Aptitude’s main enterprise is its writing devices section (88 per cent of FY23 revenues) which incorporates ball pens, fountain pens, gel pens, curler pens and metallic pens, out there throughout value factors starting from mass market to premium. The corporate began a ‘inventive division’ in FY21 and the section contributed 12 per cent or ₹115 crore to income in FY23.

Agency home presence

The corporate has a producing capability of 200 crore pens per 12 months and has the main distribution attain of three.15 lakh retailers/wholesalers. This community reaches 2,400 cities in India and enjoys 9 per cent share within the nation’s pen market. In line with RHP, the size of attain is forward of its friends DOMS, Kokuyo Camlin, Linc or different main pen producers. The corporate has a long-established OEM enterprise as nicely (20 per cent of FY23 revenues) the place it’s contracted to provide pens to international corporations.

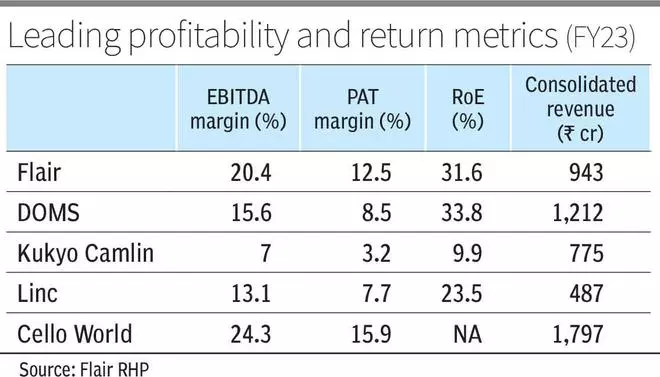

The size of operations from exports and home enterprise and attain of distribution is nicely mirrored in firm financials with main profitability and return metrics in comparison with friends (see desk). Other than economies of scale aiding margins, Aptitude’s automated manufacturing and skill to internally supply 70 per cent of its pen suggestions (that are 15 per cent of price) provides to margins, in line with the corporate. Its merchandise cowl mass market (₹5 to ₹15) in addition to premium vary which extends as much as ₹3,000 with Pierre Cardin, Hauser (each of which had been acquired) and Aptitude’s manufacturers, enhancing its product combine and thus, including to its margin potential.

Growth and metal bottles

Aptitude has began a division to fabricate metal bottles. The division shares the same finish market of faculties and workplace use. However the commonality in distribution and manufacturing is proscribed. The corporate received into the enterprise with one OEM buyer. In line with the corporate’s administration, this OEM buyer will choose up 65 per cent of output in FY24 and the corporate will construct the market within the subsequent one 12 months for the remaining portion. With clear visibility on order ebook and advertising and marketing expertise ultimately market, this section can add 6-7 per cent to revenues by FY24.

With the recent concern proceeds of ₹292 crore (whole concern dimension of ₹593 crore), Aptitude will setup a greenfield facility at Valsad in Gujarat (₹56 crores) and likewise make investments ₹87 crore to debottleneck and increase its tip manufacturing facility. This could enhance margins and add to capacities in subsequent two years. The corporate has a excessive asset turnover of three.5 instances and the recent funding will add important income capability in subsequent two years. The remaining recent concern proceeds might be utilised for working capital deployment (₹77 crore) and compensation of loans (₹43 crore).

Financials and valuation

The corporate reported revenues of ₹943 crore in FY23 which is a 63 per cent YoY development and an EBITDA margin of 20.4 per cent. The rebound is on account of operations normalising post-Covid. The corporate has a net-debt to EBITDA of 0.6 instances as on June 2023 and can enhance additional with debt compensation from recent concern.

On a publish concern foundation, Aptitude is valued at 27 instances FY23 earnings, which is inline with Linc (27 instances FY23 EPS) and at cheaper a number of in comparison with Kokuyo Camlin (62 instances).

#Aptitude #IPO #valued #story