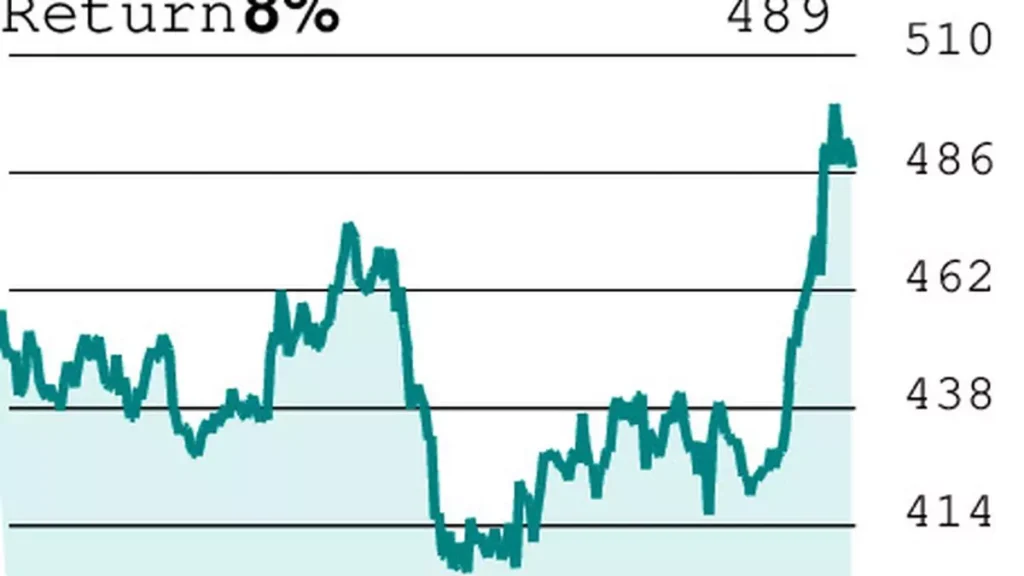

F&O pointers: ITC August futures closed at ₹491 in opposition to the spot worth of ₹489.10. Open curiosity additionally witnessed regular build-up. The premium and accumulation of open pursuits point out build-up of lengthy positions. Nevertheless, the rally won’t maintain.

Technique: We advise merchants to contemplate shopping for 490-put on ITC. This selection closed with a premium of ₹10.05. Because the market lot is 1,600 shares, this technique would value merchants ₹16,080 which might be the utmost loss. The utmost loss will occur if ITC fails to drop beneath ₹490 on expiry.

Alternatively, a pointy fall may give good income. The break-even level is ₹480. A fall beneath that degree would yield optimistic returns. We advise merchants to exit the place both at a revenue of ₹8,500 or at a lack of ₹5,500. Maintain the place for 2 weeks and could be reviewed later.

Observe-up: Ashok Leyland moved on anticipated traces and the technique might need supplied some revenue alternatives. We advise these holding the inventory to exit.

Observe: The suggestions are based mostly on technical evaluation and F&O positions. There’s a threat of loss in buying and selling

#Technique #Purchase #ITC #Put #Choice