The Israel-Hamas struggle apart, crude oil costs are anyway going up as a consequence of supply-demand circumstances. That stated, the rally may hit a wall within the second half of calendar yr 2024. It is because by then, the struggle threat premium may wane and the worldwide progress issues would possibly come into play, weighing on the costs.

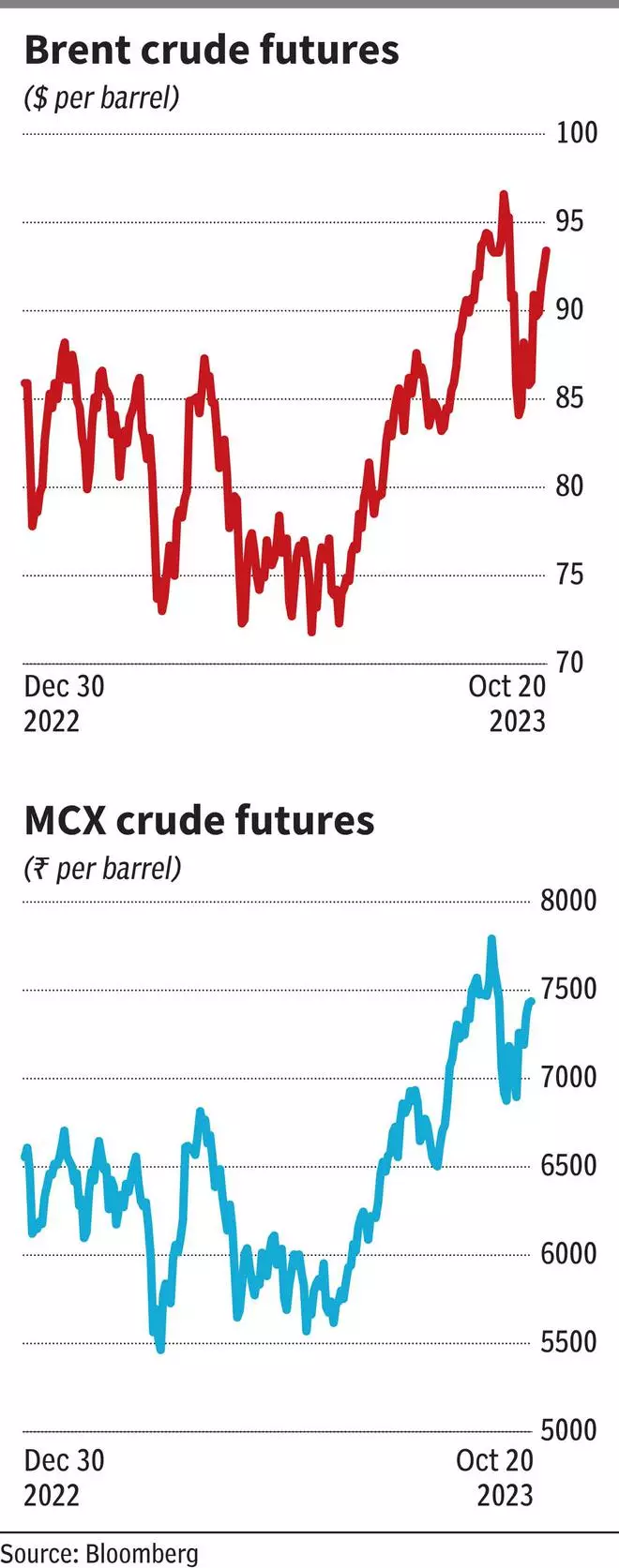

For the reason that struggle started, Brent crude futures and MCX crude futures have surged 9 and seven per cent respectively. 12 months-to-date, steady contract of Brent crude futures is up 7 per cent whereas MCX crude oil futures has gained 12 per cent because it closed at $92.2 and ₹7,330 per barrel, respectively.

For the time being, the market appears to have digested the war-related threat since there has to this point not been an affect on the supply-demand dynamics of the commodity because of the struggle.

Nonetheless, it’s the worry of the struggle spilling over to the opposite elements of the area that’s protecting buyers on edge. Particularly, as Iran has been a vocal supporter of Hamas. Iran’s strikes shall be watched for 2 causes. One, the nation’s crude oil output is sort of 3 million barrels per day (mb/d), which is about 3 per cent of the worldwide manufacturing. Two, its geography, because it touches the Strait of Hormuz. Roughly 20 per cent of the overall crude oil manufacturing is transported by way of this Strait, the gateway to the open ocean from the Persian Gulf.

That Iran produces 3 per cent of the worldwide crude just isn’t as a lot a risk to grease costs. For perspective, Russia’s manufacturing of over 10 mb/d is extra vital to the worldwide provide. Regardless of this, when Russia-Ukraine struggle started, crude oil costs shot up solely briefly in early 2022. For the remainder of the yr, the worth progressively declined due to the availability glut. Brent Crude futures closed at $85.9 in December 2022 in contrast with the excessive of $139.1 made in March 2022 as a result of the Ukraine struggle. The second issue is the larger risk. The worst worry is that Iran may disrupt the oil stream by way of the Strait of Hormuz to have an even bigger say within the struggle.

Moreover, Iran’s closeness to Hezbollah is one other concern. Hezbollah is a political celebration/militant group in Lebanon, which shares its border with Israel. Tensions have constructed up sufficient in Israel-Lebanon border as there have been exchanges of firing final week.

However because the massive powers within the West stand with Israel, Iran can’t take a giant threat by going all in. Nonetheless, because it stands, every thing is unsure within the geopolitical equation on this area and its affect on the costs of crude oil.

The underside line is that volatility in oil costs, which has lowered during the last week, can spike if the scenario worsens. That stated, this case could also be extra transitory in nature, briefly placing stress on oil costs. Over the medium time period, supply-demand dynamics will decide the place costs are headed.

There was vital growth on this entrance within the current months.

Saudi and Russia unplug

Crude oil was buying and selling within the damaging return zone till the large weapons in OPEC+ (Organisation of Petroleum Exporting Nations +) group, Saudi Arabia and Russia, introduced provide minimize.

OPEC+ is the grouping of 10 OPEC international locations and 10 non-OPEC nations. Being the highest two crude oil producers within the group, Saudi Arabia and Russia are the important thing members. Additionally, they’re among the many high 3 producers on the planet together with the US.

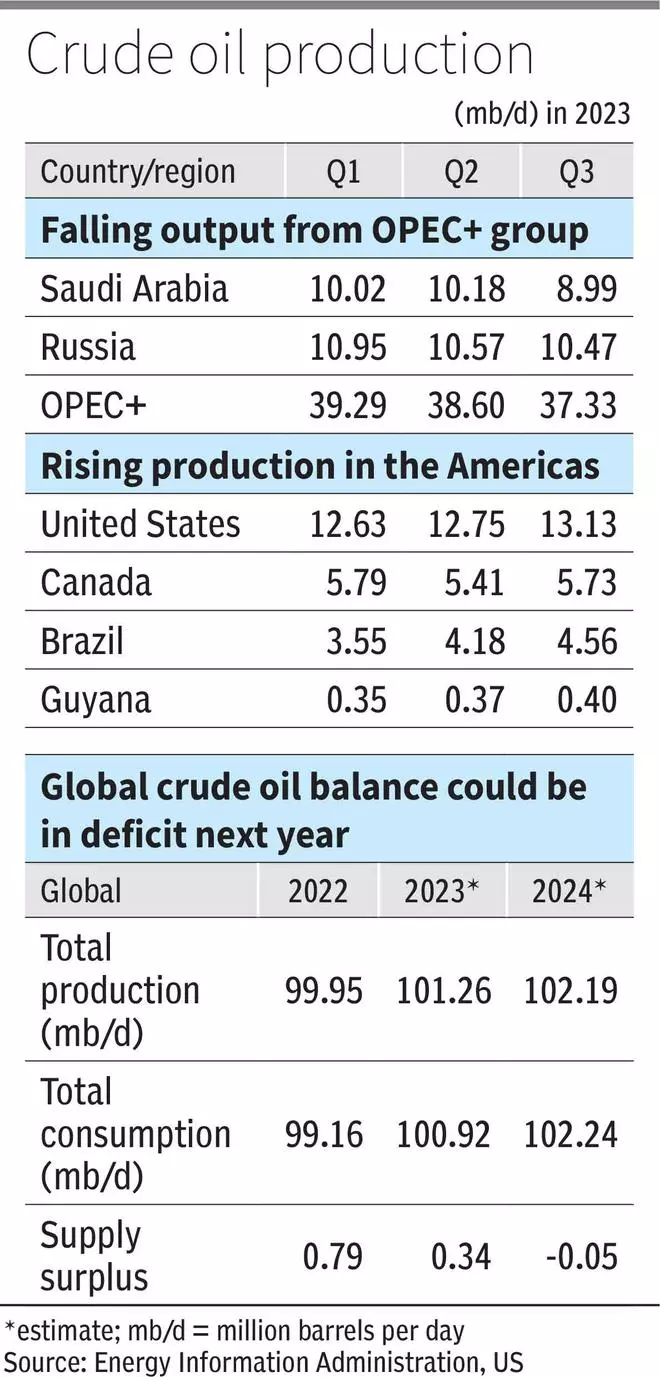

Saudi Arabia, in June this yr, introduced a voluntary minimize of 1 million barrels per day (mb/d) in oil output in July. It has now prolonged this till December 2023. Therefore, it may find yourself producing 9 mb/d this yr.

However, Russia spoke in July 2023 of a discount in oil export amounting to 0.3 mb/d till the top of the yr. The nation’s manufacturing is anticipated to be at 10.9 mb/d for 2023. Comparatively, the US is the most important producer as EIA (Power Data Administration) expects 2023 manufacturing within the US to come back in at 12.9 mb/d.

Importantly, Saudi and Russia collectively contribute to just about 20 per cent of the anticipated international output of 101.3 mb/d and practically 50 per cent of OPEC+’s 38.2 mb/d in 2023. This underlines the magnitude of affect these two international locations can have on the worldwide crude oil provide.

As provide decreased following the cuts by these two international locations, the costs have confronted upward stress since then. The Brent crude futures has risen to $92.2 now in contrast with $74.9 in June, when Saudi first introduced their minimize to assist costs.

Saudi and Russia took the measure at the same time as many OPEC+ international locations are struggling to fulfill their present manufacturing targets. Notably, OPEC+ group’s present anticipated output of 38.2 mb/d for 2023 is decrease than 2022 by 1.4 mb/d. Assuming some extension of Saudi’s manufacturing cuts into 2024, the group’s 2024 output may additional drop to 37.8 mb/d, based on EIA. Nonetheless, that is prone to be counter-balanced by improved output from North and South America.

Offset from Americas

In 2023, new undertaking begins within the Americas, particularly in Brazil and Guyana, is anticipated to greater than offset the minimize in OPEC+ provide. That is additional supported by a rise in manufacturing by the US and Canada. In whole, these 4 international locations are anticipated so as to add 2 mb/d in 2023 in opposition to the cumulative minimize of 1.3 mb/d by Saudi and Russia.

Nonetheless, regardless of this, the rise in demand outweighed enhance in provide for the primary three quarters, having web optimistic affect on worth. In 2023, the worldwide provide is anticipated to go up by 1.3 mb/d to 101.3 mb/d; the worldwide consumption is prone to enhance by practically 1.8 mb/d to 100.9 mb/d.

The rise in consumption is pushed by the pent-up demand from China, the second largest shopper of crude oil, publish the lifting of Covid-related restrictions. Additionally, there was elevated consumption in India and Brazil. The cumulative enhance in demand from China, India and Brazil stood at practically 1.2 mb/d this yr.

Because of increased consumption progress, the surplus provide can decline to somewhat over 0.3 mb/d in 2023 as in opposition to 0.8 mb/d in 2022. Apparently, as per the most recent EIA projections, the oil market may face a minor deficit in provide in 2024, doubtlessly resulting in additional depletion of inventories.

The principle motive for the deficit subsequent yr might be the discount in output by OPEC+. Nonetheless, the easing of sanctions imposed on Venezuela’s oil sector for six months by the US may assist hold the steadiness in marginal surplus. Within the third quarter of this present calendar yr, the South American nation produced about 0.8 mb/d crude oil. Therefore, if all goes effectively, the overall output from the Americas shall be additional boosted by Venezuela, easing the upward stress.

Stock motion

Within the second half of 2023, the worldwide crude oil inventories are anticipated to drop by 0.2 mb/d, based on EIA, primarily due to the availability minimize from Saudi and Russia. The stock attracts are anticipated to remain on the similar fee within the first quarter of 2024 as a result of the OPEC+ manufacturing minimize is prone to hold international oil manufacturing decrease than international oil demand. For the remaining three quarters of 2024, the stock is estimated to be balanced i.e., the speed of incoming and outgoing shares might be roughly equal.

Within the US, the most important producer and shopper of crude oil, the business crude oil inventories fell to 414 million barrels in September finish. That is the bottom inventory of crude oil because the starting of this yr. It stood at 481 million barrels in mid-March, the very best this yr. The drop was due to elevated home demand and exports.

Broadly talking, the declining development of inventories has additionally propped up costs. It’d proceed to take action within the first half of subsequent yr as stockpiles are anticipated to go down additional. EIA has revised down the typical stock for 2024 within the US to 428 million barrels in contrast with the earlier estimate of 440 million barrels.

Inverted-U worth trajectory

Web-net, contemplating the above demand-supply dynamics, the crude oil worth motion is prone to take an inverted-U trajectory. The manufacturing minimize of OPEC+, led by Saudi and Russia, can sustain the upward stress within the coming months. As per the EIA, the OPEC+ group is anticipated to trim crude oil manufacturing by 0.3 mb/d by way of 2024.

On the demand aspect, growing international locations like China, India and Brazil, together with the US, are set to see an increase in demand. Due to this fact, this issue additionally factors in the direction of costs going up within the subsequent few months. Nonetheless, the potential slowdown in China and international progress issues can decelerate the demand for the vitality commodity, significantly within the second half of 2024 (2H24).

In its current Regional Financial Outlook, the Worldwide Financial Fund (IMF) has famous slowing progress in China and the US, high two customers of crude oil. China’s actual GDP progress is anticipated to reasonable to 4.8 per cent in 2024 versus 5.2 per cent in 2023. Equally, actual GDP progress of the US is projected to melt to 1.5 per cent in 2024 in comparison with 2.1 per cent in 2023.

Due to this fact, slowdown can result in decrease crude oil demand, placing downward stress on costs in 2H24.

That stated, our anticipated trajectory would possibly go fallacious if OPEC+ additional reduces the output or Saudi opts to revive provide in early 2024. Additionally, the demand aspect of the equation may be disrupted if there’s a extreme slowdown. To not point out the chance of Israel-Hamas struggle widening.

Therefore, buyers must have a detailed watch on the actions of OPEC+ and the prospect of progress, particularly in China and the US, the highest two customers of crude oil.

What the charts say

Brent Crude futures ($92.2) began rallying in July on the again of the assist band of $70-72. After marking a excessive of $97.7 in the direction of the top of September, the contract moderated and is now buying and selling round $92. Till the assist at $83 holds true, the bias shall be bullish.

The value motion within the every day chart signifies that the Brent crude futures may recuperate and is prone to rise to the $100-105 resistance band. A breach of this degree is unlikely. Publish transferring to this barrier, the contract may consolidate for some time after which witness a gradual decline. However in case the contract breaches $105, the upswing may lengthen to $120 earlier than falling.

Because it stands, there’s a good probability for Brent crude to rise for the following few months after which drop again to the area between $83 and $88 earlier than the top of 2024.

MCX Crude oil futures (₹7,330) bounced off the assist at ₹5,600 in July. The contract registered a excessive of ₹7,884 within the closing week of September after which noticed a decline. On Friday, it closed at ₹7,330. Though ₹7,700 is a hurdle, on condition that the development is bullish, we anticipate crude oil futures to maneuver above this degree.

Within the coming months, there’s a potential for the contract to surpass the ₹8,000-mark and head in the direction of the barrier at ₹8,300. Subsequent resistance is at ₹8,800. Just like the Brent futures, the MCX crude futures too may keep sideways after reaching the ₹8,300-8,800 worth band. However then, it may slip again to ₹7,000. The value band of ₹6,800-7,000 is anticipated to limit the decline.

Infobox: Dynamics at play:

· Provide minimize by Saudi Arabia and Russia can put upward stress to the worth.

· Elevated demand from Asian majors like China, India and from the US and Brazil is anticipated to assist costs.

· Israel-Hamas struggle continues to supply the chance premium for crude oil.

· A possible drop in demand within the second half of 2024 can weigh on the costs.

· Marked shift in manufacturing coverage by the OPEC+ can affect costs on both aspect

#Massive #Story #Oil #Hit #Barrel