Within the lately ended March quarter, commentaries from most banks have been fairly non-committal on steerage with respect to mortgage development and/or sustaining profitability and the hesitation is owing to the price of cash growing by 250 foundation factors in nearly 11 months, from Might 2022 to March 2023; the steepest enhance in repo charges the nation has seen in a few years. Although its impression was barely felt by banks in FY23, it could be tough to disregard this stress for lengthy.

Listed here are the three most important elements that might destabilise the present in FY24:

Product combine

Retail loans have lengthy been the expansion automobile for banks and in FY23 as nicely. Nevertheless it was a bit of completely different from the earlier 2-3 fiscals. With debtors even within the prime classes demonstrating comfy compensation traits, banks performed inside the bandwidth of product combine. If FY21 – 22 have been years of secured loans or asset backed retail loans pushing development, FY23 belonged to the unsecured classes similar to private loans, bank cards and small ticket enterprise loans.

These are merchandise with quick tenure; normally lower than two years. What’s not clear is whether or not banks determined to push the pedal on these merchandise as a result of they noticed the rates of interest transfer up or whether or not to fight prices, they went gung-ho on these merchandise. Not like a house mortgage, most of those merchandise are benchmarked to MCLR or marginal value of fund primarily based lending charge. The benefit of MCLR over EBLR or exterior benchmark lending charge (usually linked to the repo charge) is the pricing cushion. Reset in MCLR has been slower than EBLR regardless of the repo hikes and since MCLR permits banks to cost for the product value effectively, it has helped banks earn higher margins even with out passing on the repo hikes solely.

However how lengthy can these short-tenure merchandise prop up the highest line? The regulator is growingly uncomfortable with unsecured traces of enterprise. For banks as nicely, it could not support the stability sheet development sustainably in the long term. If the banking sector liquidity is to get squeezed, which appears probably, it might impression the flexibility of banks to depend on these merchandise for lengthy; an element that will develop into evident after the festive months of September-November 2023.

Beneficial asset high quality

Asset high quality can have a number of implications on the financials of a financial institution. Decrease provisioning helps banks put up wholesome web income. It has a rub-off impact on the web curiosity margin or NIM — an indicator of profitability for banks. With a lot of the ageing-related provisioning accomplished for throughout the banking system an additional important decline on this entrance appears unlikely in FY24. A back-of-the-envelope calculation means that margins might have been greater by 20-40 foundation factors (bps) due to this impact. Now with that tapering off, the solace is that additions to non-performing belongings and its consequent provisioning value could also be like FY23. What this implies is that banks might not witness an enchancment in return on belongings or NIMs attributable to bettering asset high quality in FY24.

Value of deposits

It is a area which might be fairly attention-grabbing to observe. Even when the repo charges have gone up by 250 bps to date, value of deposits has elevated, on a median, by nearly 100-120 foundation factors; implying that the inventory of liabilities at banks are having fun with the benefit of deposits raised earlier at a lot decrease charges; one of many the explanation why profitability of banks peaked to an all-time excessive in FY23. However this benefit might skinny down as we transfer deeper into this fiscal.

For one, within the final 5–7 years with liquidity not a problem, there was a visual shift in direction of quick to medium-term deposits. Little or no of the deposit inventory is at present locked in for even 5 years. What banks have resorted to is hike the share of bulk deposit – a comparatively cheaper charge and shorter length product, to fulfill the liquidity necessities of the previous yr. Take the case of Financial institution of Baroda. Its bulk deposits on a year-on-year foundation have risen by over 80 per cent whereas development of retail deposits was lower than 5 per cent. To a big extent, most banks utilised this window of wholesale or bulk deposits, to the brim. Due to this fact, their shift to retail clients for deposits is nearly imminent.

Secondly, with a lot of the prevailing e-book largely being shorter-term deposits, after they flip due for maturity, the worth at which they might be rolled over would robotically enhance. That is anticipated to replicate on the financials of banks by September 2024 and final until about mid-FY25. What works to benefit is the momentary pause on repo hikes and the expectation that systemically charges ought to both be capped on the present ranges or begin cooling in 3–4 quarters.

Both manner, the implication that it could have on the profitability can be unavoidable for banks. For now, buyers ought to pencil in not less than 45–60 foundation factors decline in NIMs due to deposits repricing.

Profitability might presumably come again to FY21 ranges. However that’s additionally beneath the idea that banks might get cautious on the short-duration unsecured mortgage merchandise. If that’s not the case, banks could also be profitable in sustaining FY23 profitability.

Managing greater prices

The general outlook for FY 24 appears fairly sturdy, barring the probably value pressures and its implications on profitability. There are two issues that one ought to bear in mind.

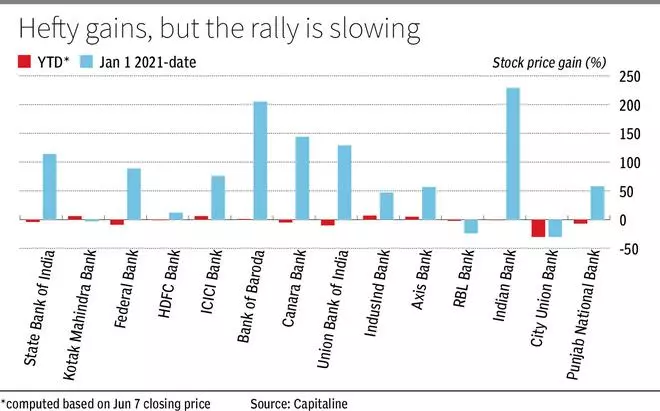

As talked about above, the current inventory worth motion of banks signifies that the Avenue isn’t factoring for an upbeat efficiency from the sector for the explanations cited above. That mentioned, it’s not an element, but, which ought to immediate buyers to steer clear of the sector

One simply must be cautious in figuring out one’s selections primarily based on the standard of the banking franchise and investor’s threat urge for food.

Banking on financial institution shares?

Representing over 35 per cent of the indices and popularly seen because the proxy to any nation’s GDP development, banking shares are exhausting to disregard. However delve into them rigorously!

With FY23 efficiency being the place it was, PSU banks have made an announcement that their financials will be simply as glowing as their personal friends’. Due to this fact, taking a generic name on PSU banks versus personal banks might not work any longer. As an alternative, it could be prudent to basket them into three classes – the protected bets, dangerous ones and the keep away from listing.

Protected bets: The nation’s prime 4 banks – specifically State Financial institution of India, Financial institution of Baroda, HDFC Financial institution and ICICI Financial institution are shares that buyers can take into account shopping for/ accumulating with out a lot draw back threat. To a big extent their stability sheet is fairly clear and so they supply steady-state development with out a lot of surprises. However these shares, having appreciated considerably within the final three years, which arguably has been the perfect interval for banking shares, should now be considered as choices which could nearly mirror the efficiency of the bellwether indices or barely outperform. Kotak Mahindra Financial institution is also added to this listing.

Dangerous ones: The candidates on this listing may very well be longer. From the PSU banks area, Union Financial institution of India, Canara Financial institution, Indian Financial institution, Financial institution of Maharashtra appear attractively, purely from valuations standpoint. Additionally, given their constant enchancment in financials, markets might begin appreciating their performances, thus reflecting within the inventory worth. Though these shares too have seen a large rally previously two years, they’re but to the touch their historic excessive costs, therefore leaving upside potential for buyers.

Inside the personal basket, Ujjivan Small Finance Financial institution, IDFC First Financial institution, RBL Financial institution and Federal Financial institution are price contemplating. Ujjivan and RBL are situations of turnaround from careworn conditions whereas IDFC First Financial institution might achieve from the company motion (merger with IDFC Restricted, its mother or father firm) beneath manner. Federal Financial institution has confronted elevated value pressures and has just about succeeded in its efforts to revamp the financial institution. The draw back issue might presumably be a slight detour from its slated plan brought on by exterior elements, which is a possible for the financial institution.

What to keep away from: Smaller franchises similar to Dhanlaxmi Financial institution and Karur Vysya Financial institution within the personal area and standalone PSU banks similar to UCO Financial institution, Indian Abroad Financial institution, Punjab and Sind Financial institution and Central Financial institution of India match into this listing. These traditionally have been shares which have seen bouts of excellent performances out there, however they might not essentially be pushed by fundamentals. There may be little to recommend that these banks can constantly ship good monetary outcomes and therefore be worth buys.

#FY23 #Financial institution #Efficiency #Shines #Inventory #Costs #Stay #Muted #Components #Watch #FY24