gear. For firms on this area, the impression of weak monsoon might include a lag, as farmers sometimes resolve on buy of farm gear solely when their incomes are wholesome. Subsequent years of weak monsoon scale back their buying energy and, therefore the demand for farm gear.

However it isn’t nearly monsoon. Farmers are depending on authorities help by means of subsidy for farm gear buy. Delay in fee of subsidy or discontinuation of such funding schemes can hit the profitability and efficiency of farm gear makers. TakeVST Tillers Tractors. The corporate, which reported a 11 per cent and 19 per cent drop in income and revenue in FY15 as a consequence of weak monsoon, noticed its earnings halve in FY19 on account of receivable points from authorities and lack of subsidy help/allocation from governments.

Past the agri inputs and agri gear, the impression of monsoon is overarching. If monsoon rains proceed to stay inadequate over the subsequent two months, this could threat the nation’s macroeconomic stability. Inflation, significantly of meals objects, has a direct relationship with monsoon. One can’t underestimate the significance of monsoon because it has penalties on rates of interest, consumption and financial progress. Therefore, it’s vital to observe the progress of the south-west monsoon over the subsequent two months.

#Huge #Story #Nino #impression #shares #agriculture #allied #sectors