PSU shares have seen a pointy rally this yr as BSE PSU Index rose by round 46 per cent on a year-to-date foundation. This has probably been pushed by rerating resulting from enticing valuation, and elevated capex spending by the federal government. One PSU participant that was a part of the rally is engineering consultancy agency, Engineers India Ltd (EIL).

Since our Accumulate score on Engineers India in bl.portfolio version dated January 15, 2023, the inventory has run up round 85 per cent. Beforehand the rationale for such score was enticing valuation, excessive dividend yield, sturdy stability sheet and wholesome order e book regardless of progress being a bit gradual. There was a pointy run-up within the inventory, with valuation increasing from one-year ahead P/E of round 11 instances to 18 instances since then. Whereas the stability sheet and order e book nonetheless stay sturdy, traders can e book income within the inventory as funding thesis has already performed out resulting from spike in inventory value and valuation.

Enterprise

Conferred with Navratna standing and managed by the Ministry of Petroleum, Engineers India is primarily engaged in offering engineering consultancy, EPC (engineering, procurement and building) and venture administration providers within the oil and fuel and petrochemicals house. Right here, the corporate is current in the whole hydrocarbon worth chain (upstream, midstream and downstream).

Within the consultancy section, EIL supplies providers corresponding to conceptualise, design, engineer and assemble initiatives as per consumer’s particular necessities whereas initiatives in its turnkey section require the corporate to handle end-to-end engineering and even EPC half.

Although consultancy section used to have a better share traditionally, i.e. 70-80 per cent, the corporate now generates 45 per cent and 55 per cent of working income from consultancy and turnkey (EPC) segments respectively. Within the turnkey section, it earns income on a cost-plus foundation and administration has guided sustainable EBIT margins of three per cent within the section whereas it expects the identical for consultancy section to be 25-27 per cent on a sustainable foundation.

Additional, about 90 per cent of firm’s enterprise is predicated within the home market whereas the remaining comes from its consultancy assignments in nations corresponding to Nigeria, the UAE, Oman and Mongolia.

EIL has a monitor document of being concerned in establishing majority of refineries and petrochemical complexes in India. Through the years, the corporate has been most well-liked accomplice for oil and fuel PSUs, corresponding to ONGC, BPCL and HPCL. Whereas retaining Oil and Fuel at core, it has been capable of diversify its operations into sectors corresponding to Fertiliser, Energy, Mining & Metallurgy and Infrastructure. Additional, EIL is exploring alternatives in different sectors corresponding to inexperienced vitality, bioethanol, coal gasification, metal emission management and inexperienced hydrogen.

Financials and valuation

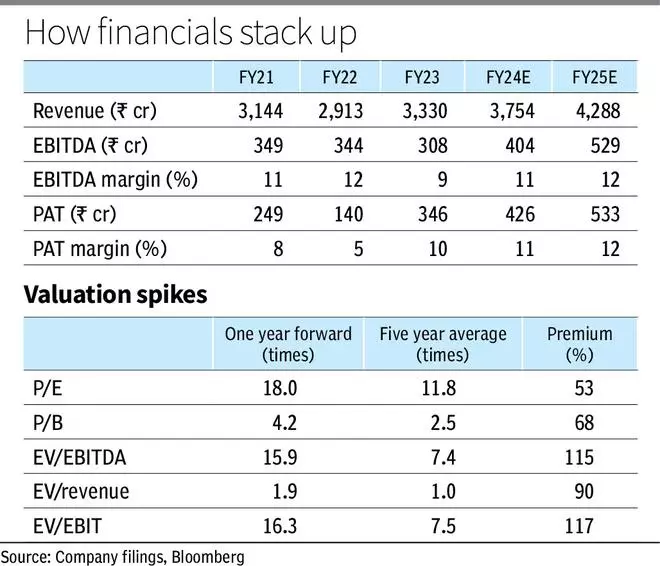

Throughout H1FY24, the corporate achieved flattish income at round ₹1,606 crore on account of weaker execution. Whereas the income from consultancy section elevated by roughly 2 per cent, that of turnkey section fell by round 1.3 per cent. Its EBITDA through the interval grew massively YoY by round 85 per cent to ₹176 crore, resulting in margins increasing from 5.7 per cent to 10.5 per cent.

Nevertheless, such EBITDA progress was largely supported by one-time liquidity injury settlement of round ₹45 crore. Moreover, it has additionally obtained ₹56 crore in Q1FY24 on account of settlement of previous claims in consultancy section and dividend revenue of about ₹14 crore, which has led to enchancment in web revenue by about 59 per cent throughout H1FY24, to ₹210 crore.

Regardless of no progress throughout H1FY24, the administration has maintained its steering of 10 per cent income progress throughout FY24, which may be on account of expectation of upper execution throughout H2FY24.

The corporate has a robust stability as it’s debt-free and cash-rich, with money stability of round ₹1,096 crore.

The inventory is buying and selling at a one-year ahead P/E (Bloomberg consensus estimates) of round 18 instances i.e. 56 per cent larger its five-year historic common of 11.5 instances. Additionally, since our final suggestion on the inventory, dividend yield has halved from 4 per cent to 2 per cent on account of spike within the inventory value.

Outlook

The corporate has a robust order e book of round ₹8,188 crore as of H1FY24 of which 94 per cent is from oil and fuel house. This suggests the order e book to income of round 2.5 instances, indicating sturdy income visibility. The order e book contains 59 per cent of consultancy-based orders, the remaining are turnkey. It stays to beseen if the administration is ready to enhance the execution of consultancy initiatives which is high-margin enterprise for the agency.

The corporate obtained order inflows of round ₹2,405 crore throughout H1FY24 and the administration guides for whole inflows to stay identical throughout FY24 because it was throughout FY23 at round ₹4,700 crore.

The corporate’s progress primarily depends upon the capex made by the oil and fuel corporations, which could possibly be much less in contrast toFY23. The priority may be compensated by EIL’s excessive order e book.

#Engineers #India #time #traders #e book #income #inventory