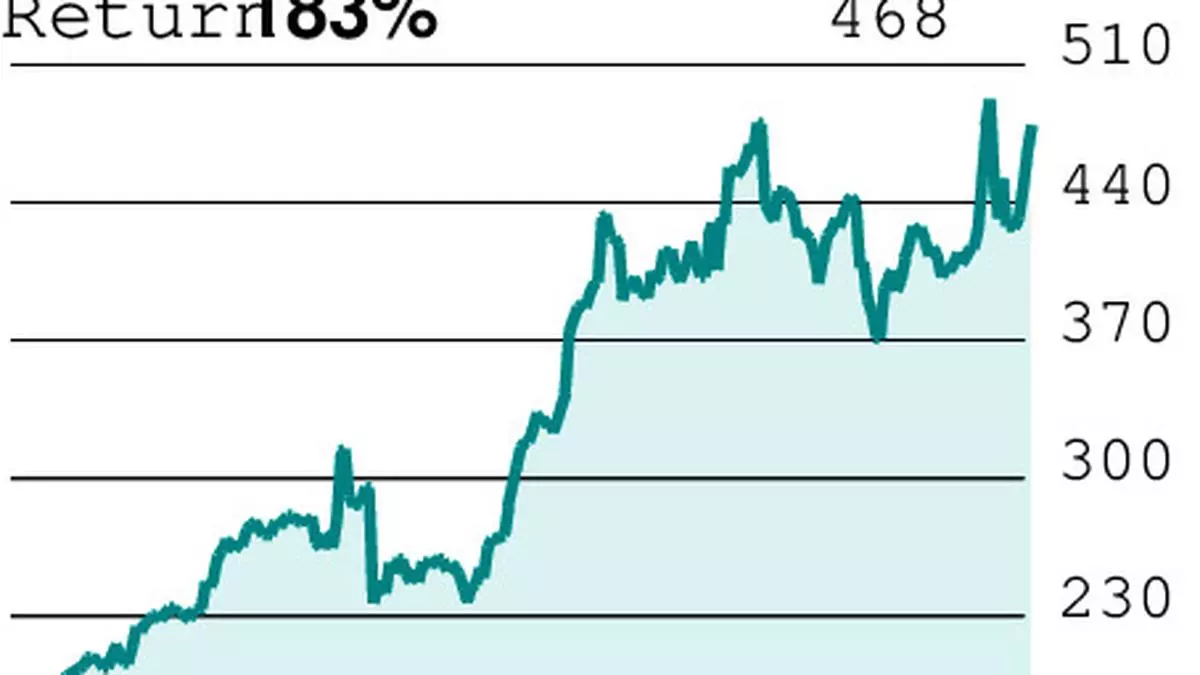

F&O pointers: The PFC Could futures closed at ₹466 and the June futures at ₹467.15 in opposition to the spot value of ₹465.95. The small premium over the spot signifies unwinding of lengthy positions. Open pursuits for PFC Could futures declined from a excessive of eight crore shares on April 26 to present 6.30 crore shares. Choice buying and selling signifies that PFC might transfer in a variety of ₹400-500.

Technique: Take into account a diagonal calendar bull-call unfold. Provoke by promoting 450-strike name (Could collection) and concurrently shopping for 480-strike name (June contract). As these choices closed with a premium of ₹21.40 and ₹28.80 respectively, merchants could need to incur an preliminary outflow of ₹11,431.25. This might be the utmost loss, which can happen if PFC turns weak and dips under ₹450.

However, revenue potentials are excessive if PFC falls or stays flat in the course of the collection and rises sharply throughout June collection. Merchants ought to needless to say because the outcomes of the Basic Election might be out on June 4, shares, particularly people who cater to energy, might be extra risky. So, risk-averse merchants might avoid the technique.

Merchants might think about exiting the place at a revenue of ₹12,500 or a lack of ₹3,800, whichever happens first.

Comply with-up: Maintain Tata Energy technique for yet one more week.

Be aware: The suggestions are primarily based on technical evaluation and F&O positions. There’s a threat of loss in buying and selling

#Technique #PFC #Calendar #BullCall #Unfold