Whereas there is no such thing as a doubt in regards to the general GDP progress story (on condition that key coalition companions are seen as pro-business), the consensus amongst analysts and economists is that the federal government would transfer extra in the direction of growing rural improvement and consumption as an entire.

The give attention to manufacturing and infrastructure would nonetheless proceed, although the tempo could also be slower as calls for for particular standing of States, elevated allocation to rural employment assure scheme (MGNREGA), decrease GST and private taxes might not enable a lot fiscal house. To make certain, the ₹11.1 trillion allotted within the interim Finances of 2024-25 itself was solely a 11.1 per cent enhance in comparison with greater than 20 per cent in earlier years.

From a basic perspective, the banks and non-banking finance corporations (NBFC) section has not rallied as a lot because the broader markets regardless of most establishments being in the very best of asset high quality well being, with strong metrics, and nonetheless accessible at enticing valuations. Many prime non-public sector banks and NBFCs have delivered nearly nil returns within the final three years, regardless of moderately robust financials.

Taking all these components into consideration, buyers can now look to extend the weightage to consumption-themed funds and take affordable publicity to banking funds, whereas making certain considerably average investments in infrastructure or manufacturing themes.

For instance, if 10 per cent of your fairness portfolio is the general publicity to thematic funds, 5 per cent may very well be in consumption funds, whereas 3 per cent and a pair of per cent may very well be apportioned to banking & monetary providers and infrastructure funds, respectively.

Learn on for extra on these themes and particular fund suggestions.

Consumption in driver’s seat

On condition that consumption accounts for over 65 per cent of India’s GDP (2023-24) — with 55.8 per cent being non-public ultimate consumption expenditure — it’s the main driver of financial progress.

As a theme, consumption is ready to develop on a secular upward path over the following decade or so on the again of a number of enabling components.

– India’s median age was 29 years as of 2021 and is ready to be solely 31.8 years by 2030, among the many youngest on the planet

– Share of inhabitants within the 15-64 years band is ready to be 68.4 per cent by 2030, once more among the many highest on the planet

– Per capita revenue is predicted to double from present ranges to $5,242 by 2031.

– The variety of Indians incomes greater than $10,000 a 12 months will contact 100 million by 2027, from 60 million in 2023

– Urbanisation is ready to extend, from 35 per cent in 2021 to 40 per cent by 2030.

– On-line shopper penetration is predicted to extend from 41 per cent 2021 to 70 per cent by 2031

These are knowledge factors from Bloomberg, Morgan Stanley, Goldman Sachs, BCG and HSBC MF.

From an funding standpoint, many consumption funds can be found for buyers with a five-year perspective.

These thematic funds spend money on corporations throughout the consumption segments — shopper discretionary, shopper durables, FMCG, know-how, e-commerce, actual property, vehicles, financials, healthcare and leisure providers, amongst others.

Fund decisions

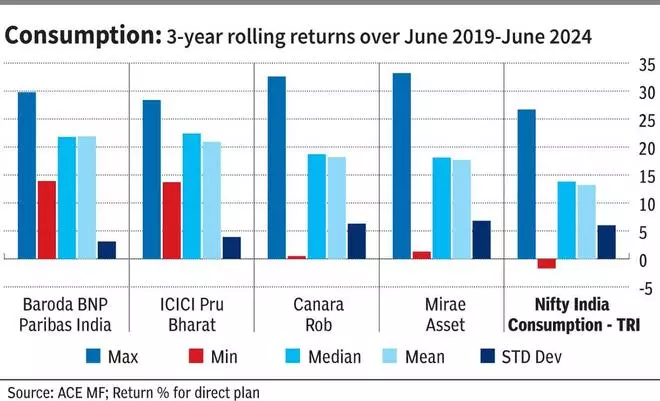

There are as many as 14 funds below the consumption theme. We thought of the three-year rolling returns over the previous 5 years. Based mostly on three-year rolling returns, the very best few by way of imply returns have been taken. Additional, we benchmarked these funds with the Nifty India Consumption TRI to see how constantly they beat the index. To maintain the alternatives extra rigorous, on condition that the schemes are thematic, we took solely funds that exceeded the returns of the benchmark at the least 80 per cent of the time.

Based mostly on these standards, Baroda BNP Paribas India Consumption and ICICI Prudential Bharat Consumption are the very best decisions for buyers. Canara Robeco Client Developments and Mirae Asset Nice Client are additionally strong choices.

Buyers can contemplate small lump-sums unfold over just a few months.

Valuation consolation in banking

It’s well-known that banks, particularly many massive non-public banks, have hardly delivered any returns over the previous few years. The truth is, the Nifty Financial institution is accessible at a price-earnings a number of of 15 occasions and a worth to e-book of two.89. Compared, the Nifty 50’s PE is 21.4 occasions, and worth to e-book is 3.95 occasions, going by NSE knowledge as on Might 31.

On condition that NPAs on the internet stage are lower than 1 per cent for many of the prime private and non-private sector banks, and with curiosity cycle being on the peak, the section might supply enticing alternatives to buyers, particularly as financial progress continues on a easy climb.

Fund decisions

Schemes monitoring the segments spend money on banks and monetary providers corporations, although weightages might be heavy for just a few shares.

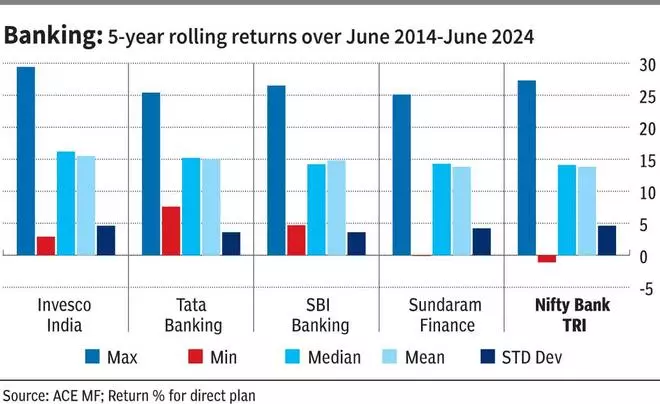

Going by 5-year rolling returns over the previous 10 years — on condition that banking is cyclical, longer-term consistency is essential — there are just a few funds buyers can contemplate.

Sundaram Monetary Providers Alternatives and SBI Banking & Monetary Providers are the very best decisions for buyers. Tata Banking & Monetary Providers and Invesco India Monetary Providers are additionally wholesome choices.

Buyers can contemplate small lump-sums or small SIPs over the long run.

Infrastructure continues to be essential

On condition that progress continues to be more likely to stay in focus for the federal government regardless of the coalition, infrastructure constructing will nonetheless be essential. Nonetheless, as said earlier, allocations have to be tempered.

Returns from the theme are typically lumpy and extremely cyclical. Lump-sums are normally prompt for thematic funds. Nonetheless, when SIPs in infrastructure funds are run for longer phrases of 7-10 years, the returns have been fairly rewarding.

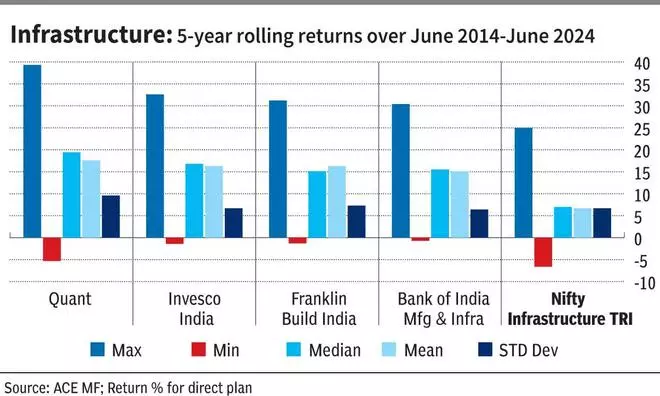

Subsequently, we thought of 5-year rolling returns over the previous 10 years and consistency in returns. We additionally took SIP returns (XIRR) over the previous 10 years to resolve upon the very best schemes.

Quant Infrastructure and Invesco India Infrastructure are the very best funds monitoring the theme. Franklin Construct India and BoI Manufacturing and Infrastructure funds are additionally pretty enticing decisions.

As famous earlier, thematic or sector funds should kind solely as much as 10 per cent of your general fairness portfolio. And inside that at present, consumption will need to have the best allocation, adopted by banking & monetary providers, and a little bit of infrastructure.

#Elections #Thematic #Mutual #Funds #Portfolio