- Additionally learn: Tata Tech, Kandhar Oil, Aptitude Writing IPOs promote like hotcakes

Promoted by Federal Financial institution which is able to proceed to stay the most important investor within the non-bank (62.4 per cent stake) publish problem and backed by homebred personal fairness main True North (14.4 per cent stake), the most important benefit of Fedbank Monetary is a well-diversified mortgage e-book, unfold throughout gold loans, mortgage in opposition to property, unsecured enterprise loans and a comparatively small proportion of mortgages. When it comes to branches, practically 75 per cent of the bodily presence is in direction of gold mortgage enterprise.

That stated, the compelling purpose for buyers to contemplate the IPO is the valuations.

5 Star Enterprise Finance’s asking charge on the time of its IPO was round 3.2x 12-month trailing worth to e-book worth. SBFC Finance’s IPO was priced at 2.3x worth to e-book. Factoring for ₹600 crore of contemporary issuance, on a publish cash foundation, Fedbank’s IPO is valued at 2x worth to e-book, making it a compelling problem, particularly contemplating how its predecessors have seen a pointy run up in multiples publish itemizing.

Enterprise overview

Fedbank Monetary Providers (previously Fedfina Monetary Providers) works similar to how most non-banks within the small and medium enterprises lending house.

- Additionally learn: Aptitude IPO: Pretty valued story

The corporate caters to a set of shoppers who would usually not be capable of entry financial institution funding to start with. Due to this fact, at over 16 per cent general yield (as on June 30, 2023), it is a excessive yield play. Though value of funds might catch up (7.77 per cent in FY23, up 33 bps year-on-year), the goal phase is such that go by means of of value is seldom a problem. In reality, this is without doubt one of the greatest benefits that SME lenders have and Fedbank can be no exception.

Due to this fact, by way of enterprise, there can be little to complain for buyers.

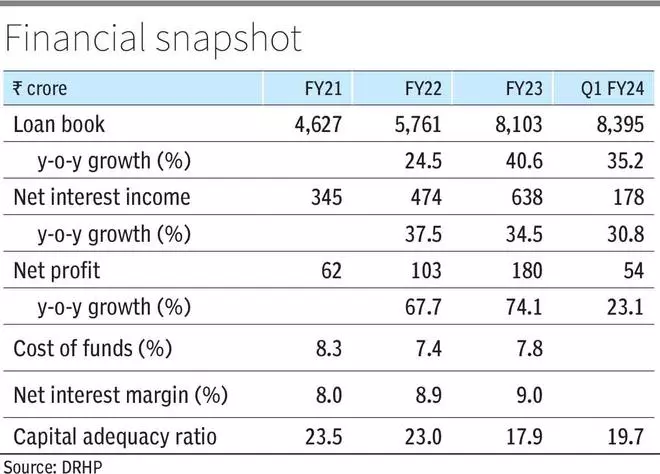

The lender has been witnessing an honest development, managing a 3-year AUM development (CAGR) of 33 per cent between FY20 and FY23. Being a excessive yield enterprise, NIM at round 9 per cent (FY23) has the headroom to soak up pricing stress if the lender ought to encounter within the quarters to come back. Maybe, the one deterring facet is the lender’s asset high quality, when seen on an remoted foundation.

From 1.01 per cent in FY21, gross non-performing belongings ratio has risen to 2.26 per cent in Q1 FY24 (2.03 per cent in FY23). Whereas the general NPA ratios for SME lenders has seen a reset publish covid, and at 2.26 per cent, Fedbank’s gross NPA is benign in comparison with SBFC’s 2.54 per cent and due to this fact not very out of whack, provided that the sector continues to be in a cleaning mode.

Nonetheless, there are two positives which ought to consolation buyers. One, Fedbank Monetary Providers has little or no buyer or operational overlaps with its mum or dad firm—Federal Financial institution. Two, each run as impartial entities and Fedbank Monetary has a diversified liabilities base which displays in its financial institution borrowing profile. With its borrowings unfold throughout over 20 banks, there may be nearly no dependence on Federal Financial institution for its ALM (asset liabilities mismatch) administration.

On the entire, with IPO valuations leaving room for upside, buyers eager to money in on the SME lending growth might take into account Fedbank Monetary Providers IPO.

#Fedbank #Monetary #Providers #IPO #Promising #franchise #first rate #valuation