- Additionally learn:Argentina cuts rate of interest to 70% as monetary markets see inflation easing additional

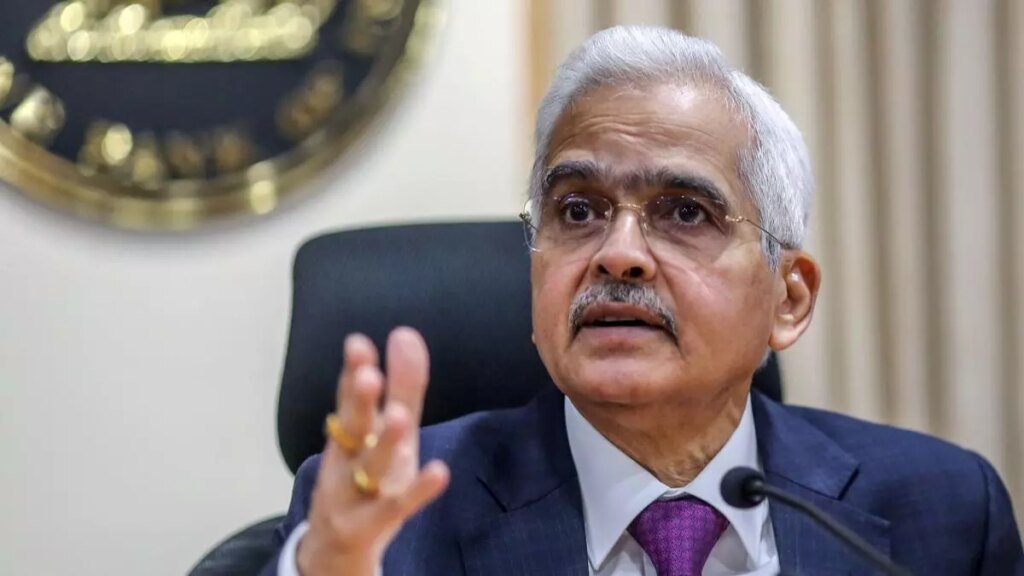

“The Indian economic system is rising at a sturdy tempo with a median annual progress of 8 per cent over the last three years. India continues to be the quickest rising main economic system on the earth…. CPI (shopper worth index) headline inflation throughout January-February 2024 (5.1 per cent in every of the months) has moderated from the elevated degree seen in December 2023 (5.7 per cent),” per Das’s assertion on the MPC assembly, which was held throughout April 3 to five, 2024. RBI launched minutes of the assembly on Friday.

He famous that the persistent and broad-based softening in CPI core inflation (CPI excluding meals and gas inflation) by 180 foundation factors (bps) since June 2023 is driving the disinflation course of, although unstable and elevated meals inflation is disrupting its tempo.

On the final MPC assembly 5 out of six members voted in favour of the decision to maintain the coverage repo price unchanged at 6.50 per cent. Jayanth R. Varma, Professor, Indian Institute of Administration, Ahmedabad, voted to scale back the coverage repo price by 25 foundation factors.

5 out of six members voted to stay targeted on withdrawal of lodging to make sure that inflation progressively aligns to the goal, whereas supporting progress. Varma voted for a change in stance to impartial.

“Wanting forward, the baseline projections present inflation moderating to 4.5 per cent in FY25 from 5.4 per cent in FY24 and 6.7 per cent in FY23. This success within the disinflation course of mustn’t distract us from the vulnerability of the inflation trajectory to the frequent incidences of provide facet shocks, particularly to meals inflation because of opposed climate occasions and different elements,” the Governor stated.

He cautioned that overlapping meals worth shocks, aside from imparting volatility to headline inflation, might also end in spillovers to core inflation.

“Lingering geo-political tensions and their impression on commodity costs and provide chains are additionally including to uncertainties within the inflation trajectory. These concerns name for financial coverage actions to tread the final mile of disinflation with excessive care,” Das stated.

- Additionally learn:In defence of RBI’s calibrated pause

MD Patra, Deputy Governor, stated the headroom offered by the regular core disinflation and gas worth deflation doesn’t guarantee a sooner alignment of the headline with the (4 per cent) goal.

Consequently, headline inflation may be anticipated to stay within the higher reaches of the tolerance band till beneficial base results come into play within the second quarter of FY25.

Therefore, situations aren’t but in place for any let-up within the restrictive stance of financial coverage.

“Downward strain on inflation have to be maintained till a greater steadiness of dangers turns into evident and the layers of uncertainty clouding the near-term clear away.

“Within the interregnum, the dedication to enduringly aligning inflation with the goal of 4 per cent must be emphasised. Stabilising inflation expectations is progressing, as mirrored in forward-looking surveys; anchoring them is essential for attaining the inflation goal,” Patra stated.

General, worth stability needs to be restored to be able to make sure that the rising progress trajectory that India is embarking upon is sustained, he added.

‘Endurance, want of hour’

Rajiv Ranjan, Government Director, RBI, noticed that going forward, whereas financial coverage appears to be heading in the right direction, it’s too early to ease guard in opposition to inflation.

“It is necessary that we acquire extra confidence on our macro numbers for FY25 and their nuances….Return of inflation to the 4 per cent goal is our goal and having come this far, it isn’t removed from sight. We have to utilise the area offered by stronger progress to deal with inflation…As an alternative of haste for coverage motion, endurance is the necessity of the hour,” he stated.

- Additionally learn:When insolvency meets cash laundering

Shashanka Bhide, Honorary Senior Advisor, Nationwide Council of Utilized Financial Analysis, stated whereas the projected inflation tendencies level to additional moderation in inflation price in FY25, additionally they point out an upturn nicely above the goal price of 4 per cent within the second half of the yr.

Given the robust momentum of progress at this juncture, it’s mandatory to take care of financial coverage deal with aligning the inflation tendencies with the goal, he added.

#Extant #financial #coverage #setting #positioned #RBI #Guv #Das