The corporate primarily offers providers similar to holding and facilitating transactions in monetary belongings similar to shares, bonds, mutual funds, treasury payments, business papers, and many others, within the dematerialised (digital) type. Depositories are a key part within the worth chain as their providers are accessed by traders, issuers (largely listed firms), inventory exchanges, clearing companies and Depository Contributors (DPs). CDSL is the chief within the enterprise, with 76 per cent share within the complete Helpful Proprietor accounts.

As an investor, while you purchase a inventory, relying in your dealer/DP, CDSL will maintain that inventory in digital type in your behalf in your demat account that you’ve got with them. You can be the Helpful Proprietor (BO) of that asset. Equally, while you offload the identical, will probably be debited out of your demat. Whilst you can not instantly open an account with a depository, their providers are accessed by DPs, which normally might be your dealer. The settlement of trades might be accomplished by Clearing Members (CMs).

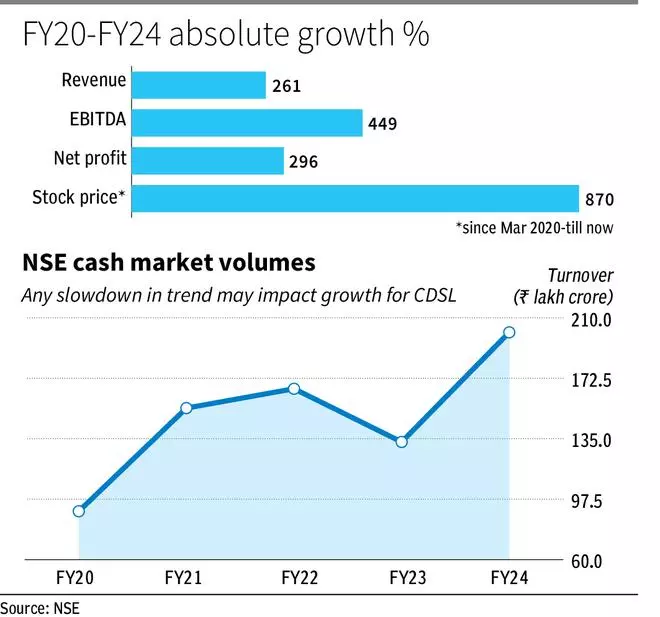

On the present worth, the inventory is valued at about 52 instances its FY24 earnings. Because the Covid lows, the inventory worth has multiplied by almost 10 instances, factoring in many of the positives. On a one-year ahead foundation, it trades at PE of 44 instances as in comparison with five-year common of 39 instances.

Whereas the premium just isn’t important in comparison with historic common, it doesn’t issue for cyclicality dangers, which can lead to slowdown in earnings development. The corporate’s appreciable dependence on inventory market efficiency for its revenues (about half are market-linked) intertwines its fortunes wih market cycles. At current, earnings are buoyant, pushed by the market upcycle. Nevertheless, present valuations don’t supply ample margins of security for any flip in market cycles. Subsequently, traders can take into account cashing out now, following the inventory’s sturdy efficiency.

Income streams

CDSL generates a significant chunk of its income from issuer fees and transaction fees. Issuer cost is the charge collected yearly from firms, whose issuances similar to shares, are electronically held in demat accounts facilitated by CDSL. It is a recurring revenue that the corporate receives.

Revenue from annual issuer cost elevated 39 per cent to ₹255 crore for FY24. That is the most important constituent in income, contributing 28 per cent to the entire revenue of ₹907 crore in FY24. It is a perform of the variety of BO accounts i.e., when a higher variety of traders maintain a selected asset, CDSL can earn more cash from the issuer of that asset. On the finish of FY24, the corporate had 11.6 crore BO accounts when in comparison with 2.1 crore on the finish of FY20. Additionally, the variety of issuers has elevated to 23,060 in FY24, from 14,762 in FY20.

Transaction fees are collected from the DPs, and that is instantly proportional to the market exercise throughout that interval. Buyers pay depository fees whereas they transact within the money market. So, extra the amount within the money phase, more cash the corporate makes. Because the turnover within the money market elevated 51 per cent and hit a file ₹201 lakh crore in FY24, the revenue from this part expanded 39 per cent to ₹221 crore within the final fiscal. Its share of the entire revenue was at 24 per cent.

Not simply within the final fiscal, the fairness market has been witnessing a gentle enhance in turnover (refer chart) (stood at ₹90 lakh crore in FY20). Total, slightly over half of the CDSL’s complete revenue is derived from annual issuer cost and transaction cost mixed.

Within the remaining half of the income, on-line information fees (i.e., CDSL fees a charge for processing e-KYC) and Preliminary Public Providing (IPO)/Company Motion (CA) fees are the important thing contributors. Aside from these, the corporate fees for facilitating e-voting and for offering e-CAS (consolidated account assertion) for traders. Within the final fiscal, on-line information fees (grew at 84 per cent yoy to ₹160 crore in FY24) contributed 18 per cent, adopted by 10 per cent by IPO/CA actions (elevated by 89 per cent yoy to ₹94 crore in FY24). Different revenue (expanded 153 per cent to ₹177 crore in FY24), which incorporates revenues from e-Voting and e-CAS, contributed to almost 20 per cent.

Financials and outlook

CDSL launched its outcomes for FY24 on Might 4. The income from operations expanded by 46 per cent to ₹812 crore, marginally beating the consensus estimate of ₹792 crore. The corporate’s revenue after tax elevated 52 per cent to ₹420 crore, surpassing the anticipated ₹405 crore. Thus, the web revenue margin for FY24 stood at 46 per cent, bettering barely from 44 per cent in FY23. The earnings per share jumped to ₹40 apiece in FY24 (versus consensus estimate of ₹38) from ₹26 in FY23.

Whereas the corporate is firing on all cylinders, the danger stems from cyclicality. Ought to there be a decline in worth at a wider degree available in the market, traders may decelerate their exercise within the fairness phase. It will probably even have repercussions on mutual funds, doubtlessly impacting CDSL’s income and profitability.

Furthermore, the income per demat has dropped to ₹70 in FY2024 in comparison with ₹106 in FY20. Which means, the newly opened demat accounts have been contributing much less in direction of CDSL’s income as the brand new traders’ focus stays predominantly on futures and choices (F&O) phase and never within the money market.

Additionally, the corporate operates in a excessive regulatory atmosphere, which can be a danger to be thought of.

That stated, there’s now a possibility in insurance coverage as IRDAI has mandated dematerialisation of insurance coverage insurance policies. CDSL operates on this house by its subsidiary CIRL (CDSL Insurance coverage Repository Restricted). However it’s a comparatively smaller participant on this house and it stays to be seen how nicely the corporate can capitalise on this phase.

#CDSL #Buyers