Analysis company BMI, a unit of Fitch Options, has forecast second-month wheat futures on the Chicago Board of Commerce to common at $6.05 a bushel ($222.29 a tonne).

September wheat futures on CBOT are ruling at $5.84 a bushel ($214.57/tonne). The year-to-date common wheat worth stands at $6.06 a bushel, it stated.

The World Financial institution, in its Commodity Outlook, stated wheat costs are forecast to say no by 15 per cent in 2024, reflecting elevated manufacturing.

Up & down

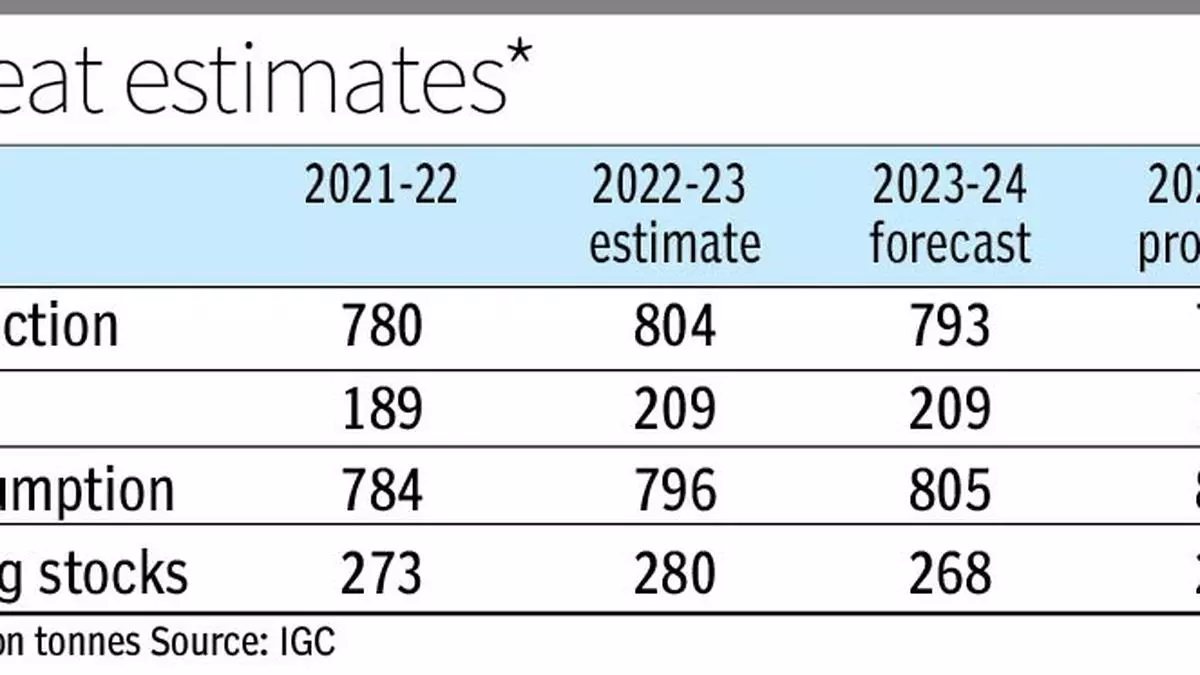

Wheat costs surged to $7.14/bushel on Could 27, a acquire of 30 per cent because the starting of 2024. Nevertheless, since then it has dropped 20 per cent. Wheat is down practically 12 per cent year-on-year. “Constructing on our projection of a 0.2 per cent lower in world wheat manufacturing for the 2023-24 season, we anticipate a 0.4 per cent enhance within the 2024-25 season, with output reaching 790.2 million tonnes,” stated the analysis company.

It forecast year-on-year manufacturing progress in key areas with Australia set to see a 22 per cent manufacturing enhance, China 2.5 per cent enhance and the US a 4 per cent enhance.

ING Assume, the financial and monetary evaluation wing of Dutch monetary companies agency ING, stated the US Division of Agriculture (USDA) has rated 51 per cent of the US winter wheat crop nearly as good to wonderful. It’s increased than the 40 per cent seen on the identical time a 12 months in the past.

Rising shorts

The USDA Financial Analysis Service (ERS) stated world wheat manufacturing in 2024-25 is forecast 7.4 million tonnes (mt) decrease than preliminary estimates however stays at a file 790.8 mt.

BMI stated the wheat market’s sensitivity to abrupt worth escalations is because of short-covering actions, notably as merchants elevated their bearish bets.

The analysis company stated on April 16, the web brief place for mushy crimson winter wheat stood at a big 96,403 contracts. It mirrored a common expectation of ample provides, with a robust emphasis on Russia and the US. “But, the market’s sentiment shifted as worries over the Russian wheat crop emerged, resulting in a downward revision in yield forecasts and a discount in web brief positions to 25,431 contracts by Could 21,” stated BMI.

Latest knowledge from the Commodity Futures Buying and selling Fee confirmed web shorts at 45,116 contracts. “This resurgence in web brief positioning suggests a correction out there after its preliminary overreaction to the Russian crop considerations and the affect of constructive early-season crop knowledge from the US, which strengthened bearish views,” the analysis company stated.

Offtake to slim deficit

These actions are indicators that the wheat market is “susceptible to speedy, short-lived worth actions in response to important updates, similar to these associated to the Russian wheat harvest outlook”, it stated.

The analysis company stated with cash managers resuming the build-up of web brief positions, downward stress on costs persists. “The market stays delicate to any important information that would doubtlessly disrupt provide expectations,” it stated.

BMI stated it anticipates world wheat consumption at 791.3 mt within the 2024-25 season. This can considerably slim the worldwide manufacturing deficit, reducing it from -10.4 million tonnes within the 2023-24 season to simply -1.1 million tonnes within the 2024-25 season.

The USDA ERS stated world wheat exports for the July−June 2024-25 commerce 12 months have been forecast 2.4 mt decrease at 213 mt. It stated wheat consumption has been lowered to 792 mt with smaller feed and residual use greater than offsetting a small enhance in meals, seed and industrial use.

World wheat ending shares are forecast decrease by 1.3 mt at 252.3 mt — the bottom since 2015/16, however opening shares will likely be 261 mt.

#World #wheat #market #stress #cash #managers #bearish #outlook