However none of those may mood the momentum in world fairness markets with the S&P 500 closing at an all-time excessive on Friday, propelled by Meta Platforms, which added the price of a Reliance Industries on a single day, and Amazon, which added the price of a TCS on single day. Earnings from these two corporations capped out what has been fairly an eventful 12 months for the ‘Magnificent Seven’ shares which are perceived by buyers to be on the forefront of the AI growth.

With Meta surging by 20 per cent on blowout earnings, it created a file for the largest-ever market-cap acquire in a single day in Wall Road historical past, with a acquire of round $205 billion. This takes its return within the final one 12 months to 155 per cent, which is sort of spectacular for a large-cap firm, and its returns for the reason that lows of November 2022 ($88) to 440 per cent!

Cumulatively, the ‘Magnificent Seven’ have added $5 trillion in market-cap within the final one 12 months as in opposition to the S&P 500 including $7.25 trillion in the identical interval. In truth, excluding the ‘Magnificent Seven’ shares, the remaining S&P 493 has not created a lot worth in any respect in mixture during the last one 12 months.

So does this ‘Magnificent Seven’ rally have extra legs?

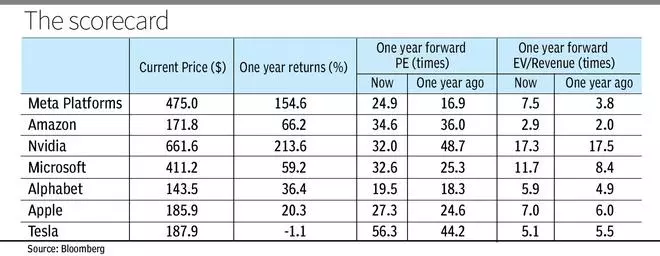

Evaluation of their efficiency during the last one 12 months signifies diverging tendencies inside this cluster with few winners and losers.

Main the pack is Nvidia, whose chips make superior AI computing potential. With nearly a close to monopoly on this area, the inventory has been the most effective performer returning 213 per cent within the final one 12 months. And the most effective factor has been that on this time its one 12 months ahead PE has really shrunk from 48.7 occasions identical time final 12 months to 32 occasions now. Within the final one 12 months, its earnings have gone up by 400 per cent whereas revenues have elevated a surprising 125 per cent YoY.

Amazon is one other firm whose relentless give attention to prices below new CEO Andy Jassy within the final two years, has seen its inventory worth transfer up properly regardless of ahead PE a number of shrinking marginally from 36 occasions a 12 months again to 34.6 occasions now. The returns in Meta and Microsoft have been a mixture of enhancing working efficiency and enlargement in valuation multiples as buyers heat as much as the prospects of their AI merchandise.

In fact, Microsoft additionally comes with a burden of being too giant and diversified, which inherently can mood the expansion charge for firm as a complete.

Tesla, Apple

Two corporations which have underwhelmed are Tesla and Apple and therefore the talk is now shifting as to whether it should be the Magnificent 5, as an alternative of seven as some level out that Tesla is an vehicle firm and never a tech firm as Elon Musk has been touting. A whole lot of Tesla’s frothy valuation was tied as much as expectations of launches of its fleet of Stage 5 autonomous vehicles and robotaxis, the timings for which have been constantly pushed again and seem years away if in any respect possible for now.

As auto business cyclicality hit the corporate, the inventory has been a disappointment with earnings declining and the inventory being held up by a number of enlargement. The a number of enlargement, too, can get examined in CY24 if investor hope wanes.

Whereas Apple has been silent on its AI plans, at its earnings convention final week Tim Prepare dinner hinted that they might have an AI announcement this 12 months. This may be essential for the corporate which has seen inventory worth broaden amidst flattish income and earnings pattern for 2 years ending FY24.

Valuation view

What may fit for the pack is that whereas hopes stay excessive, the valuations will not be as frothy as they had been in the course of the dotcom growth.

On the peak of the dotcom growth, the then high seven tech shares (Microsoft, Intel, Cisco, Qualcomm, Oracle, JDS Uniphase and Solar Microsystems) had trailing PE within the vary of fifty to 200 occasions in opposition to the crurrent magnifiient Seven’s 24-85 occasions now.

Whereas this may increasingly not defend buyers from financial slowdown and disruptions that may displace some gamers, in a worst case state of affairs it’d spare them the 80-90 per cent declines that Huge Tech skilled in 2000-02 and the decade-long restoration that adopted.

#Magnificent #fireplace #energy