The brand new age growth finance establishment (DFI) may play a vital function in facilitating mortgage syndication for big ticket loans and a lead function in supporting the SLMA (secondary mortgage market affiliation) within the growth of credit score markets as nicely.

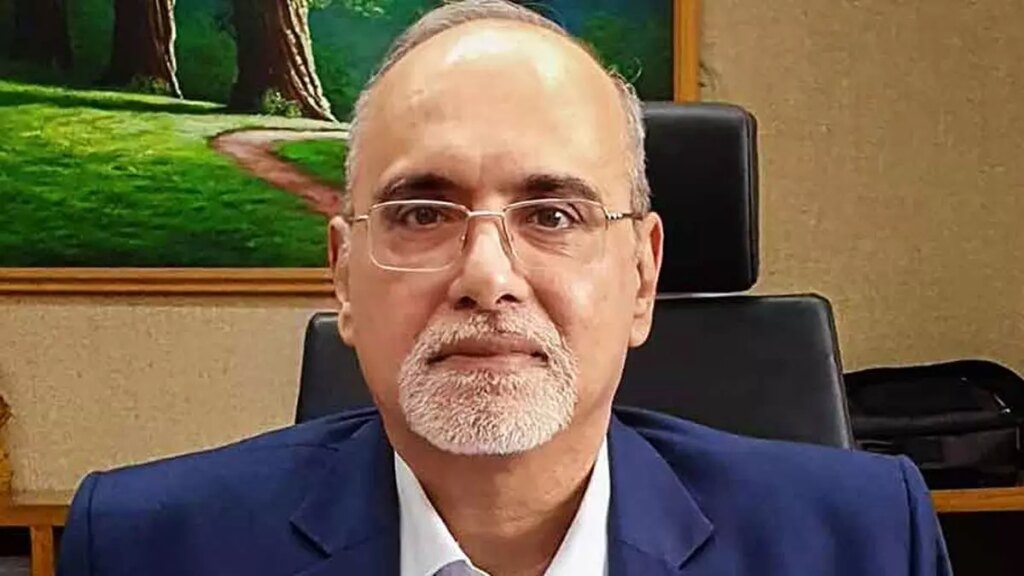

Because the DFI develops its inner score mannequin for credit score appraisal, it might additionally have the ability to provide merchandise corresponding to credit score default swaps (CDS) which might go a great distance in ushering confidence within the bond market house, Rao mentioned in his keynote deal with at an Infrastructure Conclave organised by NaBFID.

“NaBFID can play an essential function in a number of essential developmental goals, bond market growth and the supply of technical help/ consultancy companies for infra initiatives. It could try to develop into a market maker and supply ample liquidity to the traders,” he mentioned.

Rao famous that the DFI has taken promising strides by sanctioning greater than ₹1 lakh crore by the final monetary yr, together with a considerable enhance within the precise disbursal.

The preliminary capital of ₹20,000 crore supplemented with the extra grant of ₹5,000 crore ought to assist mortgage e book development within the close to time period, he added.

Additional, the expansion in scale of enormous institutional traders corresponding to life insurance coverage corporations, pension funds and many others., presents a chance for NaBFID to safe dependable long-term funding for his or her financing wants, providing a ‘pure match’.

Consequently, it must also try for a robust credit standing which can assist it to faucet each home and international sources of funding in future.

“It is usually essential that over the medium-term, plans for self-sustainable operations, beneath a enterprise mannequin that isn’t reliant on steady authorities assist, or regulatory dispensations would must be in place,” the Deputy Governor mentioned.

#Custodians #longterm #funds #supplied #consolation #lending #infrasector #RBI #Guv #Rao #tells #NaBFID