The online curiosity earnings grew 32 per cent to ₹597 crore. The pre-provisioning working revenue elevated 20 per cent to ₹288 crore in Q3 FY24. The return on asset (ROA) and return on fairness (ROE) stood at 2.3 and 25.5 per cent respectively.

- Additionally learn: Right here’s why you need to take a look at SFBs otherwise

The full enterprise grew 38.3 per cent to ₹37,009 crore as towards ₹26,763 crore in Q3 FY23. The gross advances grew 36.7 per cent to ₹17,153 crore as towards ₹12,544 crore in Q3 FY23. The advances below administration (AUM) for the quarter stood at ₹18,149 crore, up 35.9 per cent.

Of the AUM, micro and different loans contributed 72 per cent whereas retail loans accounted for 28 per cent. The disbursements throughout Q3 FY24 grew 10.6 per cent to ₹3,893 crore as towards ₹3,521 crore in Q3 FY23. The financial institution’s whole deposits grew 41 per cent Y-o-Y to succeed in ₹18,860 crore.

- Additionally learn: LIC Q3 web zooms 49% at ₹9,444 crore, Board declares ₹4 interim dividend

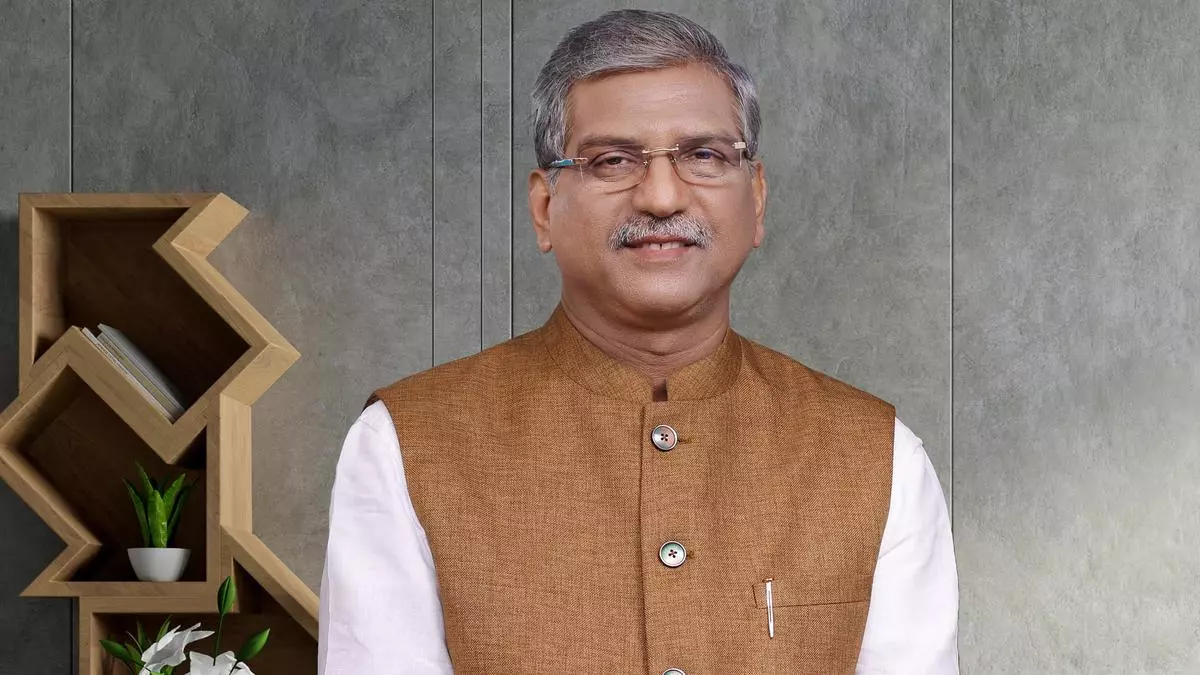

Ok Paul Thomas, MD & CEO of ESAF Small Finance Financial institution Ltd, stated, “The expansion within the financial institution’s enterprise numbers has been passable. We’re notably happy to notice a year-on-year progress of 38 per cent in our enterprise numbers. Holding this constructive pattern in thoughts, the financial institution is strategically reinforcing its efforts to make sure continued success. By improved supervisory oversight on the subject stage, we purpose to proactively handle potential challenges and additional optimize our operational effectivity. With these initiatives underway, we’re assured in reaching higher efficiency within the coming quarters.”

#ESAF #Small #Finance #Financial institution #posts #surge #web #revenue