Timeline to acquisition

GLS made a public announcement of open supply on September 21, 2023 following Nirma’s bid to amass 75 per cent of GLS. On the identical day, Nirma entered right into a share buy settlement with GLP at ₹615 per share (topic to regulatory approvals). On completion of the transaction, Nirma (the brand new promoter) ought to maintain 75 per cent and GLP shareholding will come down from 83 per cent to eight per cent in GLS.

Inventory prospects

The open supply value in the meantime has not been revised from September to now, together with the draft supply in October 23. The inventory although has rallied 35 per cent because the public announcement, primarily owing to a turnaround in API enterprise outlook, decision of provide points, stability in purchases of GLS merchandise by GLP and constructing momentum in CDMO operations.

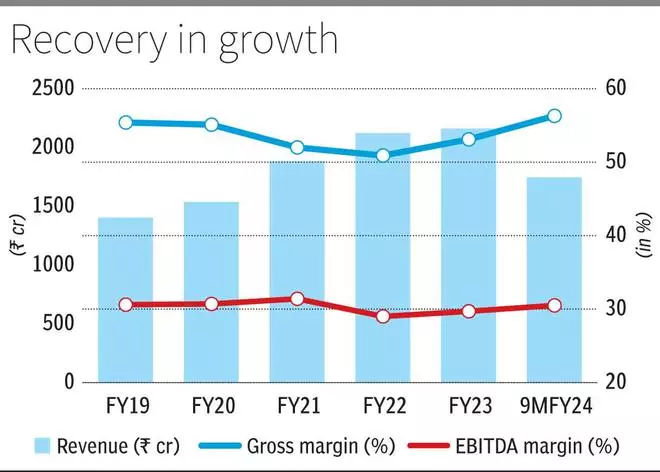

In comparison with 17 per cent Y-o-Y income CAGR in FY20-22, the topline development slowed to 1.8 per cent YoY in FY23. Covid portfolio slowing and stock build-up in regulated markets trimmed excessive development prospects for GLS.

EBITDA margin remained steady all through the interval although at round 30 per cent in FY20-23.

In 9M FY24, GLS reported a 13 per cent Y-o-Y development. The US pricing stress eased, and quantity restoration was gradual within the interval as stock stocking eases. GLS has added 400 KL capability which on hitting full utilization in FY25 will maintain mid-teens development in FY25 for GLS’ API division (90 per cent of 9MFY24 revenues). Provides to mum or dad GLP’s operations earlier contributed 50 per cent of gross sales for GLS, declined to 25 per cent within the final two years as GLP additionally confronted slower gross sales development. As mum or dad firm gross sales bounced again, this proportion bounced again to 40 per cent and GLS expects to maintain a 3rd of its gross sales from GLP. The corporate has a five-year settlement with GLP for provides after the take-over.

CDMO (contract growth and manufacturing organisations) is the opposite division for GLS. The section servicing three consumer molecules can develop to 3 extra within the subsequent one-two years, doubling its income contribution. The section is in early levels and might scale up merchandise or consumer pockets share in the long term.

The EBITDA margin in 9M FY24 has gained from easing value of intermediates/beginning supplies as China will increase provides in India. The uncooked materials value financial savings have been offset by greater worker bills that are anticipated to be one time. Even when commodity value financial savings eases in subsequent two years, worker bills reverting to regular will maintain EBITDA margins at 30 per cent in FY25.

We had earlier really useful subscribing to the IPO (July 2021) and reiterated the purchase name in Nov-2022 from the place the inventory has greater than doubled. API operations stabilizing and a powerful development lever in CDMO operations reaffirm development visibility in GLS aside from cheap valuation of 18 occasions FY25 EPS . We advocate traders maintain the inventory until the brand new promoters spell out a brand new technique and begin delivering on the identical.

#Glenmark #Life #Sciences #Nirmas #open #supply #key #insights #inventory