- Additionally learn: MFs increase holdings in BSE in Q1 amid sell-off by FPIs

The holding of home institutional traders (DIIs) rose to 16.23 per cent through the quarter. Life Insurance coverage Company of India (LIC), nevertheless, noticed its share throughout 282 firms lowering to an all-time low of three.64 per cent.

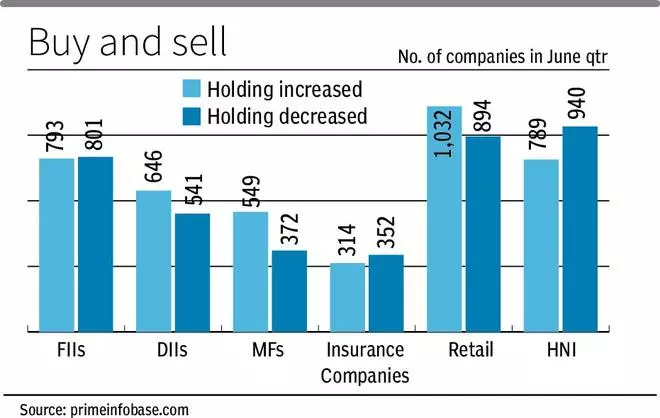

The share of retail traders reached an all-time excessive of seven.64 per cent, whereas the share of HNI traders decreased barely to 1.98 per cent as on June 30.

The share of international portfolio traders (FPIs) declined to a 12-year low of 17.38 per cent in June, down by 34 bps from 17.72 per cent 1 / 4 in the past. This has resulted within the hole between FPI and DII holding narrowing to its lowest ever. The FPI to DII possession ratio decreased to an all-time low of 1.07 as on June 30, from an all-time excessive of 1.99 in quarter ending March 2015.

Self-reliance

In response to Pranav Haldea, Managing Director, PRIME Database Group, Indian markets are quickly transferring in the direction of self-reliance with the share of DIIs set to overhaul that of FPIs within the subsequent few quarters. “For years, FPIs have been the biggest non-promoter shareholder class within the Indian market with their funding choices having an enormous bearing on the general path of the market. That is now not the case. DIIs together with retail and excessive web value People have now been enjoying a powerful counter-balancing position with their share reaching an all-time excessive of 25.85 per cent as on June 30,” he mentioned.

DIIs elevated their allocation most to Commodities to eight.73 per cent of their complete holding, whereas they decreased their allocation most to Power to 10.64 per cent of their holding. FPIs elevated their allocation most to Client Discretionary (17.13 per cent) and decreased their allocation most to IT (8.09 per cent).

The share of the Authorities (as promoter) elevated to a 7-year excessive of 10.64 per cent as on June 30 on the again of robust efficiency of a number of PSUs. However, the share of personal promoters declined to a 5-year low of 40.88 per cent as on June 30, 2024. During the last 10 quarters alone, it has fallen by 428 foundation factors from 45.16 per cent on December 31, 2021. In response to Haldea, stake gross sales by promoters to benefit from bullish markets, comparatively decrease promoter holding in a number of the IPO firms and in addition total institutionalisation of market has resulted on this.

#FPI #share #NSE #firms #declines #12year #share #recent #excessive